-

Djokovic eyes Wimbledon history, wounded Sinner in spotlight

Djokovic eyes Wimbledon history, wounded Sinner in spotlight

-

European stocks brush off Trump's copper, pharma tariff threats

-

France police raid far-right party offices over campaign financing

France police raid far-right party offices over campaign financing

-

Commerzbank commits to strategy as UniCredit ups direct stake

-

Deadly temperatures blasted western Europe in record hot June

Deadly temperatures blasted western Europe in record hot June

-

Volkswagen US deliveries fall as Trump tariffs bite

-

England recall Archer after injury exile for third Test against India

England recall Archer after injury exile for third Test against India

-

Red Bull sack team chief Horner after two decades in charge

-

Macron turns to politics on second day of UK state visit

Macron turns to politics on second day of UK state visit

-

Ukraine says Russia launched largest drone, missile attack of war

-

Red Bull sack team chief Horner afer two decades in charge

Red Bull sack team chief Horner afer two decades in charge

-

Toll of Air India disaster rests at 260 as focus turns to crash report

-

Iraq's Kurdistan enjoys all-day state electricity

Iraq's Kurdistan enjoys all-day state electricity

-

Israel, Hamas defiant as US presses for ceasefire

-

Lidl owes French rival $50 mn after ads ruled deceptive

Lidl owes French rival $50 mn after ads ruled deceptive

-

Spain PM announces anti-graft plan as scandal rocks govt

-

Marseille wildfire that closed airport 'receding'

Marseille wildfire that closed airport 'receding'

-

Demna to bow out at Balenciaga with farewell Paris fashion show

-

Markets mixed as Trump flags fresh tariffs, eyes on trade talks

Markets mixed as Trump flags fresh tariffs, eyes on trade talks

-

Mattel launches Barbie doll with diabetes

-

Cricket's Indian Premier League value surges to $18.5 bn: report

Cricket's Indian Premier League value surges to $18.5 bn: report

-

Dutch art sleuth recovers stolen trove of UNESCO-listed documents

-

Japan imperial couple visit WWII memorial, hail 'deep friendship' in Mongolia

Japan imperial couple visit WWII memorial, hail 'deep friendship' in Mongolia

-

Exiled Chinese lawyers grieve loss of civil society decade after crackdown

-

Netanyahu says reaffirmed hostages release, Hamas defeat in Trump talks

Netanyahu says reaffirmed hostages release, Hamas defeat in Trump talks

-

The long slow death of Norway's wild salmon

-

Climate change made European heatwave up to 4C hotter: study

Climate change made European heatwave up to 4C hotter: study

-

Can Kenya attract the outsourcing jobs of the AI future?

-

Taiwan kicks off military drills in face of China threat

Taiwan kicks off military drills in face of China threat

-

China's snaps 4-month consumer decline but factory price deflation deepens

-

China's 'new farmers' learn to livestream in rural revitalisation

China's 'new farmers' learn to livestream in rural revitalisation

-

Asian markets mixed as Trump flags fresh tariffs, eyes on trade talks

-

Rotten insects, viral videos and climate change: S.Korea battles 'lovebug' invasion

Rotten insects, viral videos and climate change: S.Korea battles 'lovebug' invasion

-

Bitter pill: Cuba runs low on life-saving medicines

-

Owen Farrell in line for Lions tour debut against AUNZ XV: reports

Owen Farrell in line for Lions tour debut against AUNZ XV: reports

-

India look to maintain momentum against faltering England in third Test

-

June was hottest on record in western Europe: EU monitor

June was hottest on record in western Europe: EU monitor

-

Luis Enrique ready for 'special' showdown between PSG and Real Madrid

-

Mexican cartel gunmen sentenced to 141 years in prison

Mexican cartel gunmen sentenced to 141 years in prison

-

Augmentus Raises $11M to Scale Physical AI for High-Mix, Complex Robotic Surface Finishing and Welding

-

SLAM Reports Gold Assays From 7.42 to 94.80 g/t Gold and Announces Resignation of Director/CFO

SLAM Reports Gold Assays From 7.42 to 94.80 g/t Gold and Announces Resignation of Director/CFO

-

Kapsch TrafficCom debuts the Next Generation of V2X Tolling for North America

-

Aeluma Secures New Contracts from NASA and the Navy to Advance Scalable Quantum and Sensing Technologies

Aeluma Secures New Contracts from NASA and the Navy to Advance Scalable Quantum and Sensing Technologies

-

Jama Connect(R) Attains Level 2 TISAX Certification from TÜV SÜD

-

MainStreetChamber Holdings, Inc. Announces National Licensing Agreement with Aloha Mini Golf to Expand Hawai'i-Themed Mini Golf Experiences Across the U.S.

MainStreetChamber Holdings, Inc. Announces National Licensing Agreement with Aloha Mini Golf to Expand Hawai'i-Themed Mini Golf Experiences Across the U.S.

-

AGFA HealthCare Achieves HITRUST I1 Certification, Demonstrating Its Commitment to and Compliance With Data Protection Standards, and Protecting Against Cybersecurity Threats

-

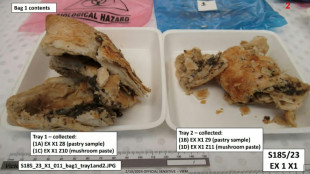

Celebrity chef dismayed over recipe used by Australia's mushroom killer

Celebrity chef dismayed over recipe used by Australia's mushroom killer

-

Delighted Maresca hails Joao Pedro after Chelsea reach Club World Cup final

-

Rubio departs for whirlwind Asia trip overshadowed by tariffs

Rubio departs for whirlwind Asia trip overshadowed by tariffs

-

Rubio imposter used AI to message high-level officials, reports say

Markets mixed as Trump flags fresh tariffs, eyes on trade talks

Stocks were mixed Wednesday as investors assessed Donald Trump's latest tariff threats, while keeping an eye on trade talks after the US president warned he would not again extend a deadline to reach deals.

Investors took in their stride news that Trump had sent letters to 14 countries outlining his new levies on expectations that most will hammer out an agreement before his new cut-off date of August 1.

But he caused rumbles on trading floors again Tuesday by announcing a 50 percent toll on copper imports and saying he was looking at 200 percent tariffs on pharmaceuticals.

The news sent the price of copper -- used in a wide range of things including cars, construction and telecoms -- to a record high Tuesday, though it edged down in Asian business.

The measures would broaden a slate of sector-specific actions Trump has imposed since returning to the White House, with autos and steel hit with taxes.

The president has ordered probes into imports of copper, pharmaceuticals, lumber, semiconductors and critical minerals that could lead to further levies.

"Today we're doing copper," he told a cabinet meeting Tuesday. "I believe the tariff on copper, we're going to make it 50 percent."

Commerce Secretary Howard Lutnick later told CNBC the rate will likely come into effect at the end of July or on August 1.

Regarding pharmaceuticals, Trump said: "We're going to give people about a year, a year and a half to come in, and after that, they're going to be tariffed.

"They're going to be tariffed at a very, very high rate, like 200 percent."

He also warned "no extensions will be granted" to his August 1 deadline for tariff deals, after he pushed back his previous cut-off of July 9 to allow more time for talks.

Despite the prospect of more tariffs, equity traders largely took the latest announcement in stride, with Wall Street ending on a mixed note.

Asia saw similar moves, with gains in Tokyo, Singapore, Seoul, Taipei, Manila, Mumbai and Jakarta tempered by losses in Hong Kong, Shanghai, Sydney, Wellington and Bangkok.

London, Frankfurt and Paris rose at the open.

"This is the market equivalent of driving with one foot on the gas and one on the brake -- negative headline risk can impact sentiment one minute, while hopes of negotiation breakthroughs ease it the next," said SPI Asset Management's Stephen Innes.

"The president's Truth Social posts are now a de facto 'risk on-risk off' barometer for global markets, each one examined like scripture, influencing metals, bond yields, and risk premiums in their wake."

However, Fabien Yip, a market analyst at IG, said: "When combined with country-specific tariffs, the impact on prices of goods and services can be far more severe than current levels suggest."

There was little major reaction to data showing Chinese consumer prices rose in June for the first time since January, providing a much-needed bright spot for the world's number two economy.

Still, that was tempered by a sharper-than-expected fall in factory gate prices that suggested there were further deflationary pressures.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 39,821.28 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 23,870.40

Shanghai - Composite: DOWN 0.1 percent at 3,493.05 (close)

London - FTSE 100: UP 0.3 percent at 8,879.67

Euro/dollar: DOWN at $1.1725 from $1.1730 on Tuesday

Pound/dollar: UP at $1.3602 from $1.3592

Dollar/yen: UP at 146.87 yen from 146.53 yen

Euro/pound: DOWN at 86.20 pence from 86.27 pence

West Texas Intermediate: DOWN 0.3 percent at $68.12 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $69.93 per barrel

New York - Dow: DOWN 0.4 percent at 44,240.76 (close)

D.Moore--AMWN