-

India exporters cautiously optimistic as US tariff deadline looms

India exporters cautiously optimistic as US tariff deadline looms

-

Real Madrid oust Juventus as Dortmund reach Club World Cup quarters

-

Relief coming for Europe after brutal heatwave

Relief coming for Europe after brutal heatwave

-

Fate of major trade deal with EU hangs over Mercosur summit

-

Thai veteran politician set for single day as acting PM

Thai veteran politician set for single day as acting PM

-

Guirassy double as Dortmund down Monterrey to reach Club World Cup quarters

-

BTS agency confirms superstars' 2026 album, tour

BTS agency confirms superstars' 2026 album, tour

-

US halting some shipments of military aid to Ukraine

-

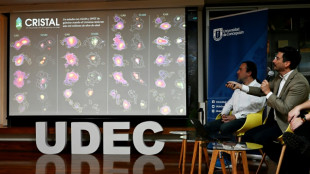

ALMA lets astronomers see building blocks of early galaxies

ALMA lets astronomers see building blocks of early galaxies

-

Philippines biodiversity hotspot pushes back on mining

-

Deal or no deal: What happens with Trump's July tariff deadline?

Deal or no deal: What happens with Trump's July tariff deadline?

-

Canada turns to drones for reforestation after wildfires

-

US, Japan, India, Australia pledge mineral cooperation on China jitters

US, Japan, India, Australia pledge mineral cooperation on China jitters

-

Son of kingpin 'El Chapo' to plead guilty to drug trafficking in US

-

Trump urges 60-day Gaza ceasefire deal ahead of Netanyahu visit

Trump urges 60-day Gaza ceasefire deal ahead of Netanyahu visit

-

Partial verdict in Combs trial, jury will keep deliberating

-

Djokovic thanks 'miracle pills' after Wimbledon win

Djokovic thanks 'miracle pills' after Wimbledon win

-

US college bans transgender athletes following swimming furor

-

Global stocks mixed as markets track US trade deal prospects

Global stocks mixed as markets track US trade deal prospects

-

Djokovic up and running at Wimbledon in bid for Grand Slam history

-

Jury reaches partial verdict in Sean "Diddy" Combs trial

Jury reaches partial verdict in Sean "Diddy" Combs trial

-

Giroud signs one-year deal with Ligue 1 club Lille

-

Gauff vows to make changes after shock Wimbledon exit

Gauff vows to make changes after shock Wimbledon exit

-

Gonzalo heads Real Madrid past Juventus and into Club World Cup quarters

-

Gauff crashes out of Wimbledon on day of shocks

Gauff crashes out of Wimbledon on day of shocks

-

Big automakers report US sales jump on pre-tariff consumer surge

-

'Alone' Zverev considers therapy after shock Wimbledon exit

'Alone' Zverev considers therapy after shock Wimbledon exit

-

Second seed Coco Gauff knocked out of Wimbledon

-

Switzerland comes to the aid of Red Cross museum

Switzerland comes to the aid of Red Cross museum

-

'That's life': No regrets for former champion Kvitova after Wimbledon farewell

-

AI videos push Combs trial misinformation, researchers say

AI videos push Combs trial misinformation, researchers say

-

UK govt guts key welfare reforms to win vote after internal rebellion

-

Polish supreme court ratifies nationalist's presidential vote win

Polish supreme court ratifies nationalist's presidential vote win

-

Macron, Putin discuss Iran, Ukraine in first talks since 2022

-

French league launches own channel to broadcast Ligue 1

French league launches own channel to broadcast Ligue 1

-

Man City left to reflect on Club World Cup exit as tournament opens up

-

Shock study: Mild electric stimulation boosts math ability

Shock study: Mild electric stimulation boosts math ability

-

Europe swelters as surprise early summer heatwave spreads

-

Third seed Zverev stunned at Wimbledon

Third seed Zverev stunned at Wimbledon

-

Israel expands Gaza campaign ahead of Netanyahu's US visit

-

Gaza mourns those killed in Israeli strike on seafront cafe

Gaza mourns those killed in Israeli strike on seafront cafe

-

Rubio hails end of USAID as Bush, Obama deplore cost in lives

-

Berlusconi family sell Monza football club to US investment fund

Berlusconi family sell Monza football club to US investment fund

-

UN aid meeting seeks end to Global South debt crisis

-

Trump ramps up Musk feud with deportation threat

Trump ramps up Musk feud with deportation threat

-

French paparazzi boss handed 18-month suspended sentence for blackmail

-

Gilgeous-Alexander agrees record $285 mln extension: reports

Gilgeous-Alexander agrees record $285 mln extension: reports

-

Tearful former champion Kvitova loses on Wimbledon farewell

-

IMF urges Swiss to strengthen bank resilience

IMF urges Swiss to strengthen bank resilience

-

Sri Lanka eye top-three spot in ODI rankings

Global stocks mixed as markets track US trade deal prospects

Global stocks were mixed Tuesday as markets monitored congressional progress on Donald Trump's massive tax and spending legislation and weighed the prospects for US trade deals ahead of Trump's July 9 tariff deadline.

The Republican-led upper congressional chamber narrowly cleared Trump's mammoth domestic policy bill, sending the measure back to the House of Representatives, where the vote is also expected to be close.

Equity market viewers have cheered the prospects of extending tax cuts while expressing misgivings about projections that the measure will add some $3 trillion to the US national debt.

The Dow advanced Tuesday, while both the S&P 500 and Nasdaq retreated from records.

Earlier European markets had also ended mixed, while Japan's Nikkei suffered a 1.2 percent drop after Trump threatened new levies on Japan over a row about the country accepting US rice exports.

"The next few days are going to be testing times for governments in many parts of the world as they try to hammer out trade deals with the US," said Dan Coatsworth, an investment analyst at AJ Bell.

While few trade agreements have been reached so far, the week began with some optimism as Canada and the United States agreed to restart trade talks after Ottawa scrapped a digital services tax contested by US tech giants.

Comments from Trump and some of his top officials also suggested the deadline was flexible, and that several pacts were nearly completed.

"We expect risk sentiment to remain shaky until a deal is agreed... investors are on pause for now and are waiting for concrete news before making their next move," said Kathleen Brooks, research director at trading group XTB.

The dollar extended its retreat against the euro and other major currencies.

The Dollar Index, which compares the greenback to a basket of major currencies, fell 10.8 percent in the first half of the year, its steepest decline since the dollar became the global benchmark currency.

Investors increasingly expect the Federal Reserve to cut rates at least twice this year -- with Trump having loudly criticized Fed chief Jerome Powell for not doing so sooner -- and all eyes will be on US jobs data due this week.

Powell responded on Tuesday at a central bankers' gathering in Portugal, insisting that the Fed must remain "completely non-political" to successfully pursue its strategy of financial and economic stability.

Among individual companies, Tesla fell 5.3 percent as the electric car company's CEO Elon Musk sparred with Trump over the tax and spending bill.

After Musk lambasted the legislation as wasteful and misguided, Trump warned of retribution against Tesla and other Musk ventures.

"This high-profile feud introduces political risk," Briefing.com said of the tiff.

"The personal nature of the conflict, amplified by Trump's comments implying Tesla's reliance on subsidies for survival, has sparked fears of broader policy shifts targeting Musk's business empire. This political uncertainty undermines investor confidence."

- Key figures at around 2050 GMT -

New York - Dow: UP 0.9 percent at 44,494.94 (close)

New York - S&P 500: DOWN 0.1 percent at 6,198.01 (close)

New York - Nasdaq: DOWN 0.8 percent at 20,202.89 (close)

London - FTSE 100: UP 0.3 percent at 8,785.33 points (close)

Paris - CAC 40: FLAT at 7,662.59 (close)

Frankfurt - DAX: DOWN 1.0 percent at 23,673.29 (close)

Tokyo - Nikkei 225: DOWN 1.2 percent at 39,986.33 (close)

Shanghai - Composite: UP 0.4 percent at 3,457.75 (close)

Hong Kong - Hang Seng Index: Closed for holiday

Euro/dollar: UP at $1.1806 from $1.1787 on Monday

Pound/dollar: UP at $1.3740 from $1.3732

Dollar/yen: DOWN at 143.41 yen from 144.03 yen

Euro/pound: UP at 85.87 pence from 85.82 pence

Brent North Sea Crude: UP 0.6 percent at $67.11 per barrel

West Texas Intermediate: UP 0.5 percent at $65.45 per barrel

M.A.Colin--AMWN