-

Israel issues 'last' warning for Gazans to flee main city

Israel issues 'last' warning for Gazans to flee main city

-

Jonathan Anderson brings new twist to Dior women with Paris debut

-

India 'welcome' to collect trophy from me, says Asian cricket boss

India 'welcome' to collect trophy from me, says Asian cricket boss

-

Schwarzenegger's 'action hero' pope says don't give up on climate change

-

'I'm breathing again': Afghans relieved after internet restored

'I'm breathing again': Afghans relieved after internet restored

-

Shein picks France for its first permanent stores

-

Five survivors pulled from Indonesia school collapse as rescuers race against time

Five survivors pulled from Indonesia school collapse as rescuers race against time

-

Deadly family drama in Munich briefly shuts Oktoberfest

-

Japanese trainer Saito hopes for better Arc experience second time round

Japanese trainer Saito hopes for better Arc experience second time round

-

'Normal' Sinner romps to 21st title but Swiatek stunned in Beijing

-

Stella McCartney takes on 'barbaric' feather industry

Stella McCartney takes on 'barbaric' feather industry

-

Mobile and internet restored across Afghanistan: AFP journalists

-

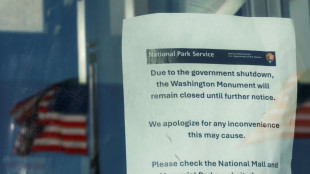

Wall Street stocks slide as US shutdown begins

Wall Street stocks slide as US shutdown begins

-

US senators struggle for off-ramp as shutdown kicks in

-

Oktoberfest briefly closed by bomb threat, deadly family drama

Oktoberfest briefly closed by bomb threat, deadly family drama

-

Swiatek out with a whimper as Navarro stuns top seed in Beijing

-

Gaza aid flotilla defies Israeli 'intimidation tactics'

Gaza aid flotilla defies Israeli 'intimidation tactics'

-

Meta defends ads model in 550-mn-euro data protection trial

-

Two pulled from Indonesia school collapse as rescuers race against time

Two pulled from Indonesia school collapse as rescuers race against time

-

Mobile and data networks return across Afghanistan: AFP journalists

-

Denmark warns EU over Russia 'hybrid war' as leaders talk defence

Denmark warns EU over Russia 'hybrid war' as leaders talk defence

-

UK's Labour govt plans permanent fracking ban

-

Russia says situation at Zaporizhzhia nuclear plant under control

Russia says situation at Zaporizhzhia nuclear plant under control

-

YouTube, platforms not cooperating enough on EU content disputes: report

-

EU eyes higher steel tariffs, taking page from US

EU eyes higher steel tariffs, taking page from US

-

Slot faces reality check at Liverpool as problems mount

-

European stocks rise, Wall St futures drop as US shutdown begins

European stocks rise, Wall St futures drop as US shutdown begins

-

Survivors still carry burden as Bali marks 2005 bombings

-

Thousands protest in Greece over 13-hour workday plans

Thousands protest in Greece over 13-hour workday plans

-

Indigenous protest urges end to Colombia border violence

-

Torrential downpours kill nine in Ukraine's Odesa

Torrential downpours kill nine in Ukraine's Odesa

-

Australia ease to six-wicket win in first New Zealand T20

-

France's Monfils announces retirement at end of 2026

France's Monfils announces retirement at end of 2026

-

'Normal' Sinner thrashes Tien in Beijing for 21st title

-

Survivor pulled from Indonesia school collapse as parents await news

Survivor pulled from Indonesia school collapse as parents await news

-

Tennis schedule under renewed scrutiny as injuries, criticism mount

-

New player load guidelines hailed as 'landmark moment' for rugby

New player load guidelines hailed as 'landmark moment' for rugby

-

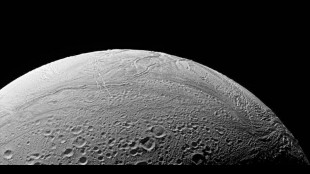

More ingredients for life discovered in ocean on Saturn moon

-

Germany's Oktoberfest closed by bomb threat

Germany's Oktoberfest closed by bomb threat

-

Spanish court opens 550-mn-euro Meta data protection trial

-

Jonathan Anderson to bring new twist to Dior women with Paris debut

Jonathan Anderson to bring new twist to Dior women with Paris debut

-

Gold hits record, Wall St futures drop as US shutdown begins

-

Sinner thrashes Tien to win China Open for 21st title

Sinner thrashes Tien to win China Open for 21st title

-

Philippines quake toll rises to 69 as injured overwhelm hospitals

-

Swiss glaciers shrank by a quarter in past decade: study

Swiss glaciers shrank by a quarter in past decade: study

-

Indonesia's MotoGP project leaves evicted villagers in limbo

-

'The Summer I Turned Pretty' sells more Paris romantic escapism

'The Summer I Turned Pretty' sells more Paris romantic escapism

-

Australia's Lyon tells England that no spinner would be Ashes error

-

Taiwan says 'will not agree' to making 50% of its chips in US

Taiwan says 'will not agree' to making 50% of its chips in US

-

Verstappen's late-season surge faces steamy Singapore examination

European stocks rise, Wall St futures drop as US shutdown begins

European stocks and gold prices rose, while Wall Street futures fell on Wednesday as the US government shut down after lawmakers failed to reach a funding deal.

The prospect of services in the United States being closed pushed gold to another record high over $3,895.

In Asia, Tokyo's stock market sank, while Hong Kong and Shanghai were closed for holidays.

European markets were lifted by pharmaceutical shares after Pfizer was granted reprieve from President Donald Trump's tariffs by agreeing to lower drug prices in the United States.

Trump also announced plans to unveil a website to allow consumers to directly purchase some medications from manufacturers at discounted rates.

While details remain thin, shares in British pharma giant AstraZeneca rose more than six percent and GSK was up almost three percent in London.

The dollar remained under pressure on concerns caused by the US government beginning to shut down Wednesday.

Democrats and Republicans failed to break a budget impasse, with talks hinging on health care funding.

"Historically shutdowns have been bad for the US dollar, bad for US equities, and bad for bonds too," said Emma Wall, chief investment strategist at Hargreaves Lansdown.

"Should the shutdown remain unresolved it is likely to drive money outside of the US to markets with more certainty," she added.

While most shutdowns end after a short period, investors were concerned it could prevent the release Friday of the key non-farm payrolls report -- a crucial guide for the Fed on rate decisions.

The closure will see non-essential operations halted, leaving hundreds of thousands of civil servants temporarily unpaid, and many social safety net benefit payments potentially disrupted.

Trump threatened to punish Democrats during any stoppage by targeting progressive priorities and forcing mass public sector job cuts.

"Shutdowns have delivered bouts of volatility, but the precedent has been that weakness tends to be short-lived," noted Joshua Mahony, chief market analyst at Scope Markets.

Futures on all three main indexes in New York were in the red.

India's rupee also made small inroads as the country's central bank decided against cutting interest rates, despite inflation remaining low, but the unit continued to hover around record lows against the greenback.

The South Asian currency has been hit by concerns over stalled trade talks with Trump that will soften painful tariffs, while Washington's strict immigration measures have added to worries.

The two sides remain in talks despite sharp disagreements over agricultural trade and New Delhi's purchases of Russian oil.

In company news, Australian mining titan BHP fell 2.5 percent following reports China had told steelmakers to temporarily stop buying seagoing, dollar-denominated cargoes from the firm, as part of a pricing dispute.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.7 percent at 9,413.05 points

Paris - CAC 40: UP 0.4 percent at 7,924.93

Frankfurt - DAX: UP 0.5 percent at 24,003.37

Tokyo - Nikkei 225: DOWN 0.9 percent at 44,550.85 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

New York - Dow: UP 0.2 percent at 46,397.89 (close)

Euro/dollar: DOWN at $1.1729 from $1.1739 on Tuesday

Pound/dollar: UP at $1.3478 from $1.3448

Dollar/yen: DOWN at 147.10 yen from 147.86 yen

Euro/pound: DOWN at 87.01 pence from 87.29 pence

West Texas Intermediate: DOWN 0.5 percent at $62.05 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $65.70 per barrel

O.Norris--AMWN