-

Sunset for Windows 10 updates leaves users in a bind

Sunset for Windows 10 updates leaves users in a bind

-

Hopes of Western refuge sink for Afghans in Pakistan

-

'Real' Greek farmers fume over EU subsidies scandal

'Real' Greek farmers fume over EU subsidies scandal

-

Trump to see Zelensky and lay out dark vision of UN

-

US lawmaker warns of military 'misunderstanding' risk with China

US lawmaker warns of military 'misunderstanding' risk with China

-

Emery seeks Europa League lift with Villa as Forest end long absence

-

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

-

Gibbs, Montgomery doubles as Lions rampage over Ravens

-

Asian markets struggle as focus turns to US inflation

Asian markets struggle as focus turns to US inflation

-

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

-

Maverick Georgian designer Demna debuts for Gucci in Milan

Maverick Georgian designer Demna debuts for Gucci in Milan

-

What do some researchers call disinformation? Anything but disinformation

-

Jimmy Kimmel show to return Tuesday

Jimmy Kimmel show to return Tuesday

-

Unification Church leader arrested in South Korea

-

Agronomics Limited Announces Onego Bio Update

Agronomics Limited Announces Onego Bio Update

-

Hemogenyx Pharmaceuticals PLC Signs Letter of Intent

-

Rocket Raises $15M to Redefine Production-Ready Application Development

Rocket Raises $15M to Redefine Production-Ready Application Development

-

Singapore firm rejects $1bn Sri Lankan pollution damages

-

Chile presidential contender vows to deport 'all' undocumented migrants

Chile presidential contender vows to deport 'all' undocumented migrants

-

China may strengthen climate role amid US fossil fuel push

-

Ryder Cup captains play upon emotions as practice begins

Ryder Cup captains play upon emotions as practice begins

-

Bradley defends US Ryder Cup player payments as charity boost

-

Trump ties autism risk to Tylenol as scientists urge caution

Trump ties autism risk to Tylenol as scientists urge caution

-

Dembele beats Yamal to Ballon d'Or as Bonmati retains women's award

-

Strength in Nvidia, Apple helps lift US equities to new records

Strength in Nvidia, Apple helps lift US equities to new records

-

Man City 'keeper Donnarumma says would have stayed at PSG

-

49ers ace Bosa to miss season after knee injury: reports

49ers ace Bosa to miss season after knee injury: reports

-

Canada wildlife decline 'most severe' in decades: WWF

-

PSG star Dembele wins men's Ballon d'Or

PSG star Dembele wins men's Ballon d'Or

-

Napoli beat battling Pisa to maintain perfect Serie A start

-

Spain's Aitana Bonmati wins Women's Ballon d'Or

Spain's Aitana Bonmati wins Women's Ballon d'Or

-

Jimmy Kimmel show to return Tuesday: Disney

-

Marseille inflict first defeat of season on PSG in Ligue 1

Marseille inflict first defeat of season on PSG in Ligue 1

-

White House promises US-controlled TikTok algorithm

-

Trump expected to tie autism risk to Tylenol as scientists urge caution

Trump expected to tie autism risk to Tylenol as scientists urge caution

-

Macron recognizes Palestinian state at landmark UN summit

-

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

-

S. Korea court issues arrest warrant for Unification Church leader: Yonhap

-

New US Fed governor says rates should be around 'mid-2%'

New US Fed governor says rates should be around 'mid-2%'

-

14 killed as rival Ecuadoran inmates fight with guns, explosives

-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

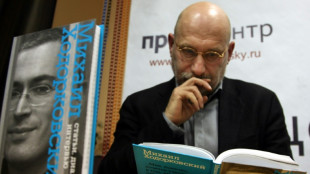

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Stocks steady ahead of key US inflation data

IRS Cracks Down on Inaccurate Charitable Deductions - Clear Start Tax Shares How to Donate Without Risk

Tax professionals warn that improper donation reporting is triggering audits and penalties for well-meaning taxpayers.

IRVINE, CA / ACCESS Newswire / August 15, 2025 / The Internal Revenue Service is intensifying its review of charitable deductions on tax returns, targeting inflated valuations, missing documentation, and donations to organizations that do not qualify for tax-exempt status. While charitable giving remains a popular tax strategy, experts say even honest mistakes can lead to costly penalties.

"Many taxpayers believe that as long as they've donated, they're in the clear - but the IRS is looking much more closely at how deductions are calculated and documented," said a spokesperson for Clear Start Tax, a nationwide tax relief and resolution firm. "We're seeing more audits where charitable deductions are flagged, even for people who thought they followed the rules."

Common pitfalls include overvaluing donated goods, failing to obtain required receipts, and claiming deductions for contributions to groups that are not officially recognized as tax-exempt. According to Clear Start Tax, these errors often occur when taxpayers rely on rough estimates or forget to verify an organization's IRS status before donating.

"The IRS expects precise records," the spokesperson explained. "If you donate clothing or household items, you need a detailed list and fair market value. If you give cash or make an online donation, you need a receipt from the charity. Without this, the deduction could be denied, and penalties may apply."

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

Clear Start Tax offers the following tips for safe charitable giving:

Verify eligibility: Confirm the organization's tax-exempt status using the IRS Tax Exempt Organization Search tool.

Document everything: Keep receipts, acknowledgment letters, and itemized lists of non-cash donations.

Be realistic about value: Use thrift store prices or IRS-approved valuation guides for goods, not original purchase prices.

Track contributions year-round: Don't wait until tax season to organize donation records.

"Giving is a great way to support causes you care about and reduce your tax bill," the spokesperson said. "But if you don't follow IRS guidelines to the letter, that good deed can end up costing you more than you saved."

About Clear Start Tax

Clear Start Tax is a national tax resolution and relief firm that helps individuals and businesses address IRS and state tax challenges. With a team of experienced professionals, the company specializes in resolving back taxes, negotiating settlements, and ensuring compliance with tax laws.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

S.Gregor--AMWN