-

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

-

England face searching Ashes questions after India series thriller

-

Zverev to meet Khachanov in ATP Toronto semi-finals

Zverev to meet Khachanov in ATP Toronto semi-finals

-

Swiss 'Mountain Tinder' sparks high-altitude attraction

-

Hong Kong hit by flooding after flurry of rainstorm warnings

Hong Kong hit by flooding after flurry of rainstorm warnings

-

Asian markets track Wall St rally on Fed rate cut bets

-

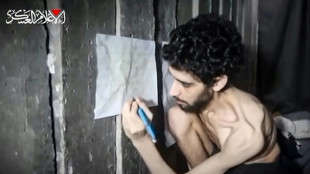

Gaza war deepens Israel's divides

Gaza war deepens Israel's divides

-

Beijing lifts rain alert after evacuating over 80,000

-

Decision time as plastic pollution treaty talks begin

Decision time as plastic pollution treaty talks begin

-

Zverev ignores fan distraction to advance to ATP Toronto semis

-

Remains of 32 people found in Mexico's Guanajuato state

Remains of 32 people found in Mexico's Guanajuato state

-

Trump tariffs don't spare his fans in EU

-

Brazil judge puts ex-president Bolsonaro under house arrest

Brazil judge puts ex-president Bolsonaro under house arrest

-

With six months to go, Winter Games organisers say they'll be ready

-

Rybakina to face teen Mboko in WTA Canadian Open semis

Rybakina to face teen Mboko in WTA Canadian Open semis

-

Australia to buy 11 advanced warships from Japan

-

Five years after Beirut port blast, Lebanese demand justice

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

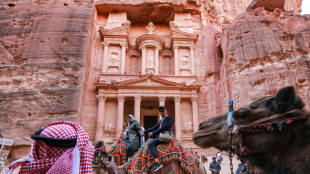

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

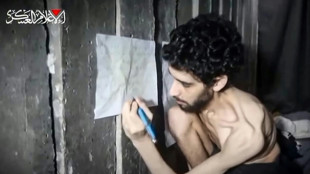

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

| SCU | 0% | 12.72 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| RIO | 0.58% | 60 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| RYCEF | 2.14% | 14.5 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BP | 2.28% | 32.49 | $ |

Globa Terra Acquisition Corporation Announces Pricing of $152 Million Initial Public Offering

MIAMI, FL / ACCESS Newswire / July 8, 2025 / Globa Terra Acquisition Corporation (the "Company") today announced the pricing of its initial public offering of 15,217,000 units at a price of $10.00 per unit. The units are expected to begin trading on The Nasdaq Global Market under the ticker symbol "GTERU" on July 9, 2025. Each unit consists of one of the Company's Class A ordinary shares, three-fourths of one redeemable warrant and one right to receive one-tenth (1/10) of one Class A ordinary share upon the consummation of an initial business combination. Each whole warrant entitles the holder thereof to purchase one Class A ordinary share at a price of $11.50 per share. Once the securities comprising the units begin separate trading, the Company expects that its Class A ordinary shares, warrants and rights will be listed on The Nasdaq Global Market under the symbols "GTER," "GTERW" and "GTERR," respectively. The offering is expected to close on July 10, 2025, subject to customary closing conditions.

The Company was formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. While the Company may pursue an initial business combination target in any industry, sector or geographic region, the Company intends to focus its search on target businesses within the agribusiness and water sectors, primarily in food-tech, ag-tech, bio-tech, controlled environment agriculture and open field crops in the case of agribusiness, and in water utility, water treatment, pipelines, desalination and other water solutions within the water sectors.

D. Boral Capital LLC is acting as sole book-running manager for the offering. The Company has granted the underwriters a 45-day option to purchase up to 2,282,550 additional units at the initial public offering price, less underwriting discounts and commissions, solely to cover over-allotments, if any.

The offering is being made only by means of a prospectus. When available, copies of the prospectus relating to the offering may be obtained from D. Boral, Attn:590 Madison Avenue 39th Floor, New York, NY 10022, by email at [email protected], or from the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov.

A registration statement on Form S-1 relating to these securities was declared effective by the U.S. Securities and Exchange Commission on July 7, 2025. This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute "forward-looking statements," including with respect to the proposed initial public offering, the closing of the offering, and the anticipated use of the net proceeds from the offering. No assurance can be given that the offering discussed above will be completed on the terms described, or at all, or that the Company will ultimately complete a business combination transaction in the sectors it is targeting or at all. Management has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While they believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond management's control. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company's registration statement on Form S-1 and preliminary prospectus for the Company's offering filed with the U.S. Securities and Exchange Commission (the "SEC"). Copies of these documents are available on the SEC's website, at www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

CONTACT

Globa Terra Acquisition Corporation

Agustin Tristan Aldave

Chief Executive Officer

Phone: + 52 (556) 698 9326

Email: [email protected]

Edward Preble

Head of Investor Relations

Phone: +1 (904) 583 7145

Email: [email protected]

Website: www.globaterra.com

SOURCE: Globa Terra Acquisition Corp.

View the original press release on ACCESS Newswire

M.Thompson--AMWN