-

Sunset for Windows 10 updates leaves users in a bind

Sunset for Windows 10 updates leaves users in a bind

-

Hopes of Western refuge sink for Afghans in Pakistan

-

'Real' Greek farmers fume over EU subsidies scandal

'Real' Greek farmers fume over EU subsidies scandal

-

Trump to see Zelensky and lay out dark vision of UN

-

US lawmaker warns of military 'misunderstanding' risk with China

US lawmaker warns of military 'misunderstanding' risk with China

-

Emery seeks Europa League lift with Villa as Forest end long absence

-

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

-

Gibbs, Montgomery doubles as Lions rampage over Ravens

-

Asian markets struggle as focus turns to US inflation

Asian markets struggle as focus turns to US inflation

-

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

-

Maverick Georgian designer Demna debuts for Gucci in Milan

Maverick Georgian designer Demna debuts for Gucci in Milan

-

What do some researchers call disinformation? Anything but disinformation

-

Jimmy Kimmel show to return Tuesday

Jimmy Kimmel show to return Tuesday

-

Unification Church leader arrested in South Korea

-

Agronomics Limited Announces Onego Bio Update

Agronomics Limited Announces Onego Bio Update

-

Hemogenyx Pharmaceuticals PLC Signs Letter of Intent

-

Rocket Raises $15M to Redefine Production-Ready Application Development

Rocket Raises $15M to Redefine Production-Ready Application Development

-

Singapore firm rejects $1bn Sri Lankan pollution damages

-

Chile presidential contender vows to deport 'all' undocumented migrants

Chile presidential contender vows to deport 'all' undocumented migrants

-

China may strengthen climate role amid US fossil fuel push

-

Ryder Cup captains play upon emotions as practice begins

Ryder Cup captains play upon emotions as practice begins

-

Bradley defends US Ryder Cup player payments as charity boost

-

Trump ties autism risk to Tylenol as scientists urge caution

Trump ties autism risk to Tylenol as scientists urge caution

-

Dembele beats Yamal to Ballon d'Or as Bonmati retains women's award

-

Strength in Nvidia, Apple helps lift US equities to new records

Strength in Nvidia, Apple helps lift US equities to new records

-

Man City 'keeper Donnarumma says would have stayed at PSG

-

49ers ace Bosa to miss season after knee injury: reports

49ers ace Bosa to miss season after knee injury: reports

-

Canada wildlife decline 'most severe' in decades: WWF

-

PSG star Dembele wins men's Ballon d'Or

PSG star Dembele wins men's Ballon d'Or

-

Napoli beat battling Pisa to maintain perfect Serie A start

-

Spain's Aitana Bonmati wins Women's Ballon d'Or

Spain's Aitana Bonmati wins Women's Ballon d'Or

-

Jimmy Kimmel show to return Tuesday: Disney

-

Marseille inflict first defeat of season on PSG in Ligue 1

Marseille inflict first defeat of season on PSG in Ligue 1

-

White House promises US-controlled TikTok algorithm

-

Trump expected to tie autism risk to Tylenol as scientists urge caution

Trump expected to tie autism risk to Tylenol as scientists urge caution

-

Macron recognizes Palestinian state at landmark UN summit

-

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

-

S. Korea court issues arrest warrant for Unification Church leader: Yonhap

-

New US Fed governor says rates should be around 'mid-2%'

New US Fed governor says rates should be around 'mid-2%'

-

14 killed as rival Ecuadoran inmates fight with guns, explosives

-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

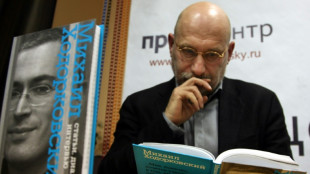

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Stocks steady ahead of key US inflation data

Capstone Reports Q2 2025 Results: Gross Margin Up to 24.4%; First Acquisition Nears Close

NEW YORK, NY / ACCESS Newswire / August 15, 2025 / Capstone Holding Corp. (NASDAQ:CAPS) today announced its second quarter 2025 financial results and strategic highlights, including substantial gross margin expansion and that it has executed an agreement today that it expects to close in the next 10 days for its first acquisition. The acquisition of a Carolina Based Stone Company will be immediately accretive and extend the company's reach into the high-growth Southeast market and expand Instone's distribution platform.

Q2 2025 results reflect continued execution on the Company's strategy of organic growth, margin expansion, and earnings-accretive acquisitions. The team is focused on delivering on our target of a $100M revenue run-rate by year-end 2025 or Q1 2026.

First Acquisition Nears Close: The acquisition agreement for a Carolina Based Stone Company has been executed and is expected to close in the next 10 days. It will be immediately accretive to both revenue and EBITDA. This strategic transaction strengthens Capstone's market presence in North Carolina - a gateway to the high-growth Southeast region - and adds premium brands with strong margin expansion potential to the Company's portfolio.

Strong Margin Growth: Gross margins expanded from 21.4% to 24.4% year-over-year, reflecting both increased sales of owned brands and disciplined cost management. This 310 basis-point margin expansion highlights Capstone's ability to drive profitability. SG&A remains on track at approximately $8.5 million annualized, supporting the Company's EBITDA growth objectives.

Active, Favorable Pipeline: Multiple additional acquisition targets are under review at attractive 4-6× EBITDA valuations, with 20-45% of each deal's consideration in non-cash consideration. At least one more acquisition is projected to close by year-end 2025, further supporting Capstone's growth pipeline.

Flexible Capital Ready: Capstone has secured an Equity Line of Credit (ELOC) and a convertible note, ensuring acquisition funding is available without reliance on high-interest debt or immediate equity dilution. This funding flexibility positions the Company to pursue earnings-accretive acquisitions that enhance both revenue growth and EBITDA performance.

Instone Positioned for Second-Half Upside: Q3 order volume is expected to rebound as market conditions normalize. Projected late-2025 interest rate cuts could give demand an extra lift. Product rollouts and new territory expansion continue to build momentum.

"It was an exciting quarter for Capstone. We're advancing our acquisition of a Carolina Based Stone Company - a transaction that will be immediately accretive to revenue and EBITDA - and will expand our footprint into one of the fastest-growing markets in the country," said Matthew Lipman, Chief Executive Officer. "We also grew gross margin to 24.4% from 21.4% a year ago, reflecting increased sales of our owned brands and disciplined cost control. Altogether, we're executing on both pillars of our strategy: expanding through high-quality, earnings-accretive acquisitions and strengthening profitability."

Access to Full Materials

Capstone has posted an investor presentation and audio commentary discussing Q1 2025 and its strategic outlook. These materials are available in the Investor Relations section of www.capstoneholdingcorp.com.

About Capstone Holding Corp.

Capstone Holding Corp. (NASDAQ: CAPS) is a diversified platform of building products businesses focused on distribution, brand ownership, and acquisition. Through its Instone subsidiary, Capstone serves 31 U.S. states, offering proprietary stone veneer, hardscape materials, and modular masonry systems. The company's strategy combines disciplined M&A, operational efficiency, and a growing portfolio of owned brands to build a scalable and durable platform.

Investor Contact:

Investor Relations

Capstone Holding Corp.

[email protected]

www.capstoneholdingcorp.com

Forward-Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements relate to future events and performance, including guidance regarding revenue and EBITDA targets, M&A strategy, use of capital, and operating outlook. Actual results may differ materially from those projected due to a range of factors, including but not limited to acquisition timing, macroeconomic conditions, and execution risks. Please review the Company's filings with the SEC for a full discussion of risk factors. Capstone undertakes no obligation to revise forward-looking statements except as required by law.

SOURCE: Capstone Holding Corp.

View the original press release on ACCESS Newswire

S.Gregor--AMWN