-

Women sommeliers are cracking male-dominated wine world open

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

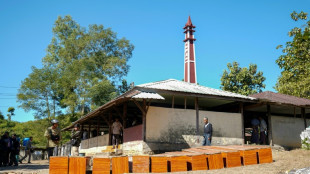

Myanmar junta denies killing civilians in hospital strike

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

-

Best Gold Investment Companies in USA Announced (Augusta Precious Metals, Lear Capital, Robinhood IRA and More Ranked)

Best Gold Investment Companies in USA Announced (Augusta Precious Metals, Lear Capital, Robinhood IRA and More Ranked)

-

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

NBA Cup goes from 'outside the box' idea to smash hit

-

UK health service battles 'super flu' outbreak

-

Can Venezuela survive US targeting its oil tankers?

Can Venezuela survive US targeting its oil tankers?

-

Democrats release new cache of Epstein photos

-

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

-

'Don't use them': Tanning beds triple skin cancer risk, study finds

-

Nancy aims to restore Celtic faith with Scottish League Cup final win

Nancy aims to restore Celtic faith with Scottish League Cup final win

-

Argentina fly-half Albornoz signs for Toulon until 2030

-

Trump says Thailand, Cambodia have agreed to stop border clashes

Trump says Thailand, Cambodia have agreed to stop border clashes

-

Salah in Liverpool squad for Brighton after Slot talks - reports

-

Marseille coach tips Greenwood as 'potential Ballon d'Or'

Marseille coach tips Greenwood as 'potential Ballon d'Or'

-

Draw marks 'starting gun' toward 2026 World Cup, Vancouver says

-

Thai PM says asked Trump to press Cambodia on border truce

Thai PM says asked Trump to press Cambodia on border truce

-

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

World stocks retrench, consolidating Fed-fuelled gains

-

Brazil left calls protests over bid to cut Bolsonaro jail time

-

Trump attack on Europe migration 'disaster' masks toughening policies

Trump attack on Europe migration 'disaster' masks toughening policies

-

US plan sees Ukraine joining EU in 2027, official tells AFP

-

'Chilling effect': Israel reforms raise press freedom fears

'Chilling effect': Israel reforms raise press freedom fears

-

Iran frees child bride sentenced to death over husband's killing: activists

-

No doubting Man City boss Guardiola's passion says Toure

No doubting Man City boss Guardiola's passion says Toure

-

Youthful La Rochelle name teen captain for Champions Cup match in South Africa

-

World stocks consolidate Fed-fuelled gains

World stocks consolidate Fed-fuelled gains

-

British 'Aga saga' author Joanna Trollope dies aged 82

-

Man Utd sweat on Africa Cup of Nations trio

Man Utd sweat on Africa Cup of Nations trio

-

EU agrees three-euro small parcel tax to tackle China flood

-

Taylor Swift breaks down in Eras documentary over Southport attack

Taylor Swift breaks down in Eras documentary over Southport attack

-

Maresca 'relaxed' about Chelsea's rough patch

Yogurt maker Lactalis betting on US appetite

French dairy giant Lactalis is betting big on North America, adapting to local preferences to attract consumers while it manages country-specific issues, such as the extreme volatility of US milk prices.

On the new production line at Stonyfield Farm in Londonderry, New Hampshire, a Lactalis subsidiary since 2017, 800,000 yogurts are pumped out every week.

The organic brand is seeing strong demand for its products aimed at babies and children, so Stonyfield plans to build a second production line for them this year.

To nibble at US market share in the yogurt sector, where Lactalis is behind Danone, Chobani and Yoplait, the company has also adopted targeted strategies.

Unlike Europeans, who often eat yogurt at the end of a meal, Americans "have yogurt for breakfast or as a snack," said Esteve Torrens, Stonyfield's CEO.

"So the yogurts must be more nutritious, and in larger portions," he adds, noting that individual cups in the US market generally weigh 170 grams, compared to just 125 grams in France.

The company also is monitoring changes in taste, like the thick, high-protein and low-sugar Icelandic yogurts from the Siggi's brand, acquired by Lactalis in 2018.

"When I came to the United States as a student, a lot of foods were full of sugar," founder Siggi Hilmarsson recalls, noting that the best-selling yogurt at the time contained proportionally more sugar than a soda.

He introduced Icelandic skyr to the American market in 2006, but sales really took off in 2012 and 2013 when "sugar replaced fat as public enemy number one in healthy eating," he said.

- Driver shortage -

He decided to sell his business four years ago to Lactalis in order to promote his yogurt in other countries. The brand is now available in France, Australia, Canada and South Korea.

With Siggi's and Stonyfield, as well the natural, specialty and organic cheeses acquired from Kraft in 2021, and the labne and other dairy products from Karoun integrated into its portfolio in 2017, the United States will become Lactalis' largest market this year after France.

It is just ahead of Canada where the group, with an annual turnover of 22 billion euros, has grown in recent years, especially after buying Ultima Foods.

The firm relies on its experience in the sector and its global reach to relaunch products whose financial performance no longer satisfied their former owners, and to expand some promising brands.

Most of the new machines installed at the Stonyfield production site come from Europe "because we have historical relations with our suppliers and they know what we need," production manager Mathieu Le Duey told reporters during a tour of the plant.

A private company founded in Laval, France in 1933 and still controlled by the Besnier family, Lactalis first entered the North American market when it opened an import-export office in the early 1980s to introduce French products.

The group has expanded through various acquisitions and now has 30 sites and 7,400 employees in Canada and the United States.

More recently it has had to grapple with issues particular to the American market, including labor shortages and volatile dairy prices, which are based on trading on the Chicago exchange.

"For two years, it's been hellish. We can't find carriers because they have trouble finding drivers," said Gilles Meziere, the group's North America chief executive.

"We have very high turnover rates in our factories," sometimes forcing the temporary suspension of production lines, he adds.

At the Stonyfield factory, the group "had to bring in executives for a day because we couldn't put the products in the boxes."

X.Karnes--AMWN