-

Film legend Bardot backs Depardieu ahead of sexual assault verdict

Film legend Bardot backs Depardieu ahead of sexual assault verdict

-

Mbappe shows fallen Real Madrid new road to riches

-

Drones hit Ukraine as Zelensky awaits Putin reply on talks

Drones hit Ukraine as Zelensky awaits Putin reply on talks

-

Indian great Kohli follows Rohit in retiring from Test cricket

-

UK hosts European ministers for Ukraine talks amid ceasefire call

UK hosts European ministers for Ukraine talks amid ceasefire call

-

Copenhagen to offer giveaways to eco-friendly tourists

-

Ocalan: founder of the Kurdish militant PKK who authored its end

Ocalan: founder of the Kurdish militant PKK who authored its end

-

Kurdish militant PKK says disbanding, ending armed struggle

-

Under pressure, UK govt unveils flagship immigration plans

Under pressure, UK govt unveils flagship immigration plans

-

India great Virat Kohli retires from Test cricket

-

US, China agree to slash tariffs in trade war de-escalation

US, China agree to slash tariffs in trade war de-escalation

-

Markets rally after China and US slash tariffs for 90 days

-

India, Pakistan military to confer as ceasefire holds

India, Pakistan military to confer as ceasefire holds

-

Kurdish militant group PKK says disbanding, ending armed struggle

-

Virat Kohli: Indian batting great and hero to hundreds of millions

Virat Kohli: Indian batting great and hero to hundreds of millions

-

India great Virat Kohli announces retirement from Test cricket

-

Netanyahu vows further fighting despite planned US-Israeli hostage release

Netanyahu vows further fighting despite planned US-Israeli hostage release

-

Salt of the earth: Pilot project helping reclaim Sri Lankan farms

-

UK towns harness nature to combat rising flood risk

UK towns harness nature to combat rising flood risk

-

Romania's far-right candidate clear favourite in presidential run-off

-

UK lab promises air-con revolution without polluting gases

UK lab promises air-con revolution without polluting gases

-

Reel tensions: Trump film trade war looms over Cannes

-

Peru hopes local miracle gets recognition under new pope

Peru hopes local miracle gets recognition under new pope

-

Opening statements in Sean Combs trial expected Monday

-

Indian army reports 'first calm night' after Kashmir truce with Pakistan holds

Indian army reports 'first calm night' after Kashmir truce with Pakistan holds

-

As world heats up, UN cools itself the cool way: with water

-

Pacers push Cavs to brink in NBA playoffs, Thunder pull even with Nuggets

Pacers push Cavs to brink in NBA playoffs, Thunder pull even with Nuggets

-

US, China to publish details of 'substantial' trade talks in Geneva

-

Asian markets rally after positive China-US trade talks

Asian markets rally after positive China-US trade talks

-

Indians buy 14 million ACs a year, and need many more

-

Election campaigning kicks off in South Korea

Election campaigning kicks off in South Korea

-

UK hosts European ministers for Ukraine talks after ceasefire ultimatum

-

Leo XIV gets down to business on first full week as pope

Leo XIV gets down to business on first full week as pope

-

White at the double as Whitecaps fight back against LAFC

-

Trump hails Air Force One 'gift' after Qatari luxury jet reports

Trump hails Air Force One 'gift' after Qatari luxury jet reports

-

'Tool for grifters': AI deepfakes push bogus sexual cures

-

US and China to publish details of 'substantial' trade talks in Geneva

US and China to publish details of 'substantial' trade talks in Geneva

-

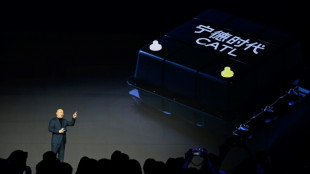

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

-

Gryphon Digital Mining Announces Merger with American Bitcoin

Gryphon Digital Mining Announces Merger with American Bitcoin

-

Genflow Biosciences PLC Announces Holding(s) in Company

-

Funding for Colosseum Project

Funding for Colosseum Project

-

AbTherx and Spice Biotechnologies Announce Multi-Program Antibody Discovery Collaboration

-

Agronomics Limited Announces Net Asset Value Calculation as at 31 March 2025

Agronomics Limited Announces Net Asset Value Calculation as at 31 March 2025

-

Kiwi Fox wins PGA Myrtle Beach title in playoff

-

Thunder edge Nuggets to level NBA playoff series

Thunder edge Nuggets to level NBA playoff series

-

Straka holds firm to win PGA Tour's Truist Championship

-

Philippines heads to polls with Marcos-Duterte feud centre stage

Philippines heads to polls with Marcos-Duterte feud centre stage

-

Napoli give Inter Scudetto hope after being held by Genoa

-

US, China hail 'substantial progress' after trade talks in Geneva

US, China hail 'substantial progress' after trade talks in Geneva

-

Blessings but not tips from Pope Leo at Peru diner

Markets rally after China and US slash tariffs for 90 days

Stocks rallied Monday after Chinese and US officials held "substantial" trade talks and slashed their tit-for-tat tariffs for 90 days, fuelling hopes the two sides will pull back from a standoff that has rattled global markets.

Investors have been on a rollercoaster ride since Donald Trump unveiled eye-watering tolls on trading partners on April 2, with the heftiest saved for Beijing, raising concerns of a trade war between the economic superpowers.

The US president eventually hiked the measures against China to 145 percent, which were met with retaliatory rates of 125 percent.

However, there have been signs of an easing of tensions and after two days of highly anticipated negotiations in Geneva, the two countries hailed progress towards ending a crisis that fuelled fears of a global recession.

On Monday the two said they would slash their levies to cool tensions and give officials time to resolve their differences.

In a joint statement the US side said it would reduce tolls to 30 percent while Chinese tariffs would be cut to 10 percent.

That came after US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer met Chinese Vice Premier He Lifeng and international trade representative Li Chenggang in the first known talks since Trump's "Liberation Day" announcement.

"We've made substantial progress between the United States and China in the very important trade talks," Bessent told reporters, while the White House has hailed what it called a new "trade deal".

China's He said the atmosphere in the talks was "candid, in-depth and constructive", adding that they were "an important first step".

Asian markets jumped, with Hong Kong up more than three percent while Shanghai also enjoyed healthy buying interest.

Tokyo, Sydney, Seoul, Taipei and Wellington were all in the green.

London, Paris and Frankfurt all rose more than one percent.

US futures surged more than one percent.

Mumbai jumped more than three percent after India and Pakistan agreed a ceasefire at the weekend following four days of missile, drone and artillery attacks between the two countries which killed at least 60 people and sent thousands fleeing.

Pakistan's stock exchange rocketed more than nine percent.

Oil prices jumped more than three percent owing to speculation easing China-US tensions would help demand. The dollar also advanced one percent against the euro and yen.

Gold, which rallied last month over a rush to safe havens, extended losses.

"The initial reaction to the weekend US-China talks (is) predictably encouraging," said Chris Weston at Pepperstone.

However, Karsten Junius at Bank J. Safra Sarasin was cautious.

"We expect financial markets to remain volatile over the coming months, as they have almost fully priced out negative economic surprises and could once again be disrupted by more serious obstacles in trade negotiations," he said in a commentary.

"In all likelihood, things may still get worse before they get better."

Investors are also awaiting the release this week of data on US inflation and retail sales, which will provide a fresh snapshot of the world's biggest economy since the tariffs were first unveiled.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 37,644.26 (close)

Hong Kong - Hang Seng Index: UP 3.3 percent at 23,630.68

Shanghai - Composite: UP 0.8 percent at 3,369.24 (close)

London - FTSE 100: UP 1.1 percent at 8,645.25

Euro/dollar: DOWN at $1.1104 from $1.1257 on Friday

Pound/dollar: DOWN at $1.3289 from $1.3308

Dollar/yen: UP at 147.89 yen from 145.31 yen

Euro/pound: DOWN at 84.44 pence from 84.57 pence

West Texas Intermediate: UP 3.6 percent at $63.24 per barrel

Brent North Sea Crude: UP 3.4 percent at $66.11 per barrel

New York - Dow: DOWN 0.3 percent at 41,249.38 (close)

J.Williams--AMWN