-

Williams 'on the back foot' after missing Barcelona: Albon

Williams 'on the back foot' after missing Barcelona: Albon

-

Real Madrid submit evidence to UEFA in Vinicius racism probe

-

Olympics rev up Milan's renewal but locals fear price to pay

Olympics rev up Milan's renewal but locals fear price to pay

-

Cardona Coll, Fatton win Olympic-debuting ski mountaineering sprint golds

-

MSF will keep operating in Gaza 'as long as we can': mission head

MSF will keep operating in Gaza 'as long as we can': mission head

-

Russian Filippov wins first medal at Milan-Cortina Games for individual neutral athletes

-

Italian Milan takes sprint honours at UAE Tour

Italian Milan takes sprint honours at UAE Tour

-

Dozens killed in jihadist attacks in northwest Nigeria

-

Zimbabwe unbeaten in T20 World Cup after six-wicket Sri Lanka win

Zimbabwe unbeaten in T20 World Cup after six-wicket Sri Lanka win

-

Postecoglou admits taking Nottingham Forest post a 'bad decision'

-

Switzerland's Fatton wins women's ski mountaineering sprint on Olympic debut

Switzerland's Fatton wins women's ski mountaineering sprint on Olympic debut

-

Kinghorn, Van der Merwe return for Scotland against Six Nations strugglers Wales

-

Repsol says could boost Venezuela oil output over 50% in 12 months

Repsol says could boost Venezuela oil output over 50% in 12 months

-

UN says Israeli actions raise 'ethnic cleansing' fears in West Bank, Gaza

-

Arteta tells faltering leaders Arsenal to harness Wolves 'pain' against Spurs

Arteta tells faltering leaders Arsenal to harness Wolves 'pain' against Spurs

-

Crowley gets nod for Irish as Prendergast drops out

-

Unbeaten Swiss to meet Great Britain in Olympic men's curling semis

Unbeaten Swiss to meet Great Britain in Olympic men's curling semis

-

UK police arrest ex-prince Andrew on suspicion of misconduct

-

Oil extends gains on US-Iran tensions, Europe stocks slide

Oil extends gains on US-Iran tensions, Europe stocks slide

-

Former prince Andrew, a historic downfall

-

Sri Lanka post 178-7 against Zimbabwe ahead of T20 Super Eights

Sri Lanka post 178-7 against Zimbabwe ahead of T20 Super Eights

-

OpenAI's Altman tells leaders regulation 'urgently' needed

-

US renews threat to leave IEA

US renews threat to leave IEA

-

Liverpool boss Slot says Isak in 'final stages of rehab'

-

Airbus ready to build two new European fighter jets if 'customers' ask

Airbus ready to build two new European fighter jets if 'customers' ask

-

UN Sudan probe finds 'hallmarks of genocide' in El-Fasher

-

Costelow starts, Hamer-Webb makes Wales debut in Six Nations clash with Scotland

Costelow starts, Hamer-Webb makes Wales debut in Six Nations clash with Scotland

-

Facing US warnings, Iran defends right to nuclear enrichment

-

Ex-South Korea leader Yoon gets life in prison for insurrection

Ex-South Korea leader Yoon gets life in prison for insurrection

-

OpenAI's Altman says at India summit regulation 'urgently' needed

-

British couple held in Iran sentenced to 10 years

British couple held in Iran sentenced to 10 years

-

West Indies ease past Italy to tune up for T20 Super Eights

-

At least 16 killed after building collapses in Pakistan following blast

At least 16 killed after building collapses in Pakistan following blast

-

Summit photo op fails to unite AI startup rivals

-

OpenAI's Altman says world 'urgently' needs AI regulation

OpenAI's Altman says world 'urgently' needs AI regulation

-

Horror comics boom in our age of anxiety

-

Turkey fires up coal pollution even as it hosts COP31

Turkey fires up coal pollution even as it hosts COP31

-

London fashion week opens with tribute to one of its greats

-

Ex-S.Korea leader Yoon gets life in prison for insurrection

Ex-S.Korea leader Yoon gets life in prison for insurrection

-

Pea soup, veggie mash contest warms up Dutch winter

-

South Korea's Yoon: from rising star to jailed ex-president

South Korea's Yoon: from rising star to jailed ex-president

-

Private companies seek to import fuel amid Cuban energy crisis

-

India search for 'perfect game' as South Africa loom in Super Eights

India search for 'perfect game' as South Africa loom in Super Eights

-

India's Modi calls for inclusive tech at AI summit

-

Airbus planning record commercial aircraft deliveries in 2026

Airbus planning record commercial aircraft deliveries in 2026

-

Elections under fire: Colombia endures deadliest campaign in decades

-

Traore backs 'hungry' Italy against France in Six Nations

Traore backs 'hungry' Italy against France in Six Nations

-

All-rounder Curran brings stuttering England to life at the death

-

South Korea court weighs death sentence for ex-president Yoon

South Korea court weighs death sentence for ex-president Yoon

-

Tech chiefs address India AI summit as Gates cancels

Art's Way Reports Improved Results With Modular Buildings Growth Offsetting Ag Market Challenges

ARMSTRONG, IA, IA / ACCESS Newswire / October 7, 2025 / Art's Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the third quarter of fiscal 2025.

Marc McConnell, the Company's President, CEO, and Chairman, reports, "We continue to be pleased by operational progress and improved profitability during our third quarter and year to date despite persistent headwinds in the ag equipment space. During the quarter, we again benefited greatly from strong performance by our Modular Buildings segment while our Agricultural Products segment continued to experience modest demand. We remain focused on enhancing our products and customer experience to improve our market position in both segments while also further improving our balance sheet and cashflow positions. We are cautiously optimistic that strong profitability among livestock producers will lead to improvement in demand in the near term and into 2026."

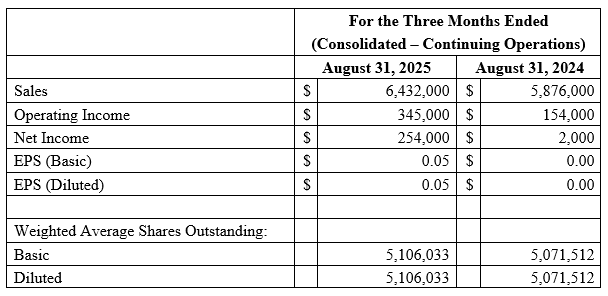

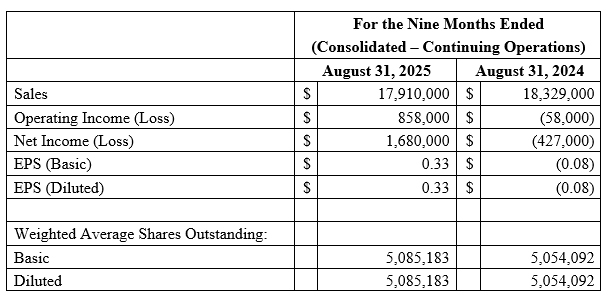

Consolidated - continuing operations

Sales of $6,432,000 for Q3 of fiscal 2025, a 9.5% increase from Q3 2024, and sales of $17,910,000 for the nine months ended August 31, 2025, a 2.3% decline from the same period of 2024.

Nine-month gross profit as a percentage of sales improved 1.2% compared to the first nine months of fiscal 2024.

Operating expenses decreased by 13.1% for the nine months ended August 31, 2025 compared to the same period in fiscal 2024.

Net income of $1,680,000 for the nine months ended August 31, 2025, a $2,107,000 improvement from the same period in fiscal 2024. We received an Employee Retention Credit refund during the nine months ending August 31, 2025 that positively impacted net income by $1,154,000.

Agricultural Products

Sales of $2,983,000 for Q3 of fiscal 2025, a 0.2% decline from the same period of 2024, and sales of $9,956,000 for the nine months ended August 31, 2025, a 15.5% decline from the first nine months of fiscal 2024.

Nine-month gross profit as a percentage of sales declined 3.4% compared to the first nine months of fiscal 2024.

Operating expenses decreased by 23.0% for the nine months ended August 31, 2025 compared to the same period in fiscal 2024.

Net income of $139,000 for the nine months ended August 31, 2025, an improvement of $1,337,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund during the nine months ended August 31, 2025 that positively impacted net income by $976,000 in this segment.

We have experienced decreased demand for the last six fiscal quarters due to difficult agricultural market conditions highlighted by high interest rates, increasing input costs and low row crop prices. Although our inventory decreased from heightened levels in fiscal 2024, many dealers are still sitting on inventory from other equipment manufacturers, which hampers our ability to get these dealers to stock more of our equipment. We believe product availability will be key for the next two fiscal quarters to capitalize on retail opportunities and yearend tax buying. Strategically, we are continuing to build inventory through our fiscal year end despite low demand in order to be responsive to farmers needs this fall. Livestock prices, predominately cattle, continue to be at all-time highs in fiscal 2025 and have driven strong grinder mixer sales activity thus far in fiscal 2025. We expect cattle farmers to have strong earnings in 2025, and we could potentially see retail opportunities in an attempt to offset tax liability prior to the calendar year-end. The agriculture market is highly cyclical, and we believe this is the bottom of the cycle. We anticipate that conditions will start to improve in the next 9 to 15 months in our market. Our efforts in fiscal 2024 to right-size our production and administrative staff have reduced our operating expenses which is aiding in our efforts to weather the bottom of the cycle. Our fall early order program starts in October and runs through January 15th. The sales decreases for the three- and nine- months periods ended August 31, 2025 compared to the same periods in fiscal 2024, resulted in less variable margin to cover our fixed costs comparatively while inflationary forces also negatively affected our gross margin. Steel prices began to rise in February 2025 due to tariff uncertainty and infrastructure projects that impacted domestic demand. While steel prices have dropped from their peak in April 2025, we have not seen them return to 2024 levels. We are also paying higher prices from tariff charges for imported products, which is negatively affecting our margin. We are exploring reshoring options for these items in an attempt to reduce the gross margin impact. We expect to pass on a 3-5% price increase to our customers with our fall early order program due to rising costs from our suppliers.

Modular Buildings

Sales of $3,449,000 for Q3 2025, up 19.4% from Q3 2024. Nine-month sales of $7,954,000, a 21.4% increase from the first nine months of fiscal 2024.

Nine-month gross profit as a percentage of sales improved 8.9% compared to the first nine months of fiscal 2024.

Operating expenses increased by 40.3% for the nine months ended August 31, 2025 compared to the same period in fiscal 2024. The increase is due to overlap in sales positions discussed below and increased commission expense due to an increase in ag building sales.

Net income of $1,542,000 for the nine months ended August 31, 2025, an improvement of $771,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund in the nine months ended August 31, 2025 that positively impacted net income by $179,000 in this segment.

Consistent execution on our backlog by our project managers and production team has driven sales up approximately 20% for the quarter and year to date ended August 31, 2025. We continue to grow our reputation with impactful projects in the custom research and laboratory fields in fiscal 2025. Quoting activity and custom build inquiries continue to remain strong in Q4 of fiscal 2025, despite earlier concerns about a pullback of government grants and funding. In Q1 of fiscal 2025, we brought on a Director of Business Development and Sales who replaced our then-serving President and Director of Sales. Our outgoing President and Director of Sales is working part-time as a consultant to maintain customer relationships. With the additional sales help, we are exploring new markets where our custom buildings can compete in the marketplace, including, but not limited to: datacenters, wastewater treatment facilities, petroleum and mining analysis labs, chemical production and transportation offices. We continue to see strong margins in this segment from increased workforce proficiency and software improvements, which have improved our data analytics and ability to remain within budget.

Income (Loss) per Share: Income per basic and diluted share for the first nine months of fiscal 2025 was $0.33, compared to a loss per basic and diluted share of $0.08 for the same period in fiscal 2024.

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact:

Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

[email protected]

Or visit the Company's website at www.artsway.com/

Caution Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of federal securities laws. In some cases, you can identify forward-looking statements by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," "optimistic," "opportunity," or the negative of these terms or other similar expressions. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including, but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases and tariffs, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products; domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's public filings with the Securities and Exchange Commission. Actual results may differ materially from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire

Th.Berger--AMWN