-

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

-

England face searching Ashes questions after India series thriller

-

Zverev to meet Khachanov in ATP Toronto semi-finals

Zverev to meet Khachanov in ATP Toronto semi-finals

-

Swiss 'Mountain Tinder' sparks high-altitude attraction

-

Hong Kong hit by flooding after flurry of rainstorm warnings

Hong Kong hit by flooding after flurry of rainstorm warnings

-

Asian markets track Wall St rally on Fed rate cut bets

-

Gaza war deepens Israel's divides

Gaza war deepens Israel's divides

-

Beijing lifts rain alert after evacuating over 80,000

-

Decision time as plastic pollution treaty talks begin

Decision time as plastic pollution treaty talks begin

-

Zverev ignores fan distraction to advance to ATP Toronto semis

-

Remains of 32 people found in Mexico's Guanajuato state

Remains of 32 people found in Mexico's Guanajuato state

-

Trump tariffs don't spare his fans in EU

-

Brazil judge puts ex-president Bolsonaro under house arrest

Brazil judge puts ex-president Bolsonaro under house arrest

-

With six months to go, Winter Games organisers say they'll be ready

-

Rybakina to face teen Mboko in WTA Canadian Open semis

Rybakina to face teen Mboko in WTA Canadian Open semis

-

Australia to buy 11 advanced warships from Japan

-

Five years after Beirut port blast, Lebanese demand justice

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

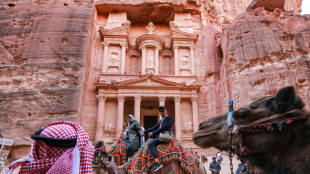

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

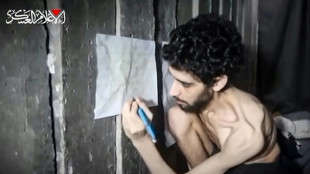

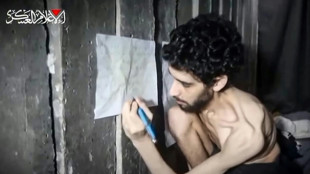

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

| SCU | 0% | 12.72 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| RIO | 0.58% | 60 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| RYCEF | 2.14% | 14.5 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BP | 2.28% | 32.49 | $ |

PB Financial Corporation Reports Record Second Quarter 2025 Earnings

ROCKY MOUNT, NC / ACCESS Newswire / July 8, 2025 / Ted E. Whitehurst, President and CEO of PB Financial Corporation (OTCQX:PBNC), the holding company (the "Company") for Providence Bank, reported net income available to common shareholders for the quarter ended June 30, 2025, of $5,112,688 compared to $4,111,594 for the same period in 2024, an increase of 24.35%. For the six-month period ended June 30, 2025, net income available to common shareholders was $9,813,082 compared to $7,280,844 for the same period in 2024, an increase of 34.78%.

As of June 30, 2025, the Company reported total assets of $1.402 billion compared to $1.261 billion on June 30, 2024, an increase of 11.14%. Total deposits were $1.186 billion and gross loans were $1.176 billion at the end of the second quarter of 2025, compared to total deposits of $1.051 billion and gross loans of $1.066 billion at the end of the second quarter of 2024, increases of 12.85% and 10.34%, respectively.

Whitehurst commented, "I am very pleased to report record quarterly earnings. The Company continued to have strong growth throughout the entire organization. We have been able to continue to drive efficiency from our strategic merger with Coastal Bank & Trust last year. As always, we will look for opportunities to further enhance shareholder value."

For the six-month period ended June 30, 2025, the Company had basic earnings of $3.42 per share compared to $2.76 per share for the same period last year, an increase of 23.91%. As of June 30, 2025, the book value per common share was $41.48 compared to $37.19 on June 30, 2024, an increase of 11.54%. On August 22, 2025, the Company will pay its third quarter dividend of $0.59 per share for each share of common stock outstanding. This will be the 55th consecutive quarterly cash dividend paid.

Providence Bank is a state-chartered community bank headquartered at 450 N. Winstead Avenue in Rocky Mount, North Carolina, with branches in Rocky Mount, Tarboro, Nashville, Wilson, Raleigh, Jacksonville, Holly Ridge, Morehead City, Richlands, and a loan production office in New Bern.

This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding PB Financial Corporation. Those statements may include but are not limited to statements regarding the Company's plans, objectives, expectations and intentions and other statements identified by words such as "believes," "considers," "expects," "anticipates," "estimates," "intends," "plans," "targets," "projects," "would be," and similar expressions. These statements are based upon current beliefs and expectations of management of PB Financial Corporation and are subject to significant risks and uncertainties. Actual or future results or events may differ from those set forth in the forward-looking statements. PB Financial Corporation does not undertake to update any forward-looking statements in this press release. The information as of and for the quarters ended June 30, 2025 and June 30, 2024 as presented are unaudited.

For more information, contact:

Ted E. Whitehurst, President and CEO

252-467-2990; [email protected]

PB Financial Corporation

Consolidated Balance Sheets and Statements of Operations

Balance Sheets | June 30, | December 31, | ||

In Thousands | 2025 | 2024 | ||

Assets | (unaudited) | * | ||

Cash and due from banks | $ | 12,992 | $ | 11,445 |

Interest-earning deposits with banks | 41,142 | 13,385 | ||

Investment securities | 122,701 | 114,048 | ||

Loans, gross | 1,176,128 | 1,129,337 | ||

Allowance for credit losses | (10,487 | ) | (10,205 | ) |

Intangible assets | 14,347 | 14,278 | ||

Other assets | 44,768 | 44,922 | ||

Total assets | $ | 1,401,591 | $ | 1,317,210 |

Liabilities and | ||||

Stockholders' Equity | ||||

Deposits | $ | 1,186,033 | $ | 1,115,145 |

Borrowed funds | 63,422 | 58,496 | ||

Other liabilities | 12,454 | 10,282 | ||

Shareholders' Equity | 139,682 | 133,287 | ||

Total liabilities and | ||||

stockholders' equity | $ | 1,401,591 | $ | 1,317,210 |

Book value per share | $ | 41.48 | $ | 39.63 |

Tangible book value per share | $ | 36.60 | $ | 34.72 |

Statements of Operations

In Thousands

For the three months ended | For the six months ended | |||||||||||

June 30, | June 30, | June 30, | June 30, | |||||||||

2025 | 2024 | 2025 | 2024 | |||||||||

(unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||

Interest income | $ | 21,856 | $ | 20,034 | $ | 42,894 | $ | 35,674 | ||||

Interest expense | 9,361 | 8,900 | 18,628 | 16,784 | ||||||||

Net interest income | 12,495 | 11,134 | 24,266 | 18,890 | ||||||||

Provision for credit losses | 118 | 20 | 279 | 192 | ||||||||

Net interest income after | ||||||||||||

provision for credit losses | 12,377 | 11,114 | 23,987 | 18,698 | ||||||||

Non interest income | 461 | 489 | 937 | 788 | ||||||||

Non interest expense | 5,802 | 5,771 | 11,410 | 9,226 | ||||||||

Income before income taxes | 7,036 | 5,832 | 13,514 | 10,260 | ||||||||

Income tax expense | 1,610 | 1,406 | 3,074 | 2,504 | ||||||||

Net income | 5,426 | 4,426 | 10,440 | 7,756 | ||||||||

Preferred stock dividends | 313 | 314 | 627 | 475 | ||||||||

Net income available to common stockholders | $ | 5,113 | $ | 4,112 | $ | 9,813 | $ | 7,281 | ||||

Net income per common share - basic | $ | 1.78 | $ | 1.46 | $ | 3.42 | $ | 2.76 | ||||

Net income per common share - diluted | $ | 1.70 | $ | 1.41 | $ | 3.27 | $ | 2.65 | ||||

* Derived from audited financial statements

SOURCE: PB Financial Corp.

View the original press release on ACCESS Newswire

H.E.Young--AMWN