-

Koepka leaves LIV Golf: official

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

-

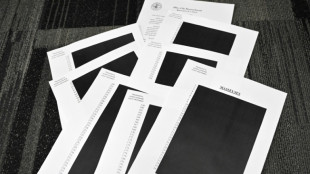

Trump in Epstein files: five takeaways from latest release

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

Ineos snap up Scotsman Onley

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Forte Group Announces Amended Terms to Initiatives to Strengthen Financial Position

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESS Newswire / July 18, 2025 / Forte Group Holdings Inc. (CSE:FGH)(OTC:FGHFF)(FSE:7BC0, WKN:A40L1Z)("Forte Group" or the "Company"), a diversified lifestyle and wellness consumer packaged goods company, announces that, further to its news release dated July 14, 2025, it intends to amend the terms of a series of initiatives designed to strengthen its financial position, including a non-brokered private placement financing (the "Private Placement"), consisting of the issuance of an aggregate of 8,700,000 units of the Company (each, a "Unit"), at a price of $0.05 per Unit for aggregate gross proceeds of up to $435,000 and a Debt Settlement (as defined below).

Private Placement

Each Unit will consist of one common share in the capital of the Company (each, a "Share") and 0.59 transferable common share purchase warrants of the Company (each whole warrant, a "Warrant"), with each Warrant entitling the holder to acquire one additional Share (each, a "Warrant Share") at a price of $0.065 per Warrant Share for a period of two years from the date of closing.

Closing of the Private Placement is anticipated to occur on or about July 25, 2025, and is subject to certain conditions, including, but not limited to, the receipt of all necessary regulatory approvals, and subject to addressing any comments received from the Canadian Securities Exchange during a five business day period from the date of this news release in accordance with their policies.

The net proceeds of the Private Placement are intended to be used for general working capital and outstanding payables. The securities issued under the Private Placement will be subject to a statutory hold period expiring four months and one day from the date of issuance.

Proposed Debt Settlement

In line with its continued efforts to strengthen its balance sheet, the Company intends to settle debt totaling $504,119.20 owed to certain creditors of the Company in consideration for the issuance of an aggregate 3,360,795 units of the Company (each, a "Debt Settlement Unit") at a deemed price of $0.15 per Debt Settlement Unit (the "Debt Settlement").

Each Debt Settlement Unit will consist of one Share (each, a "Debt Share") and 0.59 transferable common share purchase warrants (each whole warrant, a "Debt Settlement Warrant"), with each Debt Settlement Warrant exercisable to purchase one additional common share of the Company (each, a "Debt Settlement Warrant Share") at an exercise price of $0.065 per Debt Settlement Warrant Share for a period of two years from the date of closing of the Debt Settlement. The securities issued under the Debt Settlement will be subject to a statutory hold period expiring four months and one day from the date of issuance.

Closing of the Debt Settlement is anticipated to occur on or about July 25, 2025, and is subject to certain conditions, including, but not limited to, the receipt of all necessary regulatory approvals, and subject to addressing any comments received from the Canadian Securities Exchange during a five business day period from the date of this news release in accordance with their policies.

Insiders may participate in the Private Placement and the Debt Settlement and such participation may constitute a related party transaction under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI61-101"). The Company intends to rely on exemptions from the formal valuation and minority shareholder approval requirements provided under subsections 5.5(a) and 5.7(a) of MI 61-101 on the basis that participation in the Private Placement and Debt Settlement by insiders will not exceed 25% of the fair market value of the Company's market capitalization. No finder's fees are expected to be payable in connection with the Private Placement.

About Forte Group Holdings Inc.

Forte Group Holdings Inc. (CSE:FGH)(OTC:FGHFF)(FSE:7BC0, WKN:A40L1Z) a diversified lifestyle and wellness consumer packaged goods company. Forte Group develops and manufactures a range of alkaline and mineral-enriched beverages and nutraceutical supplements for both its TRACE brand and private-label clients. Based in British Columbia, Canada, Forte Group owns a pristine natural alkaline spring water aquifer and operates a 40,000-square-foot, Health Canada and HACCP-certified manufacturing facility near Osoyoos, British Columbia. The Company's distribution network includes traditional retail and e-commerce channels, delivering wellness-focused products directly to consumers through its innovative offerings.

On behalf of the Board of Directors:

Marcello Leone, Chief Executive Officer and Director

[email protected]

604-569-1414

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws. These forward-looking statements include, but are not limited to, statements regarding the completion and timing of the Private Placement and the Debt Settlement, the receipt of regulatory approvals, the intended use of proceeds, including with respect to the participation of insiders, and the potential financial impact of these transactions on Forte Group. Forward-looking statements reflect management's current expectations, estimates, projections, and assumptions as of the date hereof and are subject to a number of known and unknown risks, uncertainties, and other factors that could cause actual outcomes to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, among others: the ability to complete the Private Placement and Debt Settlement on the anticipated timeline or at all; the receipt of necessary regulatory approvals; the availability of funds; risks associated with market conditions; insider participation exceeding anticipated thresholds; and general risks relating to the Company's business, including those detailed from time to time in its public disclosure documents available on SEDAR+ at www.sedarplus.ca. Readers are cautioned not to place undue reliance on any forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

SOURCE: Forte Group Holdings

View the original press release on ACCESS Newswire

O.M.Souza--AMWN