-

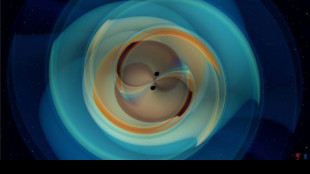

Gravitational waves from black hole smash confirm Hawking theory

Gravitational waves from black hole smash confirm Hawking theory

-

Israel launches deadly strike on Yemen rebel media arm

-

Fossil energy 'significant' driver of climate-fuelled heatwaves: study

Fossil energy 'significant' driver of climate-fuelled heatwaves: study

-

Oldest known lizard ancestor discovered in England

-

Smoke from 2023 Canada fires linked to thousands of deaths: study

Smoke from 2023 Canada fires linked to thousands of deaths: study

-

Software company Oracle shares surge more than 35% on huge AI deals

-

UK aims to transform Alzheimer's diagnosis with blood test trial

UK aims to transform Alzheimer's diagnosis with blood test trial

-

US Senate panel advances nomination of Trump's Fed governor pick

-

Israeli strikes shake quiet Qatar, strain US ties

Israeli strikes shake quiet Qatar, strain US ties

-

Russian drones in Poland put NATO to the test

-

Emotional Axelsen well beaten on return from six months out

Emotional Axelsen well beaten on return from six months out

-

US producer inflation unexpectedly falls in first drop since April

-

Viking ships make final high-risk voyage to new Oslo home

Viking ships make final high-risk voyage to new Oslo home

-

UK PM expresses 'confidence' in ambassador to US after Epstein letter

-

Belgium seeks US help in drug trafficking fight

Belgium seeks US help in drug trafficking fight

-

Spain PM's wife denies embezzlement in fresh court hearing

-

Stock markets strike records despite geopolitical unrest

Stock markets strike records despite geopolitical unrest

-

Spain to deploy 'extraordinary' security for Vuelta finale

-

Ex-Premier League referee Coote charged with making indecent child image

Ex-Premier League referee Coote charged with making indecent child image

-

Ryder Cup pairings not 'set in stone', says Europe captain Donald

-

What we know about Israel's attack on Hamas in Qatar

What we know about Israel's attack on Hamas in Qatar

-

Poland warns of escalation, holds NATO talks after Russian drone intrusion

-

Australia Davis Cup captain Hewitt handed ban for pushing anti-doping official

Australia Davis Cup captain Hewitt handed ban for pushing anti-doping official

-

New French PM vows 'profound break' with past to exit crisis

-

Israel vows to strike foes anywhere after Qatar attack

Israel vows to strike foes anywhere after Qatar attack

-

Kony defence urges ICC judges to halt case

-

British horse racing strikes over proposed tax rise on betting

British horse racing strikes over proposed tax rise on betting

-

Zara owner Inditex shares soar as sales growth revives

-

Stock markets rise amid geopolitical unrest

Stock markets rise amid geopolitical unrest

-

Poland calls urgent NATO talks after Russian drone incursion

-

Three dead, three missing in attempts to cross Channel

Three dead, three missing in attempts to cross Channel

-

Hong Kong legislature rejects same-sex partnerships bill

-

'Block everything': protests grip France as new PM starts job

'Block everything': protests grip France as new PM starts job

-

Von der Leyen urges EU to fight for place in 'hostile' world

-

Kidnapped Israeli-Russian academic Tsurkov released in Iraq

Kidnapped Israeli-Russian academic Tsurkov released in Iraq

-

Syrian jailed for life over deadly knife attack at German festival

-

Top EU court upholds nuclear green label

Top EU court upholds nuclear green label

-

Pacific Island leaders back 'ocean of peace' at fraught summit

-

Israel defends Qatar strikes after rebuke from Trump

Israel defends Qatar strikes after rebuke from Trump

-

'Block everything': France faces disruption as new PM starts job

-

Ozempic maker Novo Nordisk to cut 9,000 global jobs

Ozempic maker Novo Nordisk to cut 9,000 global jobs

-

Five athletes who could sparkle at world championships

-

Asian markets enjoy record day as new US jobs data fans rate cut hopes

Asian markets enjoy record day as new US jobs data fans rate cut hopes

-

South Korea overturns 60-year ruling on woman's self-defence case

-

Classical music is not Netflix, says Latvian mezzo-soprano Elina Garanca

Classical music is not Netflix, says Latvian mezzo-soprano Elina Garanca

-

The factors behind violent unrest in Nepal

-

Nepal army bids to restore order after deadly protests oust PM

Nepal army bids to restore order after deadly protests oust PM

-

Trump jeered at Washington restaurant, called 'Hitler of our time'

-

Jamaica, Curacao and Honduras win in World Cup qualifying

Jamaica, Curacao and Honduras win in World Cup qualifying

-

Pacific Islands leaders to back 'ocean of peace' at fraught summit

| VOD | -1.15% | 11.725 | $ | |

| SCS | -0.57% | 16.785 | $ | |

| CMSC | 0.54% | 24.27 | $ | |

| RBGPF | 0% | 77.27 | $ | |

| RELX | -4.16% | 45.305 | $ | |

| RYCEF | 1.48% | 14.87 | $ | |

| GSK | -0.37% | 40.63 | $ | |

| AZN | -0.43% | 80.87 | $ | |

| RIO | 0.71% | 62.315 | $ | |

| CMSD | -0.12% | 24.34 | $ | |

| BCE | -0.29% | 24.13 | $ | |

| NGG | 0.26% | 70.54 | $ | |

| BCC | 0.49% | 85.71 | $ | |

| BTI | -0.27% | 56.11 | $ | |

| BP | 1.06% | 34.455 | $ | |

| JRI | 1.22% | 13.95 | $ |

IRS to Flag Excessive Business Deductions in 2025 - Clear Start Tax Shares What Write-Offs Could Trigger an Audit

IRS enforcement priorities shift toward questionable write-offs, putting small business owners and self-employed taxpayers on notice in 2025.

IRVINE, CA / ACCESS Newswire / September 10, 2025 / The Internal Revenue Service (IRS) is sharpening its focus on business deductions in 2025, warning that overly aggressive write-offs could increase the chances of an audit. Tax professionals say the move is part of a broader push by the agency to close the "tax gap" by targeting areas where income may be underreported or expenses overstated.

According to Clear Start Tax, a national tax relief firm, deductions for travel, meals, home offices, and vehicle expenses are expected to draw heightened scrutiny this filing season.

"The IRS isn't saying you can't deduct legitimate business expenses," a Clear Start Tax spokesperson explained. "What they are signaling is that excessive or inconsistent deductions - especially when they don't line up with the size or nature of your business - will likely trigger a closer look."

The IRS has expanded its use of data analytics and artificial intelligence to identify deduction patterns that stand out from industry norms. For example, a sole proprietor reporting $60,000 in income but claiming $40,000 in travel expenses may face questions about whether those costs were truly business-related.

"One of the biggest mistakes taxpayers make is blurring the line between personal and business expenses," Clear Start Tax said. "Writing off a family vacation as a 'business trip' or deducting 100% of car costs when the vehicle is used mostly for personal errands are the types of moves that raise red flags."

Clear Start Tax advises taxpayers to keep detailed records, including receipts, mileage logs, and documentation that clearly ties expenses to business activity. Without proper substantiation, deductions can be disallowed, leading to back taxes, penalties, and interest.

"It's not about avoiding deductions," the spokesperson added. "It's about making sure the deductions you claim can stand up under IRS review."

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

About Clear Start Tax

Clear Start Tax is a trusted national tax relief firm dedicated to helping individuals and businesses resolve IRS and state tax issues. With a focus on education, transparency, and proven strategies, Clear Start Tax has assisted thousands of taxpayers in reducing liabilities, negotiating settlements, and regaining financial stability.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

O.M.Souza--AMWN