-

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

-

What is the EU's anti-coercion 'bazooka' it could use against US?

-

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

-

Gold, silver hit peaks and stocks sink on new US-EU trade fears

-

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

-

Warhorse Wawrinka stays alive at farewell Australian Open

-

Bangladesh face deadline over refusal to play World Cup matches in India

Bangladesh face deadline over refusal to play World Cup matches in India

-

High-speed train collision in Spain kills 39, injures dozens

-

Auger-Aliassime retires in Melbourne heat with cramp

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

-

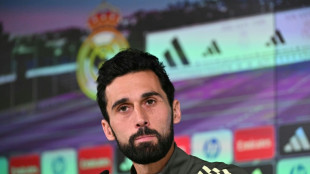

Stroking egos key for Arbeloa as Real Madrid host Monaco

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

-

Gauff 'erases' serving wobbles in winning Melbourne start

Gauff 'erases' serving wobbles in winning Melbourne start

-

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

-

Three-time finalist Medvedev grinds into Australian Open round two

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

-

China says economy grew 5% last year, among slowest in decades

China says economy grew 5% last year, among slowest in decades

-

Young star Zheng may have to give back Australian Open prize money

-

Gauff overcomes wobble in winning start to Melbourne title bid

Gauff overcomes wobble in winning start to Melbourne title bid

-

Harry set for final courtroom battle against UK media

-

'It wasn't clean': Mother mourns son killed in US Maduro assault

'It wasn't clean': Mother mourns son killed in US Maduro assault

-

Louvre heist probe: What we know

-

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

-

Morocco fans stunned, disappointed as Senegal win Africa title

-

Senegal fuelled by 'injustice' in AFCON final triumph, says hero Gueye

Senegal fuelled by 'injustice' in AFCON final triumph, says hero Gueye

-

Battery X Metals Announces Closing of $2.4 Million Private Placement Financing with Participation from Former Director and Executive Officer of Fortune 500 Skechers USA, Inc.

-

Apex Summarizes Progress to-date and 2026 Outlook at the Rift Rare Earth Project

Apex Summarizes Progress to-date and 2026 Outlook at the Rift Rare Earth Project

-

BioNxt Reports Successful Final In-Vivo Dosing Study Results Supporting Superior Bioavailability of Cladribine Sublingual ODF

-

Genflow Biosciences PLC Announces Directorate Change

Genflow Biosciences PLC Announces Directorate Change

-

Troubadour Resources Successfully Completes Phase 1 of the Multi-Phase Drill Program at Senneville Gold-Silver-Copper Property

-

Core Critical Metals Corp. Applauds Canada Nickel's Milestone Achievements and Highlights Strategic Proximity in Timmins Nickel District

Core Critical Metals Corp. Applauds Canada Nickel's Milestone Achievements and Highlights Strategic Proximity in Timmins Nickel District

-

PolyPeptide Successfully Closes Financial Year 2025 With Strong Revenue Growth and Marked Improvement in Profitability

PolyPeptide Successfully Closes Financial Year 2025 With Strong Revenue Growth and Marked Improvement in Profitability

BAAR, CH / ACCESS Newswire / January 19, 2026 / PolyPeptide Group AG (SIX:PPGN), a specialized global CDMO for peptide-based active pharmaceutical ingredients, today announced the successful closing of its financial year 2025.

Highlights

PolyPeptide closes financial year 2025 with strong revenue growth and a marked improvement in profitability, in line with the revised guidance issued at the H1 2025 results

Revenue of approximately EUR 389 million, representing an implied growth rate of circa +15.6% versus prior year, mainly driven by metabolic therapeutics; at constant currency rates, growth was slightly higher at around the mid-point of the guidance

Marked improvement in profitability from 7.5% in 2024 to between 11 - 12% EBITDA margin; towards the upper end of the guidance

Capital expenditures are expected to be in line with guidance, at just over EUR 100 million

Improved operating cash flow combined with increased financing flexibility, resulting in a year-end level of cash and cash equivalents of EUR 75 million and EUR 51 million undrawn and available under the committed revolving credit facility

Juan José Gonzalez, CEO of PolyPeptide: "The strong momentum we achieved in 2025 reflects improved execution across our multi-site network, a rich development pipeline, and rapid growth in the expanding GLP-1 market. As demand continues to accelerate, PolyPeptide is well positioned, leveraging its peptide expertise and proprietary technologies, to deliver on its mid-term targets. We will continue to strengthen our capabilities, expand capacity in close partnership with customers, and maintain the financial flexibility required to support long-term growth."

The financial figures presented herein are preliminary and unaudited.

Revenue and profitability

In 2025, PolyPeptide generated revenue of approximately EUR 389 million, translating into an implied growth of circa +15.6% compared with 2024, primarily driven by metabolic therapeutics. At constant currency rates, revenue growth was slightly higher. Capacity expansion projects have progressed well throughout the year with the large-scale solid-phase peptide synthesis (SPPS) asset in Braine-l'Alleud, Belgium achieving target utilization rate.

PolyPeptide also delivered a marked improvement in profitability in FY 2025, reaching between 11 - 12% EBITDA margin towards the upper end of guidance and up from 7.5% in 2024.

Cash flow and cash available

With strong operating cash flow in 2025 and the expansion of the existing credit facility announced in May 2025, PolyPeptide closed the year with cash and cash equivalents of EUR 75 million and EUR 51 million undrawn and available under the EUR 151 million committed revolving credit facility.

Audited full-year 2025 results and Mid-term outlook

Based on the progress achieved in 2025 and the current momentum, PolyPeptide reaffirms its mid‑term targets to double revenue reported for 2023 by 2028, with the EBITDA margin expected to approach 25% in 2028. Guidance for 2026 will be communicated, as customary, upon publication of the full-year financial results for 2025, scheduled for 12 March 2026.

Contact

PolyPeptide Group AG

Corporate Communications

Lauren Starr

[email protected]

T: +41 43 502 0580

PolyPeptide Group AG

Investor Relations

Tim Brandl

[email protected]

T: +41 43 502 0580

About PolyPeptide

PolyPeptide Group AG and its consolidated subsidiaries ("PolyPeptide") is a specialized Contract Development & Manufacturing Organization (CDMO) for peptide- and oligonucleotide-based active pharmaceutical ingredients. By supporting its customers mainly in pharma and biotech, it contributes to the health of millions of patients across the world. PolyPeptide serves a fast-growing market, offering products and services from pre-pre-clinical to commercial stages. Its broad portfolio reflects the opportunities in drug therapies across areas and with significant exposure to metabolic diseases, including GLP-1. Dating back to 1952, PolyPeptide today runs a global network of six GMP-certified facilities in Europe, the U.S. and India. PolyPeptide's shares (SIX: PPGN) are listed on SIX Swiss Exchange. For more information, please visit polypeptide.com.

@PolyPeptide -- follow us on LinkedIn

Disclaimer

This media release has been prepared by PolyPeptide Group AG and includes forward-looking information and statements concerning the outlook for the Group's business. These statements are based on current expectations, estimates and projections about the factors that may affect the Group's future performance. These expectations, estimates and projections are generally identifiable by statements containing words such as 'expects', 'believes', 'estimates', 'targets', 'plans', 'projects', 'outlook' or similar expressions. Although PolyPeptide Group AG believes that its expectations reflected in any such forward-looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.

In particular, the statements related to the Mid-term outlook constitute forward-looking statements and are not guarantees of future financial performance. The Group's actual results of operations could deviate materially from those set forth in the Mid-term outlook. As such, investors should not place undue reliance on the statements related to the Mid-term outlook.

Except as otherwise required by law, PolyPeptide Group AG disclaims any intention or obligation to update any forward-looking statements as a result of developments.

Alternative financial performance measures (APM)

This media release contains references to operational indicators and APM that are not defined or specified by IFRS, including revenue at constant currency rates, EBITDA margin and capital expenditures. These APM should be regarded as complementary information to and not as substitutes for the Group's consolidated financial results based on IFRS. These APM may not be comparable to similarly titled measures disclosed by other companies. For the definitions of the main operational indicators and APM used, including related abbreviations refer to the section "Definitions and reconciliations" in PolyPeptide Group AG's Annual Report 2024.

For the purposes of this media release, unless the context otherwise requires, the term 'the Com-pany' means PolyPeptide Group AG, and the terms 'PolyPeptide', 'the Group', 'we', 'us' and 'our' mean PolyPeptide Group AG and its consolidated subsidiaries.

SOURCE: PolyPeptide Group

View the original press release on ACCESS Newswire

P.M.Smith--AMWN