-

Bolivia's new president faces worst economic crisis in decades

Bolivia's new president faces worst economic crisis in decades

-

Serious, popular, besties with Trump: Italy's Meloni marks three years

-

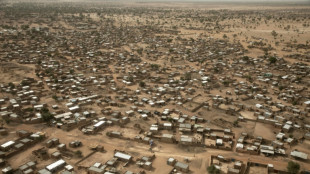

In the Sahel, no reprieve under jihadist blockade

In the Sahel, no reprieve under jihadist blockade

-

One year on, Spain's flood survivors rebuild and remember

-

Cargo plane skids off Hong Kong runway, kills two

Cargo plane skids off Hong Kong runway, kills two

-

Myanmar junta says seized 30 Starlink receivers in scam centre raid

-

Japan set for new coalition and first woman PM

Japan set for new coalition and first woman PM

-

Toxic haze chokes Indian capital

-

Flood reckoning for Bali on overdevelopment, waste

Flood reckoning for Bali on overdevelopment, waste

-

China's economic growth slows amid sputtering domestic demand

-

Atletico aim to convince Alvarez they belong among elite on Arsenal visit

Atletico aim to convince Alvarez they belong among elite on Arsenal visit

-

Rebuilding Leverkusen wary of world's best PSG

-

French police hunt Louvre jewel thieves

French police hunt Louvre jewel thieves

-

Blue Jays down Mariners to force game seven decider in MLB playoff series

-

Asian markets bounce back as China-US trade fears ease

Asian markets bounce back as China-US trade fears ease

-

California's oil capital hopes for a renaissance under Trump

-

OpenAI big chip orders dwarf its revenues -- for now

OpenAI big chip orders dwarf its revenues -- for now

-

Phony AI content stealing fan attention during baseball playoffs

-

Haaland, Kane and Mbappe battle to be Europe's best

Haaland, Kane and Mbappe battle to be Europe's best

-

Verstappen makes clear he is gunning for a fifth world title

-

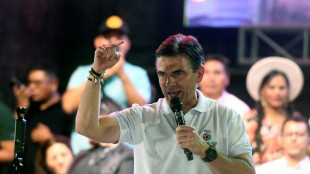

'Capitalism for all': Rodrigo Paz, Bolivia's ideology-shy president-elect

'Capitalism for all': Rodrigo Paz, Bolivia's ideology-shy president-elect

-

Bolivia elects center-right president, ending two decades of socialism

-

FIFA 2026 Host City Monterrey Renews with SEVN as Exclusive Media Rights Partner for Legends Match on January 17, 2026

FIFA 2026 Host City Monterrey Renews with SEVN as Exclusive Media Rights Partner for Legends Match on January 17, 2026

-

Tocvan Advances Drilling, Trenching, and Pilot Mine Preparation, Mobilizing Equipment to North and South Blocks at Gran Pilar Gold-Silver Project

-

Genflow Biosciences PLC Announces Recognition of Patentability of Claims

Genflow Biosciences PLC Announces Recognition of Patentability of Claims

-

Ex-Buccaneers running back Martin dies at 36

-

NFL Eagles soar over Vikings while Colts improve to 6-1

NFL Eagles soar over Vikings while Colts improve to 6-1

-

Bolivians look right for a new president, ending two decades of socialism

-

Frustrated Piastri calls for calm review

Frustrated Piastri calls for calm review

-

Leao double fires AC Milan past livid Fiorentina and top of Serie A

-

Jaminet guides Toulon to win over Racing, Serin injured

Jaminet guides Toulon to win over Racing, Serin injured

-

Verstappen cruises to victory, cuts chunk out of F1 lead

-

Mbappe sends Real Madrid top as Getafe self-destruct

Mbappe sends Real Madrid top as Getafe self-destruct

-

Leao double fires AC Milan past Fiorentina and top of Serie A

-

NFL Eagles soar over Vikings while Chiefs blank Raiders

NFL Eagles soar over Vikings while Chiefs blank Raiders

-

Polls close as Bolivians look to the right for economic salvation

-

Amorim wants more after 'biggest' Man Utd win at Liverpool

Amorim wants more after 'biggest' Man Utd win at Liverpool

-

Paris Louvre heist lays bare museum security complaints

-

Auger-Aliassime thanks new bride after lifting Brussels ATP title

Auger-Aliassime thanks new bride after lifting Brussels ATP title

-

Thieves steal French crown jewels from Louvre in daytime raid

-

Frank unable to explain Spurs' miserable home record

Frank unable to explain Spurs' miserable home record

-

Man Utd stretch Liverpool losing streak to four games

-

'Black Phone 2' wins N. America box office

'Black Phone 2' wins N. America box office

-

US announces attack on Colombia rebel group boat as Trump ends aid

-

Deila fired as head coach of MLS Atlanta United

Deila fired as head coach of MLS Atlanta United

-

Beleaguered Venezuela celebrates double canonization

-

Durant agrees to NBA Rockets two-year $90 mln extension: reports

Durant agrees to NBA Rockets two-year $90 mln extension: reports

-

Kenya buries long-time opposition leader Raila Odinga

-

Malinin wins men's figure skating at French Grand Prix

Malinin wins men's figure skating at French Grand Prix

-

Robbers steal French crown jewels from Louvre

Asian markets bounce back as China-US trade fears ease

Asian markets rose Monday after conciliatory comments from Donald Trump at the weekend ease worries about China-US trade tensions, while Tokyo stocks surged to a record on news of a deal to end political turmoil in Japan.

Investors also took heart from data showing China's economy grew more than expected in the third quarter, with the gains building on the positive mood from Wall Street, where all three main indexes bounced back from Thursday's losses.

Sentiment took a hit last week from a fresh flare-up in the trade standoff between Washington and Beijing when the US president threatened to hammer China with 100 percent tariffs in response to its latest controls on rare earth exports.

That led to another round of tit-for-tat measures and Trump warning that a meeting with Chinese counterpart Xi Jinping planned for next week might not go ahead.

However, tempers appeared to have cooled at the weekend, with the two sides agreeing Saturday to hold more trade talks.

Chinese state media said Vice Premier He Lifeng and US Treasury Secretary Scott Bessent had held "candid, in-depth and constructive exchanges" during a call, and that both sides agreed to hold a new round of negotiations "as soon as possible".

Hours before the call, Fox News released excerpts of an interview with Trump in which he said he would meet Xi at the APEC summit after all, and added that the 100 percent tariff was "not sustainable".

Markets across Asia rose on the softer tone, with Hong Kong up more than two percent and Shanghai also well up as data showed China's economy grew in line with expectations in the third quarter, though at its slowest pace in a year.

Seoul, Wellington, Taipei and Manila also rallied.

"Catalysed by Trump's remark... markets appear priced for a positive or at least less-bad outcome," said Chris Weston at Pepperstone.

"The market's base case now seems to be that China will offer concessions on its rare-earth export controls, paving the way for the US to extend the current 30 percent 'tariff truce' by another 90 days beyond its 10 November deadline."

Tokyo led the gains, surging almost three percent to a new peak, as Japan's ruling party said it was set to sign a new coalition deal on Monday, paving the way for Sanae Takaichi to become the country's first woman prime minister.

Stocks were sent into a spin last week when her bid to become premier -- having won her party's leadership earlier in the month -- was derailed after its alliance partner withdrew its support.

Traders also took heart from a bounceback for US regional bank stocks Friday, which had been pummelled Thursday following disclosures from two mid-sized players of expected losses tied to problem loans.

The recovery Friday in those banks -- Salt Lake City-based Zions Bancorp and Phoenix-based Western Alliance Bancorporation -- and other lenders suggested investors were less fearful of systemic problems.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 2.9 percent at 48,970.40 (break)

Hong Kong - Hang Seng Index: UP 2.2 percent at 25,797.98

Shanghai - Composite: UP 0.6 percent at 3,860.79

Euro/dollar: DOWN at $1.1665 from $1.1670 on Friday

Pound/dollar: UP at $1.3436 from $1.3433

Dollar/yen: UP at 150.97 yen from 150.50 yen

Euro/pound: DOWN at 86.82 percent from 86.88 pence

West Texas Intermediate: DOWN 0.5 percent at $57.24 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $61.02 per barrel

New York - Dow: UP 0.5 percent at 46,190.61 (close)

London - FTSE 100: DOWN 0.9 percent at 9,354.57 (close)

P.Martin--AMWN