-

Zelensky urges allies to seek 'regime change' in Russia

Zelensky urges allies to seek 'regime change' in Russia

-

Trump envoy to inspect Gaza aid as pressure mounts on Israel

-

US theater and opera legend Robert Wilson dead at 83

US theater and opera legend Robert Wilson dead at 83

-

EA shooter 'Battlefield 6' to appear in October

-

Heavyweight shooter 'Battlefield 6' to appear in October

Heavyweight shooter 'Battlefield 6' to appear in October

-

Justin Timberlake says he has Lyme disease

-

Atkinson and Tongue strike as India struggle in England decider

Atkinson and Tongue strike as India struggle in England decider

-

US theater and opera auteur Bob Wilson dead at 83

-

Trump envoy to visit Gaza as pressure mounts on Israel

Trump envoy to visit Gaza as pressure mounts on Israel

-

In Darwin's wake: Two-year global conservation voyage sparks hope

-

Microsoft valuation surges above $4 trillion as AI lifts stocks

Microsoft valuation surges above $4 trillion as AI lifts stocks

-

Verstappen quells speculation by committing to Red Bull for 2026

-

Study reveals potato's secret tomato past

Study reveals potato's secret tomato past

-

Trump's envoy in Israel as Gaza criticism mounts

-

Squiban solos to Tour de France stage win, Le Court maintains lead

Squiban solos to Tour de France stage win, Le Court maintains lead

-

Max Verstappen confirms he is staying at Red Bull next year

-

Mitchell keeps New Zealand on top against Zimbabwe

Mitchell keeps New Zealand on top against Zimbabwe

-

Vasseur signs new contract as Ferrari team principal

-

French cities impose curfews for teens to curb crime

French cities impose curfews for teens to curb crime

-

Seals sing 'otherworldly' songs structured like nursery rhymes

-

India captain Gill run out in sight of Gavaskar record

India captain Gill run out in sight of Gavaskar record

-

Trump's global trade policy faces test, hours from tariff deadline

-

Study reveals potato's secret tomato heritage

Study reveals potato's secret tomato heritage

-

Wirtz said I would 'enjoy' Bayern move, says Diaz

-

West Ham's Paqueta cleared of betting charges

West Ham's Paqueta cleared of betting charges

-

AI gives stocks a lift, dollar mixed tracking Fed, tariffs

-

Authorities abandon recovery of German Olympian killed in Pakistan

Authorities abandon recovery of German Olympian killed in Pakistan

-

Talks over France, Lions game 'progressing': Benazzi

-

Popovici ready to hit the beach after world swim sprint double

Popovici ready to hit the beach after world swim sprint double

-

Magic Marchand adds gold to world record as McIntosh wins again

-

Sweden jihadist jailed for life over Jordan pilot burned alive

Sweden jihadist jailed for life over Jordan pilot burned alive

-

Zelensky signs bill ensuring anti-graft agencies' 'independence'

-

Sleepless in Singapore: Marchand wins gold, day after world record

Sleepless in Singapore: Marchand wins gold, day after world record

-

England make early double strike in India series decider

-

Popovici wins 100m freestyle world gold for sprint double

Popovici wins 100m freestyle world gold for sprint double

-

Marchand wins 200m medley gold, day after world record

-

Thousands of Afghans scramble for chance to work in Qatar

Thousands of Afghans scramble for chance to work in Qatar

-

Trump's envoy arrives in Israel as Gaza criticism mounts

-

McIntosh powers to third gold of worlds, 12-year-old Yu fourth

McIntosh powers to third gold of worlds, 12-year-old Yu fourth

-

Hong Kong sees 3.1% growth in second quarter

-

Stocks, dollar mixed tracking Fed, tariffs, results

Stocks, dollar mixed tracking Fed, tariffs, results

-

World Athletics brings in gene tests for female category eligibility

-

Trump says tariffs are making US 'great & rich' again

Trump says tariffs are making US 'great & rich' again

-

Pakistan opposition leader given 10 years for Imran Khan protests

-

India's Bumrah out of Oval finale as England bowl in fifth Test

India's Bumrah out of Oval finale as England bowl in fifth Test

-

Rights groups urge Nepal to reverse Telegram ban

-

BMW says can weather tariff storm despite profit plunge

BMW says can weather tariff storm despite profit plunge

-

Zelensky urges allies to push for 'regime change' in Russia

-

Renault profits slump as competition intensifies

Renault profits slump as competition intensifies

-

Beijing officials admit 'gaps' in readiness after rains kill dozens

| SCU | 0% | 12.72 | $ | |

| CMSC | 1.09% | 22.85 | $ | |

| RBGPF | 0.52% | 74.42 | $ | |

| BCC | -1.29% | 83.81 | $ | |

| NGG | 0.28% | 70.39 | $ | |

| SCS | 0% | 10.33 | $ | |

| CMSD | 0.9% | 23.27 | $ | |

| GSK | -4.9% | 37.15 | $ | |

| RIO | 0.47% | 59.77 | $ | |

| BCE | -0.86% | 23.33 | $ | |

| AZN | -4.79% | 73.09 | $ | |

| RYCEF | 7.62% | 14.18 | $ | |

| RELX | 0.21% | 51.89 | $ | |

| VOD | -2.31% | 10.81 | $ | |

| BP | -0.31% | 32.15 | $ | |

| BTI | 0.97% | 53.68 | $ | |

| JRI | 0.15% | 13.13 | $ |

National Capital Bancorp, Inc. Reports Second Quarter Earnings and Quarterly Cash Dividend

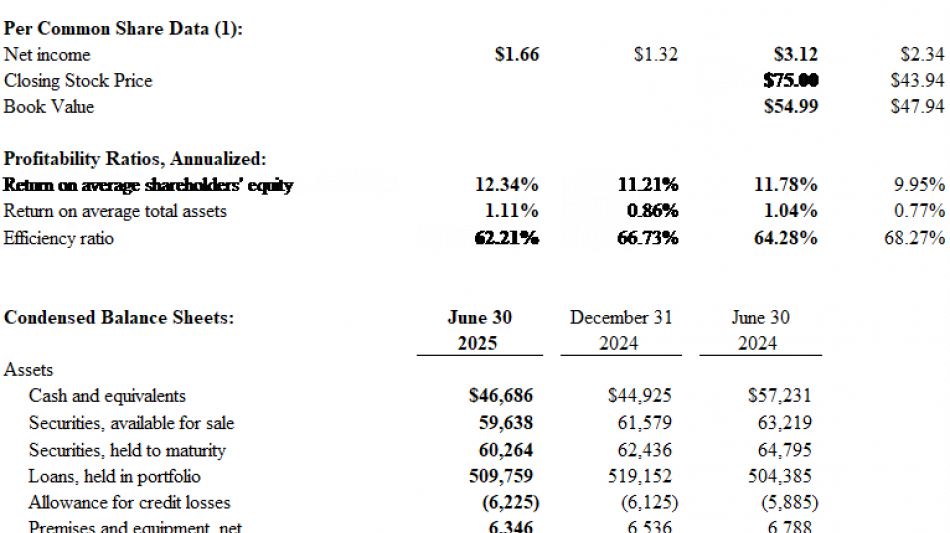

WASHINGTON, DC / ACCESS Newswire / July 30, 2025 / National Capital Bancorp, Inc. (the "Company") (OTCID:NACB), the holding company for The National Capital Bank of Washington ("NCB" or the "Bank") reported net income of $1,914,000, or $1.66 per common share, for the three months ended June 30, 2025, compared to net income of $1,520,000 or $1.32 per common share, for the quarter ended June 30, 2024. For the six months ended June 30, 2025, the Company reported net income of $3,587,000, or $3.12 per share, compared to $2,690,000, or $2.34 for the six months ended June 30, 2024. Earnings per share, cash dividends per share and average shares outstanding have been adjusted to reflect the November 2024 4:1 stock split paid in the form of a stock dividend. The increase in earnings was primarily attributable to higher net interest income driven by continued net interest margin expansion.

Total assets were down slightly year-over-year at $702,597,000 on June 30, 2025, compared to $715,959,000 on June 30, 2024. Total loans of $509,759,000 on June 30, 2025, decreased by $11.3 million during the quarter but have increased by $5.4 million over the past twelve months. Loan balances in the quarter were impacted by the payoff of several construction loan projects, a payoff of a maturing CRE loan, as well as lower utilization of commercial revolving credit lines. Total deposits of $611,778,000 on June 30, 2025, decreased $7.8 million during the quarter but have increased $4.1 million over the past twelve months. The Company has been focused on balanced growth with deposit growth providing funding for new loan opportunities. As a result, the Company continues to experience a relatively low reliance on wholesale funding sources and maintains strong levels of available secured borrowing capacity to meet the financing and cash flow needs of our client base as well as continuing to pursue desirable new relationship opportunities.

The Company's net interest margin of 3.68% during the second quarter of 2025 increased slightly compared with 3.65% in the first quarter of 2025 and compares very favorably with 3.27% in the second quarter of 2024. Our strong mix of core deposits has allowed the Company to maintain a more stable cost of funds and combined with a favorable shift in our asset mix, has resulted in the improved net interest margin compared with the prior year.

Total shareholders' equity increased to $63,281,000 on June 30, 2025 from $55,179,000 a year ago due primarily to the retained earnings for the past twelve months. For the six months ended June 30, 2025, the return on average assets and return on average equity was 1.04% and 11.78%, respectively.

"We are encouraged by the Bank's performance through the first half of 2025, highlighted by continued improvement in our net interest margin and meaningful progress in our efficiency ratio," said Jimmy Olevson, President and Chief Executive Officer of the Bank. "While we recognize a year-over-year slowdown in loan growth, we remain optimistic given the strength of our current loan pipeline. We remain cautious given the broader economic conditions and ongoing uncertainty in the DC market and are proactively monitoring credit quality across our loan portfolio. Our focus remains on driving long-term shareholder value, which is supported by the dedication of our exceptional team."

The Company also announced today that its Board of Directors has declared a cash dividend of $0.21 per share for shareholders of record as of August 15, 2025. The dividend payout of $241,682.70 on 1,150,870 shares is payable August 29, 2025.

In February 2025, the Board of Directors approved a share repurchase program of up to $600,000, allowing for purchases from time to time, in open market or private transactions with an expiration date of February 28, 2026. This program replaced the $300,000 share repurchase program approved in 2024. There were no share repurchases during the quarter ended June 30, 2025.

National Capital Bancorp, Inc. is the holding company for The National Capital Bank of Washington, which was founded in 1889 and is Washington's Oldest Bank. NCB is headquartered on Capitol Hill with offices in the Friendship Heights community in Northwest D.C., the Courthouse/Clarendon community in Arlington, Virginia and the Fox Hill senior living community of Bethesda, Maryland. NCB also operates residential mortgage and commercial lending offices and a wealth management services division. NCB product and service offerings include personal and business deposit accounts, robust online and mobile banking services and sophisticated treasury management solutions - all delivered with top-rated personal service. NCB is well positioned to serve all the banking needs of those in our communities. For more information about NCB, visit www.nationalcapitalbank.bank.

Forward-Looking Statements

This news release may contain certain forward-looking statements, such as statements of the Company's plans, objectives, expectations, estimates and intentions. Forward-looking statements may be identified using words such as "expects," "subject," "will," "intends," "will be" or "would," These statements are subject to change based on various important factors (some of which are beyond the Company's control) and actual results may differ materially. Accordingly, readers should not place undue reliance on any forward-looking statements (which reflect management's analysis of factors only as of the date of which they are given). These factors include general economic conditions, trends in interest rates, the ability of the Company to effectively manage its growth and results of regulatory examinations, among other factors. The foregoing list of important factors is not exclusive.

Contact: Randal J. Rabe, EVP, Chief Financial Officer

Phone: 202-546-8000

Email: [email protected]

SOURCE: NATIONAL CAPITAL BANCORP, INC.

View the original press release on ACCESS Newswire

P.Costa--AMWN