-

Indonesia defiant after IOC calls for no events over Israeli gymnast ban

Indonesia defiant after IOC calls for no events over Israeli gymnast ban

-

Stung by high costs, Dutch board 'shopbus' to cheaper Germany

-

S.Africa seeks to save birds from wind turbine risks

S.Africa seeks to save birds from wind turbine risks

-

South Africa close on win after six-wicket Harmer rocks Pakistan

-

Oil and gas majors stick to their guns on climate advertising

Oil and gas majors stick to their guns on climate advertising

-

Online search a battleground for AI titans

-

Champion de Crespigny to captain Australia against Eddie Jones's Japan

Champion de Crespigny to captain Australia against Eddie Jones's Japan

-

Bangladesh leader urges calm after cabinet neutrality questioned

-

Trump heads to Asia aiming to make deals with Xi

Trump heads to Asia aiming to make deals with Xi

-

Chicago Fire, Portland Timbers advance with MLS Cup wild card wins

-

King Charles to hold historic prayer with Pope Leo

King Charles to hold historic prayer with Pope Leo

-

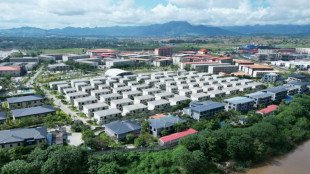

Cambodian police arrest 57 South Koreans accused of cyberscams

-

Spurs' Wembanyama scores 40 in triumphant NBA return

Spurs' Wembanyama scores 40 in triumphant NBA return

-

Taiwan detects first cases of swine fever

-

Tigers in trouble as Malaysian big cat numbers dwindle

Tigers in trouble as Malaysian big cat numbers dwindle

-

Myanmar scam centre raid sends hundreds fleeing to Thailand

-

Inside India's RSS, the legion of Hindu ultranationalists

Inside India's RSS, the legion of Hindu ultranationalists

-

EU seeks to shore up Ukraine as Trump wavers on peace push

-

Chicago Fire top Orlando 3-1 to advance in MLS Cup playoffs

Chicago Fire top Orlando 3-1 to advance in MLS Cup playoffs

-

Climate crunch time in Brussels as EU leaders meet

-

Crude spikes as Trump threatens Russian giants, stocks turn lower

Crude spikes as Trump threatens Russian giants, stocks turn lower

-

Napoli's title defence creaking ahead of clash with rivals Inter

-

Verstappen chasing glory as McLaren duo bid to bounce back

Verstappen chasing glory as McLaren duo bid to bounce back

-

Amazon uses AI to make robots better warehouse workers

-

New Japan PM to advance defence spending target: reports

New Japan PM to advance defence spending target: reports

-

Trump, Colombia leader trade threats as US strikes boats in Pacific

-

Flush with cash, US immigration agency expands weaponry and surveillance

Flush with cash, US immigration agency expands weaponry and surveillance

-

Meta to cut 600 jobs in artificial intelligence: reports

-

Frustrated federal employees line up for food as US shutdown wears on

Frustrated federal employees line up for food as US shutdown wears on

-

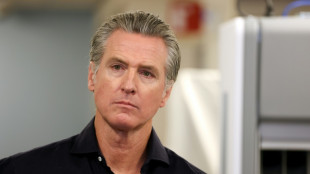

California to deploy national guard to help food banks

-

Guardian Metal Resources PLC Announces Change of Broker

Guardian Metal Resources PLC Announces Change of Broker

-

Tocvan Announces Discovery of Two New Target Areas With Historic Underground Workings at North Block Gran Pilar Gold-Silver Project

-

Guardian Metal Resources PLC Announces Tempiute Project Operational Update

Guardian Metal Resources PLC Announces Tempiute Project Operational Update

-

Colombian ambassador to US tells AFP Trump threats 'unacceptable'

-

Trump slaps 'tremendous' sanctions on Russian oil for Ukraine war

Trump slaps 'tremendous' sanctions on Russian oil for Ukraine war

-

Trump, Colombia leader trade threats as US strikes boat in Pacific

-

Trump slaps 'trememdous' sanctions on Russian oil for Ukraine war

Trump slaps 'trememdous' sanctions on Russian oil for Ukraine war

-

Lakers feel lack of LeBron in NBA season-opening loss

-

Charles to be first UK king to pray with pope in 500 years

Charles to be first UK king to pray with pope in 500 years

-

Liverpool back on track while Real, Bayern and Chelsea win in Champions League

-

Chelsea teenagers shine in rout of 10-man Ajax

Chelsea teenagers shine in rout of 10-man Ajax

-

Global stocks mostly fall on lackluster results from Netflix, others

-

Liverpool end losing streak with thumping win at Eintracht Frankfurt

Liverpool end losing streak with thumping win at Eintracht Frankfurt

-

Tesla profits tumble on higher costs, tariff drag

-

US troops train in Panama jungle, as tensions simmer with Venezuela

US troops train in Panama jungle, as tensions simmer with Venezuela

-

Chelsea hit 10-man Ajax for five

-

Bellingham strike helps Real Madrid edge Juventus

Bellingham strike helps Real Madrid edge Juventus

-

US, EU pledge new sanctions on Russia for Ukraine war

-

Rubio due in Israel as US tries to shore up Gaza ceasefire

Rubio due in Israel as US tries to shore up Gaza ceasefire

-

To make ends meet, Argentines sell their possessions

Crude spikes as Trump threatens Russian giants, stocks turn lower

Crude prices spiked more than two percent Thursday after Donald Trump said he would hit two Russian oil companies with hefty sanctions, while talk that the White House was planning curbs on software exports to China added to gloom on markets.

Both main oil contracts jumped almost three percent -- having climbed more than two percent Tuesday -- on news of the measures after the US leader said Ukraine peace efforts with counterpart Vladimir Putin "don't go anywhere".

The move was joined by another round of punishments by the European Union as part of attempts to pressure Moscow to end its three-and-a-half-year invasion of Ukraine.

Trump decided on the sanctions after plans for a fresh summit with Putin in Budapest collapsed this week.

"Every time I speak with Vladimir, I have good conversations, and then they don't go anywhere," the US president said in response to a question from an AFP journalist in the Oval Office.

But he hoped the "tremendous sanctions" on oil giants Rosneft and Lukoil Oil would be short-lived, and that "the war will be settled".

Brent and WTI were both sitting at near two week-highs after the spikes, helped by claims by Trump that India agreed to cut its purchases of the commodity from Russia as part of a US trade deal.

New Delhi has neither confirmed nor denied any policy shift.

Equity markets fortunes were not as good, with most of Asia tracking losses on Wall Street amid lingering concerns that a tech-led surge to record highs this year may be reaching its end, and some observers warning of a bubble forming.

Tokyo, Hong Kong, Shanghai, Sydney, Taipei, Manila and Jakarta all tumbled, though Singapore, Seoul and Wellington edged up.

And gold clawed back some of the previous two days' losses, edging up around one percent to $4,075 -- but well down from the record high above $4,381 touched earlier in the week.

While there is an expectation Trump will meet Chinese counterpart next week at the APEC summit in South Korea, investors were jolted slightly when he suggested that might not take place.

And on Wednesday uncertainty was stoked again after a report said the administration was looking at curbing shipments of a range of software-powered exports to China, including laptops and jet engines, owing to Beijing's rare earths controls.

Those mineral controls sparked a round of tit-for-tat exchanges between the superpowers that sparked fresh trade war worries, including Trump's threat of 100 percent tariffs on China.

"Everything is on the table," US Treasury Secretary Scott Bessent replied when asked about limits on software exports to China.

"If these export controls, whether it's software, engines or other things happen, it will likely be in coordination with our G7 allies," he added, according to Bloomberg News.

There was a feeling that the issue was unlikely to explode into a full-on crisis, though analysts retained some caution.

"Headlines that the US is considering software export curbs on China have certainly done risk no favours on the day," said Pepperstone's Chris Weston.

They "inject a degree of doubt into the collective's consensus position that we will ultimately see a positive resolution in the US–China trade negotiations".

"The ingrained belief remains that Trump's threat of 100 percent additional import tariffs on China is unlikely to take effect on 1 November -- or, if they do, that they'll be rolled back soon enough -- and that China is unlikely to retaliate with punchy tariffs of its own.

"But is the market mispricing the risk of a strong-arm response from either side—one that could contradict the conciliatory tone both US and Chinese officials have projected through the media?"

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.3 percent at 48,664.74 (break)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 25,637.25

Shanghai - Composite: DOWN 0.9 percent at 3,880.18

Euro/dollar: DOWN at $1.1598 from $1.1606 on Wednesday

Pound/dollar: DOWN at $1.3339 from $1.3356

Dollar/yen: UP at 152.41 from 151.99 yen

Euro/pound: UP at 86.95 pence from 86.90 pence

West Texas Intermediate: UP 2.3 percent at $59.85 per barrel

Brent North Sea Crude: UP 2.3 percent at $64.05 per barrel

New York - Dow: DOWN 0.7 percent at 45,590.41 (close)

London - FTSE 100: UP 0.9 percent at 9,515.00 (close)

F.Dubois--AMWN