-

Strength in Nvidia, Apple helps lift US equities to new records

Strength in Nvidia, Apple helps lift US equities to new records

-

Man City 'keeper Donnarumma says would have stayed at PSG

-

49ers ace Bosa to miss season after knee injury: reports

49ers ace Bosa to miss season after knee injury: reports

-

Canada wildlife decline 'most severe' in decades: WWF

-

PSG star Dembele wins men's Ballon d'Or

PSG star Dembele wins men's Ballon d'Or

-

Napoli beat battling Pisa to maintain perfect Serie A start

-

Spain's Aitana Bonmati wins Women's Ballon d'Or

Spain's Aitana Bonmati wins Women's Ballon d'Or

-

Jimmy Kimmel show to return Tuesday: Disney

-

Marseille inflict first defeat of season on PSG in Ligue 1

Marseille inflict first defeat of season on PSG in Ligue 1

-

White House promises US-controlled TikTok algorithm

-

Trump expected to tie autism risk to Tylenol as scientists urge caution

Trump expected to tie autism risk to Tylenol as scientists urge caution

-

Macron recognizes Palestinian state at landmark UN summit

-

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

-

S. Korea court issues arrest warrant for Unification Church leader: Yonhap

-

New US Fed governor says rates should be around 'mid-2%'

New US Fed governor says rates should be around 'mid-2%'

-

14 killed as rival Ecuadoran inmates fight with guns, explosives

-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

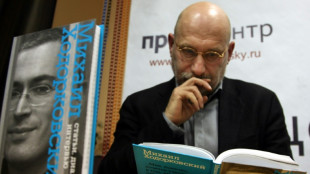

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Stocks steady ahead of key US inflation data

-

Jews flock to Ukraine for New Year pilgrimage despite travel warning

Jews flock to Ukraine for New Year pilgrimage despite travel warning

-

Trump autism 'announcement' expected Monday

-

Over 60,000 Europeans died from heat during 2024 summer: study

Over 60,000 Europeans died from heat during 2024 summer: study

-

Clashes as tens of thousands join pro-Palestinian demos in Italy

-

UK charity axes Prince Andrew's ex-wife over Epstein email

UK charity axes Prince Andrew's ex-wife over Epstein email

-

France, others to recognize Palestinian state at UN

-

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

-

Merz tasks banker with luring investment to Germany

-

Russia offers to extend nuclear arms limits with US by one year

Russia offers to extend nuclear arms limits with US by one year

-

Stocks turn lower ahead of key US inflation data

-

Gavi to undergo knee operation on meniscus injury: Barcelona

Gavi to undergo knee operation on meniscus injury: Barcelona

-

Frenchman denies killing wife in case that captivated France

-

Bavuma out of Test series in Pakistan as De Kock back for ODIs

Bavuma out of Test series in Pakistan as De Kock back for ODIs

-

Bavuma out of Test series as De Kock back for white-ball games

-

French town halls defy government warning to fly Palestinian flags

French town halls defy government warning to fly Palestinian flags

-

French zoo returns poorly panda and partner to China

-

IEA feels the heat as Washington pushes pro-oil agenda

IEA feels the heat as Washington pushes pro-oil agenda

-

Three things we learned from the Azerbaijan Grand Prix

-

Spanish bank BBVA raises offer for rival Sabadell

Spanish bank BBVA raises offer for rival Sabadell

-

Tens of thousands join pro-Palestinian demos, strikes in Italy

-

Man City's Silva fumes over lack of respect in schedule row

Man City's Silva fumes over lack of respect in schedule row

-

Israeli army operations stir fears in Syria's Quneitra

-

Chelsea's Palmer likely to avoid groin surgery: Maresca

Chelsea's Palmer likely to avoid groin surgery: Maresca

-

Horner formally leaves Red Bull after agreeing exit from F1 team

New US Fed governor says rates should be around 'mid-2%'

The US Fed governor newly appointed by President Donald Trump argued Monday for significantly lower interest rates, signaling that concerns over inflation may be overblown.

"I believe the appropriate Fed funds rate is in the mid-two percent area, almost two percentage points lower than current policy," said Federal Reserve Governor Stephen Miran at the Economic Club of New York.

In his first policy speech since joining the central bank, Miran warned that "leaving short-term interest rates roughly two percentage points too tight risks unnecessary layoffs and higher unemployment."

Last week, Miran was the sole dissenter to the Fed's decision to cut interest rates by a quarter point, instead favoring a larger half-point reduction.

On Monday, he laid out an argument on why the "neutral rate" of interest -- the level that neither stimulates nor slows the economy -- has dropped.

This is due to immigration restrictions, tariffs and tax policy changes, he believes. In turn, interest rates should also be lower.

He added that "with respect to tariffs, relatively small changes in some goods prices have led to what I view as unreasonable levels of concern."

Trump has frequently urged the Fed to slash rates this year, stepping up political pressure on the independent central bank.

But underscoring policymakers' different considerations, St Louis Fed President Alberto Musalem cautioned in a separate speech Monday of risks that above-target inflation could be more persistent than desirable.

He said officials should "tread cautiously" in reducing rates.

The central bank's latest decision brought the benchmark lending rate to a range between 4.0 percent and 4.25 percent, and it flagged risks to employment in lowering levels.

Miran, in explaining his thinking on the economy, said policy is "very restrictive."

His swift arrival to the Fed last week came as Trump has ramped up pressure for large rate cuts.

The president has also moved to oust another Fed governor, who has mounted a legal challenge against her removal.

Miran had been chairing the White House Council of Economic Advisers prior to joining the bank, and was sworn in just before the Fed's rate-setting meeting started last Tuesday.

His term expires January 31, and he has faced criticism for taking a leave of absence rather than resigning from his White House role while at the Fed.

He reiterated Monday that he would step down from the Trump administration if he expected to remain for a longer Fed term.

Miran also pledged to remain independent from politics, saying that he would "respectfully listen" if Trump urged for interest rate changes, but ultimately make up his mind based on his own analysis.

He did not shy away from further dissents: "I'm not going to vote for something I don't believe in, just for the sake of creating an illusion of consensus."

M.A.Colin--AMWN