-

'Hothead' Fognini announces retirement from tennis

'Hothead' Fognini announces retirement from tennis

-

Werner unveiled as first new Leipzig coach in Klopp era

-

Zelensky talks peace with pope ahead of Ukraine recovery conference

Zelensky talks peace with pope ahead of Ukraine recovery conference

-

Musk's chatbot Grok slammed for praising Hitler, dishing insults

-

Another Lions injury worry after fullback Kinghorn limps off

Another Lions injury worry after fullback Kinghorn limps off

-

Rider quits Tour de France after cycling 174km with fractured shoulder

-

Top European rights court finds Russia committed abuses in Ukraine

Top European rights court finds Russia committed abuses in Ukraine

-

Inspired Queensland upset NSW to snatch State of Origin crown

-

Lions tame gutsy Brumbies for fourth straight win on Australia tour

Lions tame gutsy Brumbies for fourth straight win on Australia tour

-

Red Bull sack F1 team chief Horner

-

Demna bows out at Balenciaga with star-studded Paris catwalk show

Demna bows out at Balenciaga with star-studded Paris catwalk show

-

Lions tame gutsy Brumbies to make it four straight wins

-

Djokovic eyes Wimbledon history, wounded Sinner in spotlight

Djokovic eyes Wimbledon history, wounded Sinner in spotlight

-

European stocks brush off Trump's copper, pharma tariff threats

-

France police raid far-right party offices over campaign financing

France police raid far-right party offices over campaign financing

-

Commerzbank commits to strategy as UniCredit ups direct stake

-

Deadly temperatures blasted western Europe in record hot June

Deadly temperatures blasted western Europe in record hot June

-

Volkswagen US deliveries fall as Trump tariffs bite

-

England recall Archer after injury exile for third Test against India

England recall Archer after injury exile for third Test against India

-

Red Bull sack team chief Horner after two decades in charge

-

Macron turns to politics on second day of UK state visit

Macron turns to politics on second day of UK state visit

-

Ukraine says Russia launched largest drone, missile attack of war

-

Red Bull sack team chief Horner afer two decades in charge

Red Bull sack team chief Horner afer two decades in charge

-

Toll of Air India disaster rests at 260 as focus turns to crash report

-

Iraq's Kurdistan enjoys all-day state electricity

Iraq's Kurdistan enjoys all-day state electricity

-

Israel, Hamas defiant as US presses for ceasefire

-

Lidl owes French rival $50 mn after ads ruled deceptive

Lidl owes French rival $50 mn after ads ruled deceptive

-

Spain PM announces anti-graft plan as scandal rocks govt

-

Marseille wildfire that closed airport 'receding'

Marseille wildfire that closed airport 'receding'

-

Demna to bow out at Balenciaga with farewell Paris fashion show

-

Markets mixed as Trump flags fresh tariffs, eyes on trade talks

Markets mixed as Trump flags fresh tariffs, eyes on trade talks

-

Mattel launches Barbie doll with diabetes

-

Cricket's Indian Premier League value surges to $18.5 bn: report

Cricket's Indian Premier League value surges to $18.5 bn: report

-

Dutch art sleuth recovers stolen trove of UNESCO-listed documents

-

Japan imperial couple visit WWII memorial, hail 'deep friendship' in Mongolia

Japan imperial couple visit WWII memorial, hail 'deep friendship' in Mongolia

-

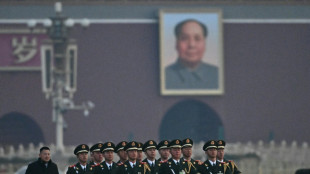

Exiled Chinese lawyers grieve loss of civil society decade after crackdown

-

Netanyahu says reaffirmed hostages release, Hamas defeat in Trump talks

Netanyahu says reaffirmed hostages release, Hamas defeat in Trump talks

-

The long slow death of Norway's wild salmon

-

Climate change made European heatwave up to 4C hotter: study

Climate change made European heatwave up to 4C hotter: study

-

Can Kenya attract the outsourcing jobs of the AI future?

-

Taiwan kicks off military drills in face of China threat

Taiwan kicks off military drills in face of China threat

-

China's snaps 4-month consumer decline but factory price deflation deepens

-

China's 'new farmers' learn to livestream in rural revitalisation

China's 'new farmers' learn to livestream in rural revitalisation

-

Asian markets mixed as Trump flags fresh tariffs, eyes on trade talks

-

Rotten insects, viral videos and climate change: S.Korea battles 'lovebug' invasion

Rotten insects, viral videos and climate change: S.Korea battles 'lovebug' invasion

-

Bitter pill: Cuba runs low on life-saving medicines

-

Owen Farrell in line for Lions tour debut against AUNZ XV: reports

Owen Farrell in line for Lions tour debut against AUNZ XV: reports

-

India look to maintain momentum against faltering England in third Test

-

June was hottest on record in western Europe: EU monitor

June was hottest on record in western Europe: EU monitor

-

Luis Enrique ready for 'special' showdown between PSG and Real Madrid

Commerzbank commits to strategy as UniCredit ups direct stake

German lender Commerzbank said Wednesday it was committed to its strategy after Italian bank UniCredit formally upped its stake in its rival, laying the ground for a potential takeover bid.

UniCredit said late Tuesday it had increased its direct stake in Commerzbank to around 20 percent from 10 percent, following all the necessary regulatory approvals.

The Italian group said it intended to convert a further tranche equivalent to around nine percent of Commerzbank's stock and held through derivatives into fully owned shares.

The moves, which made UniCredit the single-largest shareholder in the German bank, were "once again not coordinated with Commerzbank", the bank said in a statement sent to AFP on Wednesday.

Commerzbank has strongly resisted a possible takeover by UniCredit since the Italian bank announced in September it had quietly built up a stake in the German group.

The move triggered talk that UniCredit chief Andrea Orcel wanted to push for an ambitious pan-European banking merger.

"The adjustment in UniCredit's position has no impact on our strategic direction or our ambitions," Commerzbank said.

Commerzbank has looked to trim costs to make it more resistant to a takeover, announcing plans to cut 3,900 jobs by 2028, most of them in Germany.

Germany's second-largest private lender has also looked to win over stockholders by putting forward a share buy back programme.

The German government has, similar to Commerzbank itself, flatly opposed a takeover by UniCredit, with Chancellor Friedrich Merz describing the Italian group's moves as "hostile".

Berlin still holds a 12.1-percent stake in Commerzbank, the legacy of a 2008 bailout in the midst of the global financial crisis.

The government had begun the process of exiting its position in Commerzbank but has paused sales of its shares since UniCredit's interest became clear.

A large portion of the Commerzbank shares initially acquired by UniCredit in September were bought directly from the German government, a move which surprised officials.

A finance ministry spokeswoman said Wednesday that the government had "taken note" of UniCredit's latest steps.

The government "rejects UniCredit's renewed uncoordinated and unfriendly approach" and "supports Commerzbank's strategy of independence", the spokeswoman said.

As such, the government would not be parting ways with the remainder of its stake, she said.

Y.Kobayashi--AMWN