-

NYALA Digital Asset AG paves new way for digital securities as a profitable investment

NYALA Digital Asset AG paves new way for digital securities as a profitable investment

-

'Make America Healthy Again' report updated to remove nonexistent studies

-

Griffin continues hot streak with 65 to lead at Memorial

Griffin continues hot streak with 65 to lead at Memorial

-

Munguia denies doping despite adverse test result

-

What comes next in Trump's legal battle over tariffs?

What comes next in Trump's legal battle over tariffs?

-

Ukraine renews demand to see Russia's peace terms

-

Remains of Mayan city nearly 3,000 years old unearthed in Guatemala

Remains of Mayan city nearly 3,000 years old unearthed in Guatemala

-

Canadian wildfire emergency spreads to second province

-

Djokovic rolls past Moutet to reach French Open last 32

Djokovic rolls past Moutet to reach French Open last 32

-

Brook hails 'exceptional' Bethell as England rout West Indies

-

Elon Musk's rocket-fueled ride with Trump flames out

Elon Musk's rocket-fueled ride with Trump flames out

-

Trump tariffs stay in place for now, after appellate ruling

-

AC Milan announce they are parting with coach Conceicao

AC Milan announce they are parting with coach Conceicao

-

Hamas says new US-backed truce proposal does not meet demands

-

England captain Brook off to winning start with West Indies thrashing

England captain Brook off to winning start with West Indies thrashing

-

Russia says Ukraine not responding on Istanbul talks

-

Who said what: French Open day 5

Who said what: French Open day 5

-

Sinner thrashes retiring Gasquet at French Open, Djokovic, Gauff through

-

White House slams court decision blocking Trump tariffs

White House slams court decision blocking Trump tariffs

-

Gauff says women's matches 'worthy' of French Open night session

-

US judge sentences ex-Goldman Sachs banker to two years over 1MDB scandal

US judge sentences ex-Goldman Sachs banker to two years over 1MDB scandal

-

US says Israel backs latest Gaza truce plan sent to Hamas

-

Trump steps up call for US rate cuts in talks with Fed chief

Trump steps up call for US rate cuts in talks with Fed chief

-

Climate action could save half of world's vanishing glaciers, says study

-

After 2 months, 40 witnesses, Maradona trial scrapped

After 2 months, 40 witnesses, Maradona trial scrapped

-

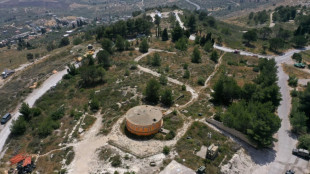

Israel's settlement plan in occupied West Bank draws criticism

-

'Perfect end': Sinner brings curtain down on Gasquet at French Open

'Perfect end': Sinner brings curtain down on Gasquet at French Open

-

After 2 months, 40 witnesses, Maradona trial declared null

-

Hazlewood helps Bengaluru thrash Punjab to reach IPL final

Hazlewood helps Bengaluru thrash Punjab to reach IPL final

-

Harvard graduation overshadowed by Trump threats

-

Munar slams crowd 'circus' after tough French Open loss

Munar slams crowd 'circus' after tough French Open loss

-

France to ban smoking outdoors in most places: minister

-

White House slams 'blatantly wrong' court decision blocking Trump tariffs

White House slams 'blatantly wrong' court decision blocking Trump tariffs

-

Bethell stars as England make 400-8 against West Indies in 1st ODI

-

Chapo's ex-lawyer among Mexico's 'high-risk' aspiring judges

Chapo's ex-lawyer among Mexico's 'high-risk' aspiring judges

-

'Make America Healthy Again' report cites nonexistent studies: authors

-

Stocks shrug off US court's tariff ruling

Stocks shrug off US court's tariff ruling

-

Snappy Norris denies change to title approach

-

Denz breaks away to win for Roglic as Del Toro protects Giro lead

Denz breaks away to win for Roglic as Del Toro protects Giro lead

-

Sidi Ould Tah: Africa's new 'super banker'

-

Bublik plays 'match of his life' to upset De Minaur in Paris

Bublik plays 'match of his life' to upset De Minaur in Paris

-

De Minaur blames 'too much tennis' after French Open letdown

-

Generative AI's most prominent skeptic doubles down

Generative AI's most prominent skeptic doubles down

-

Hamas says examining new US deal for Gaza

-

Albon picks up the tab for Russell's lobster pasta Monaco 'revenge'

Albon picks up the tab for Russell's lobster pasta Monaco 'revenge'

-

Gauff fights past Valentova to reach French Open third round

-

Boeing CEO confident US will clear higher MAX output in 2025

Boeing CEO confident US will clear higher MAX output in 2025

-

Harvard holds graduation in shadow of Trump threat

-

Sinner thrashes retiring Gasquet at French Open, Zverev, Andreeva through

Sinner thrashes retiring Gasquet at French Open, Zverev, Andreeva through

-

Vondrousova plays through pain to meet Pegula at French Open

Stocks sink as rally over eased trade tensions fades

Stock markets sank Wednesday on evaporating cheer over eased tariff tensions, and oil prices climbed as Washington appeared closer to possibly putting fresh sanctions on Moscow over Ukraine.

London, Paris and Frankfurt all closed lower, following Asia down.

New York was trading in similar red territory.

Much of the focus on Wall Street was on Nvidia, the US chipmaker, whose earnings report -- to be released after New York's close -- was being viewed as a bellwether for tech stocks generally.

"This is expected to be another quarter of monster revenue for Nvidia, however it may lead to the familiar question, can these results continue?" asked Kathleen Brooks, research director at XTB.

She and others pointed to uncertainty over US restrictions on semiconductor exports, against a backdrop of effervescent chip demand as artificial intelligence development accelerates.

Crude prices surged more than two percent, ahead of an OPEC meeting to discuss output and hiked tensions over Russia and Iran.

President Donald Trump's rare rebuke Tuesday of Russian counterpart Vladimir Putin over stepped-up attacks on Ukraine -- saying he was "playing with fire" -- raised the prospect of tougher US sanctions on Russian energy and banking sectors.

US-Iran talks on curbing Tehran's nuclear programme have also yielded no breakthrough so far, additionally fuelling speculation of tightened sanctions.

The US dollar picked up against major currencies, but analysts said that masked a fundamental weakness in the greenback, and in the US debt market, evident in recent weeks.

"It's the creeping realisation that US assets no longer provide the same refuge" they used to, said Stephen Innes of SPI Asset Management. "Dollar strength is no longer reflexive -- it's contested."

Europe and Asia were down after a rally over the previous two days triggered by Trump's announcement he was pausing threatened 50-percent tariffs on the European Union to give space to trade negotiations.

"The market no longer takes Trump at his word when he delivers swathing tariff hikes seemingly at random," said Brooks.

David Morrison, senior market analyst at Trade Nation, said: "It looks as if investors are looking past tariffs, assuming that all will be for the best, in the best of all worlds. This Panglossian view could be severely tested, and a US-EU deal could prove hard to achieve."

In Europe, auto giant Stellantis, which makes Jeep, Peugeot, Chrysler and Fiat vehicles, named a new CEO -- its North America chief Antonio Filosa -- to succeed Carlos Tavares, who was sacked in December.

"To give him full authority and ensure an efficient transition, the Board has granted him CEO powers effective June 23," the company said.

Stellantis shares closed more than two percent down.

A Financial Times report that European Central Bank President Christine Lagarde had discussed leaving her post early to take the helm of the World Economic Forum had little impact on the euro.

"It is trading in a relatively tight range, suggesting that reports Christine Lagarde may not fulfill her full term at the ECB is not having an impact on European markets," said XTB's Brooks.

- Key figures at around 1545 GMT -

New York - Dow: DOWN 0.3 percent at 42,198.20 points

New York - S&P 500: DOWN 0.3 percent at 5,905.81

New York - Nasdaq Composite: DOWN 0.1 percent at 19,173.59

London - FTSE 100: DOWN 0.6 percent at 8,726.01 (close)

Paris - CAC 40: DOWN 0.5 percent at 7,788.10 (close)

Frankfurt - DAX: DOWN 0.8 percent at 24,038.19 (close)

Tokyo - Nikkei 225: FLAT at 37,722.40 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 23,258.31 (close)

Shanghai - Composite: FLAT at 3,339.93 (close)

Euro/dollar: DOWN at $1.1288 from $1.1329 on Tuesday

Pound/dollar: DOWN at $1.3460 from $1.3504

Dollar/yen: UP at 145.01 yen from 144.34 yen

Euro/pound: DOWN at 83.85 pence from 83.88 pence

Brent North Sea Crude: UP 2.3 percent at $64.99 per barrel

West Texas Intermediate: UP 2.6 percent at $62.44 per barrel

Y.Nakamura--AMWN