-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

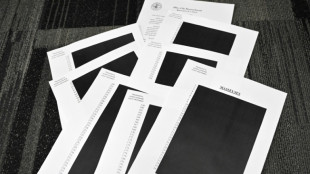

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

-

EVCS Appoints Eric Danner as Chief Executive Officer; Gustavo Occhiuzzo Named Executive Chairman & Chief Strategy Officer

EVCS Appoints Eric Danner as Chief Executive Officer; Gustavo Occhiuzzo Named Executive Chairman & Chief Strategy Officer

-

BCII Enterprises Appoints Emmy Award-Winning Media Strategist and Former White House Advisor Evan "Thor" Torrens as Strategic Advisor

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

-

Dolphin Subsidiary Shore Fire Media's Podcast Clients Recognized as 2025's Best

Stocks slip on strong US growth data

Wall Street's main stock indices briefly slid lower on Tuesday as much stronger-than-expected US growth figures befuddled hopes for further interest rate cuts, while gold and silver struck fresh records.

US economic growth in the third quarter came in at 4.3 percent on an annualised basis, easily topping expectations, as consumer and government spending rose.

Equities had been buoyed in recent weeks by expectations the Federal Reserve would lower borrowing costs further in 2026, with data showing US unemployment rising and inflation easing.

The strong figures could persuade the US Federal Reserve to hold off on further interest rate cuts in 2026.

"The key takeaway from the report is that the US economy was certainly running on the warm side" in the third quarter, said Briefing.com analyst Patrick O'Hare.

"That will stir some concerns about the Fed's recent decision to cut rates in December and the risk of stoking increased inflation in pursuit of keeping the economy on a growth trajectory," he added.

Wall Street's main indices moved lower at the start of trading in New York, but both the S&P 500 and Nasdaq quickly pushed into positive territory.

Before the US GDP data was released precious metals pushed higher on the back of expectations for more US rate cuts, which makes them more attractive to investors.

Gold jumped to a high above $4,497 per ounce, while silver was just short of $70 an ounce, with the US blockade against Venezuela and the Ukraine conflict adding support.

Copper, which is used in electric vehicle batteries and solar panels, hit a record price of $12,159.50 per tonne.

"Silver and above all copper are benefitting from structural support from the energy transition, electrification the colossal needs for digital infrastructure and artificial intelligence," said John Plassard, an analyst at Cite Gestion Private Bank.

Europe's main stock markets were mixed in afternoon trading.

"European stock markets appear to have entered a period of consolidation as we head into the final trading days of 2025," said Joshua Mahony, chief market analyst at Scope Markets.

"With the Santa rally period traditionally taking place over the final five days of the year, investors will be hoping that the bulls are gathering momentum for a final push tomorrow onwards," he added.

Asian markets enjoyed a bright start, although some stuttered as the day wore on.

Shanghai was higher, while Hong Kong dipped and Tokyo closed flat.

On currency markets, the yen extended gains after Japan's Finance Minister Satsuki Katayama flagged authorities' powers to step in to support the unit, citing speculative moves in markets.

The yen suffered heavy selling after Bank of Japan boss Kazuo Ueda held off signalling another rate hike anytime soon following last week's increase.

In company news, shares in Danish pharmaceutical giant Novo Nordisk jumped more than eight percent after the US approved its popular GLP-1 anti-obesity drug Wegovy to be administered in pill form for weight loss.

- Key figures at around 1430 GMT -

New York - Dow: DOWN 0.2 percent at 48,286.54

New York - S&P 500: DOWN less than 0.1 percent at 6,873.79

New York - Nasdaq Composite: DOWN less than 0.1 percent at 23,407.70

London - FTSE 100: FLAT at 9,868.85

Paris - CAC 40: DOWN 0.2 percent at 8,109.06

Frankfurt - DAX: UP 0.3 percent at 24,330.51

Tokyo - Nikkei 225: FLAT at 50,412.87 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,774.14 (close)

Shanghai - Composite: UP 0.1 percent at 3,919.98 (close)

Dollar/yen: DOWN at 156.45 yen from 156.99 yen on Monday

Euro/dollar: UP at $1.1773 from $1.1756

Pound/dollar: UP at $1.3494 from $1.3458

Euro/pound: DOWN at 87.25 pence from 87.35 pence

West Texas Intermediate: UP less than 0.1 percent at $58.05 per barrel

Brent North Sea Crude: FLAT at $62.05 per barrel

burs-rl/rmb

A.Rodriguezv--AMWN