-

Zelensky urges allies to seek 'regime change' in Russia

Zelensky urges allies to seek 'regime change' in Russia

-

Trump envoy to inspect Gaza aid as pressure mounts on Israel

-

US theater and opera legend Robert Wilson dead at 83

US theater and opera legend Robert Wilson dead at 83

-

EA shooter 'Battlefield 6' to appear in October

-

Heavyweight shooter 'Battlefield 6' to appear in October

Heavyweight shooter 'Battlefield 6' to appear in October

-

Justin Timberlake says he has Lyme disease

-

Atkinson and Tongue strike as India struggle in England decider

Atkinson and Tongue strike as India struggle in England decider

-

US theater and opera auteur Bob Wilson dead at 83

-

Trump envoy to visit Gaza as pressure mounts on Israel

Trump envoy to visit Gaza as pressure mounts on Israel

-

In Darwin's wake: Two-year global conservation voyage sparks hope

-

Microsoft valuation surges above $4 trillion as AI lifts stocks

Microsoft valuation surges above $4 trillion as AI lifts stocks

-

Verstappen quells speculation by committing to Red Bull for 2026

-

Study reveals potato's secret tomato past

Study reveals potato's secret tomato past

-

Trump's envoy in Israel as Gaza criticism mounts

-

Squiban solos to Tour de France stage win, Le Court maintains lead

Squiban solos to Tour de France stage win, Le Court maintains lead

-

Max Verstappen confirms he is staying at Red Bull next year

-

Mitchell keeps New Zealand on top against Zimbabwe

Mitchell keeps New Zealand on top against Zimbabwe

-

Vasseur signs new contract as Ferrari team principal

-

French cities impose curfews for teens to curb crime

French cities impose curfews for teens to curb crime

-

Seals sing 'otherworldly' songs structured like nursery rhymes

-

India captain Gill run out in sight of Gavaskar record

India captain Gill run out in sight of Gavaskar record

-

Trump's global trade policy faces test, hours from tariff deadline

-

Study reveals potato's secret tomato heritage

Study reveals potato's secret tomato heritage

-

Wirtz said I would 'enjoy' Bayern move, says Diaz

-

West Ham's Paqueta cleared of betting charges

West Ham's Paqueta cleared of betting charges

-

AI gives stocks a lift, dollar mixed tracking Fed, tariffs

-

Authorities abandon recovery of German Olympian killed in Pakistan

Authorities abandon recovery of German Olympian killed in Pakistan

-

Talks over France, Lions game 'progressing': Benazzi

-

Popovici ready to hit the beach after world swim sprint double

Popovici ready to hit the beach after world swim sprint double

-

Magic Marchand adds gold to world record as McIntosh wins again

-

Sweden jihadist jailed for life over Jordan pilot burned alive

Sweden jihadist jailed for life over Jordan pilot burned alive

-

Zelensky signs bill ensuring anti-graft agencies' 'independence'

-

Sleepless in Singapore: Marchand wins gold, day after world record

Sleepless in Singapore: Marchand wins gold, day after world record

-

England make early double strike in India series decider

-

Popovici wins 100m freestyle world gold for sprint double

Popovici wins 100m freestyle world gold for sprint double

-

Marchand wins 200m medley gold, day after world record

-

Thousands of Afghans scramble for chance to work in Qatar

Thousands of Afghans scramble for chance to work in Qatar

-

Trump's envoy arrives in Israel as Gaza criticism mounts

-

McIntosh powers to third gold of worlds, 12-year-old Yu fourth

McIntosh powers to third gold of worlds, 12-year-old Yu fourth

-

Hong Kong sees 3.1% growth in second quarter

-

Stocks, dollar mixed tracking Fed, tariffs, results

Stocks, dollar mixed tracking Fed, tariffs, results

-

World Athletics brings in gene tests for female category eligibility

-

Trump says tariffs are making US 'great & rich' again

Trump says tariffs are making US 'great & rich' again

-

Pakistan opposition leader given 10 years for Imran Khan protests

-

India's Bumrah out of Oval finale as England bowl in fifth Test

India's Bumrah out of Oval finale as England bowl in fifth Test

-

Rights groups urge Nepal to reverse Telegram ban

-

BMW says can weather tariff storm despite profit plunge

BMW says can weather tariff storm despite profit plunge

-

Zelensky urges allies to push for 'regime change' in Russia

-

Renault profits slump as competition intensifies

Renault profits slump as competition intensifies

-

Beijing officials admit 'gaps' in readiness after rains kill dozens

| SCU | 0% | 12.72 | $ | |

| CMSC | 1.09% | 22.85 | $ | |

| RBGPF | 0.52% | 74.42 | $ | |

| BCC | -1.29% | 83.81 | $ | |

| NGG | 0.28% | 70.39 | $ | |

| SCS | 0% | 10.33 | $ | |

| CMSD | 0.9% | 23.27 | $ | |

| GSK | -4.9% | 37.15 | $ | |

| RIO | 0.47% | 59.77 | $ | |

| BCE | -0.86% | 23.33 | $ | |

| AZN | -4.79% | 73.09 | $ | |

| RYCEF | 7.62% | 14.18 | $ | |

| RELX | 0.21% | 51.89 | $ | |

| VOD | -2.31% | 10.81 | $ | |

| BP | -0.31% | 32.15 | $ | |

| BTI | 0.97% | 53.68 | $ | |

| JRI | 0.15% | 13.13 | $ |

Commencement Bancorp, Inc. (CBWA) Announces Second Quarter 2025 Results

2025 Second Quarter Financial Highlights:

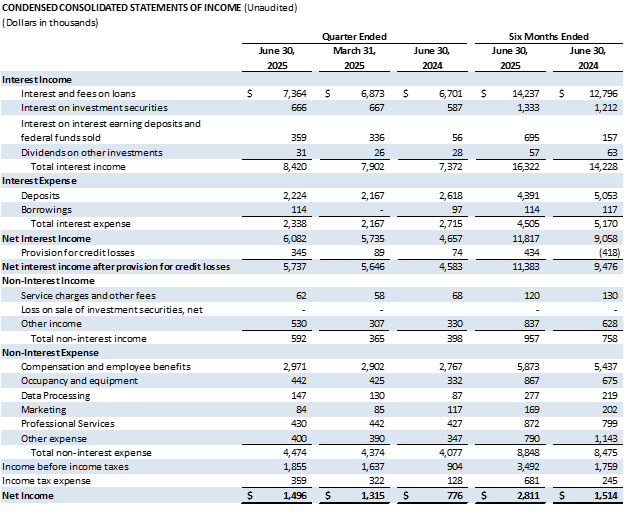

Net income was $1.5 million compared to $1.3 million for the first quarter of 2025 and $776,000 for the second quarter of 2024.

Loans receivable increased $37.9 million, or 32.4% annualized growth rate.

Deposits increased $20.5 million, or 14.4% annualized growth rate.

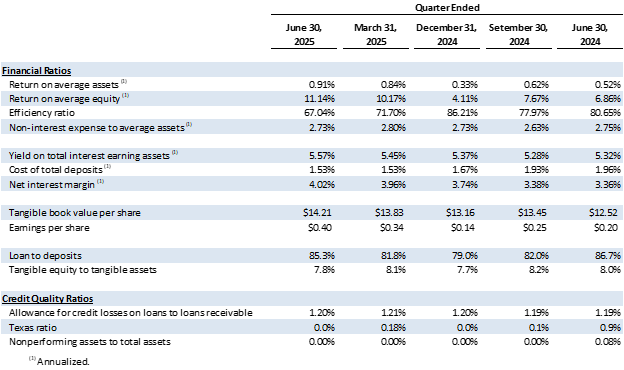

Net interest margin increased to 4.02% from 3.96% during the first quarter of 2025.

Total cost of deposits remained steady at 1.53%.

The Bank had no nonperforming assets as of June 30, 2025.

Capital ratios remained well above regulatory requirements.

TACOMA, WA / ACCESS Newswire / July 29, 2025 / Commencement Bancorp, Inc. (OTCQX:CBWA) (the "Company", "we," or "us"), the parent company of Commencement Bank (the "Bank") reported net income of $1.5 million, or $0.40 per share, for the second quarter of 2025, compared to $1.3 million, or $0.34 per share, for the first quarter of 2025 and $776,000, or $0.20 per share, for the second quarter of 2024.

"We are pleased with our continued net interest margin expansion in 2025, resulting in an improvement of 58 basis points over the same period in 2024. Due to the hard work of our bankers, we are reaping the rewards of higher loan volumes and increased yields, which when combined with our focus on managing our overall cost of funds, has resulted in improved profitability. Our capital and liquidity remain strong, and our reputation as the trusted local bank is allowing us to exceed our loan growth goals for the year," said John E. Manolides, Chief Executive Officer.

"Our bankers' calling activity and business development throughout the past several months has started to materialize, which was evidenced in the second quarter. I'm proud of their resilience while competing, building trust, and earning new lending, deposit, and treasury relationships. Our heightened brand and style of banking continues to resonate in the markets we serve, and it's rewarding to see our strong performance during the quarter," said Nigel L. English, President & Chief Operating Officer.

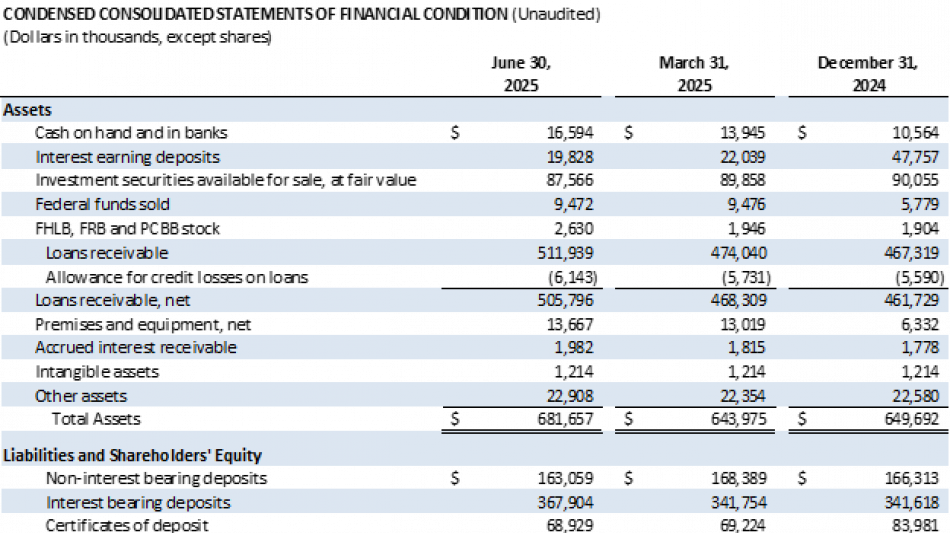

Balance Sheet

Total assets increased to $681.7 million at June 30, 2025 from $644.0 million at March 31, 2025 due to loan growth.

Investment securities available for sale decreased $2.3 million, or 2.6%, to $87.6 million at June 30, 2025 from $89.9 million at March 31, 2025. This decrease was due to principal payments and amortization of $2.2 million and an increase in unrealized losses of $88,000. The slight increase in market rates at June 30, 2025 caused the increase in unrealized losses.

Loans receivable increased $37.9 million, or 8.0%, to $511.9 million at June 30, 2025 from $474.0 million at March 31, 2025 due primarily to new loan originations, offset slightly by principal payments. The Bank originated commitments of $62.3 million during second quarter of 2025 compared to $20.8 million during the first quarter of 2025 and $27.3 million during the second quarter of 2024.

Total deposits increased $20.5 million, or 3.5%, to $599.9 million at June 30, 2025 from $579.4 million at March 31, 2025. Noninterest bearing deposits, as a percentage of total deposits, was 27.2% at June 30, 2025.

Total borrowings were $15.0 million at June 30, 2025 and represented a 3-month advance from the Federal Home Loan Bank ("FHLB") at a fixed rate of 4.50%. Borrowings were necessary during the second quarter of 2025 to fund higher than projected loan growth.

Credit Quality

The Bank had no nonperforming assets at June 30, 2025 or March 31, 2025. The allowance for credit losses to loan receivable remains strong at 1.20% at June 30, 2025.

The percentage of classified loans (loans rated Substandard or worse) to loans receivable improved to 1.69% at June 30, 2025 from 2.13% at March 31, 2025 due primarily to the payoff of two loan relationships. The Bank proactively downgrades loans if the borrower is experiencing financial difficulties.

Liquidity

The Bank has ample liquidity with both on- and off-balance sheet sources. Total on-balance sheet liquidity of $133.5 million, or 19.6% of total assets at June 30, 2025, includes cash and cash equivalents as well as unencumbered investment securities. The Bank had access to available Federal Home Loan Bank advances, Federal Reserve discount window, and federal fund lines with correspondent banks of $185.0 million at June 30, 2025.

Income Statement

Net interest income increased $347,000, or 6.1%, during the second quarter of 2025 compared to the first quarter of 2025 due to the increase in interest income of $518,000, offset by the increase in interest expense of $171,000. Net interest margin increased six basis points ("bps") to 4.02% during the second quarter of 2025 from 3.96% during the first quarter of 2025 and increased 66 bps from 3.36% during the second quarter of 2024.

Interest income on loans increased $491,000 during the second quarter of 2025 compared to the first quarter of 2025 due primarily to an increase in average balance of loans of $18.0 million. The yield on net loans increased 12 bps to 6.11% for the second quarter of 2025 from 5.99% for the first quarter of 2025 due to loan mix, higher yields on new originations, and repricing higher on existing portfolio rates.

Interest expense on deposits increased $57,000 during the second quarter of 2025 compared to the first quarter of 2025 due to an increase in the average balance of deposits of $8.2 million. Total cost of deposits was 1.53% for both the second quarter of 2025 and the first quarter of 2025.

Interest expense on borrowings increased to $114,000 during the second quarter of 2025. There was no borrowing expense during the first quarter of 2025 and $97,000 during the second quarter of 2024. The cost of the short-term funding will be augmented by dividends from the FHLB stock anticipated to be received during the third quarter of 2025.

Total non-interest income increased $227,000 during the second quarter of 2025 compared to the first quarter of 2025 due to the recognition of loan swap fee income of $188,000 and higher customer-related transactional activity in the second quarter of 2025.

Total non-interest expense increased $100,000, or 2.3%, during the second quarter of 2025 compared to the first quarter of 2025 due primarily to increase in compensation and employee benefits related to an increase in full-time equivalents and incentive compensation accrual. The second quarter of 2025 also includes three months of lease amortization and depreciation of assets related to the new Tacoma headquarters and final moving costs, as compared to one month of such costs during the first quarter of 2025.

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com

For further discussion, please contact the following:

John E. Manolides,Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Brandi Parker, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc.undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank

View the original press release on ACCESS Newswire

P.Silva--AMWN