-

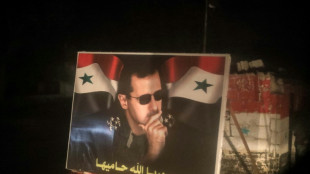

France issues third arrest warrant against Syria's ex-leader Assad

France issues third arrest warrant against Syria's ex-leader Assad

-

Vance rejects any West Bank annexation as Rubio heads to Israel

-

Injured MotoGP champion Marquez to miss rest of season

Injured MotoGP champion Marquez to miss rest of season

-

China vows to boost consumption, national security after key meet

-

Judge clears British ex-soldier of Bloody Sunday murders

Judge clears British ex-soldier of Bloody Sunday murders

-

Short and Connolly star as Australia beat India to seal ODI series

-

EU parliament adopts curbs on plastic pellet pollution

EU parliament adopts curbs on plastic pellet pollution

-

Europe plans satellite powerhouse to rival Musk's Starlink

-

French court convicts TotalEnergies over misleading climate claims

French court convicts TotalEnergies over misleading climate claims

-

Wembanyama's height sparks debate once again in NBA

-

Thrill-a-minute DJ gets the crowds pumping at new Philippines event

Thrill-a-minute DJ gets the crowds pumping at new Philippines event

-

Gender-row boxer Lin wins gold in first event since Paris Olympics

-

King Charles, Pope Leo pray together in historic first

King Charles, Pope Leo pray together in historic first

-

Pogacar, peloton face Alpe d'Huez twice as Tour de France 2026 route unveiled

-

Pakistan spin lessons good for South Africa, says Markram

Pakistan spin lessons good for South Africa, says Markram

-

Oil prices surge as Trump hits Russian crude with sanctions

-

Eddie Jones plots shock against much-changed Australia in Tokyo

Eddie Jones plots shock against much-changed Australia in Tokyo

-

La Liga's Miami match: Why did it fail and what happens next?

-

Bangladesh court to deliver verdict against Hasina on November 13

Bangladesh court to deliver verdict against Hasina on November 13

-

Third T20 between New Zealand and England washed out

-

King Charles meets Pope Leo ahead of historic prayer

King Charles meets Pope Leo ahead of historic prayer

-

Injured Italian skier Bassino out of home Winter Olympics

-

Rubio heads to Israel as US seeks to firm up Gaza truce

Rubio heads to Israel as US seeks to firm up Gaza truce

-

Eddie Jones says 'I enjoy beating Australia' ahead of Tokyo reunion

-

Oil spikes as Trump targets Russia giants, US-China hopes lift stocks

Oil spikes as Trump targets Russia giants, US-China hopes lift stocks

-

Zelensky hails Trump sanctions on Russia as 'strong' message

-

Indonesia, Brazil strike cooperation deals as leaders meet

Indonesia, Brazil strike cooperation deals as leaders meet

-

Rohit stars as India make 264-9 in 2nd ODI against Australia

-

Harmer stars as South Africa beat Pakistan to draw series

Harmer stars as South Africa beat Pakistan to draw series

-

Indonesia defiant after IOC calls for no events over Israeli gymnast ban

-

Stung by high costs, Dutch board 'shopbus' to cheaper Germany

Stung by high costs, Dutch board 'shopbus' to cheaper Germany

-

S.Africa seeks to save birds from wind turbine risks

-

South Africa close on win after six-wicket Harmer rocks Pakistan

South Africa close on win after six-wicket Harmer rocks Pakistan

-

Oil and gas majors stick to their guns on climate advertising

-

Online search a battleground for AI titans

Online search a battleground for AI titans

-

Champion de Crespigny to captain Australia against Eddie Jones's Japan

-

Bangladesh leader urges calm after cabinet neutrality questioned

Bangladesh leader urges calm after cabinet neutrality questioned

-

Trump heads to Asia aiming to make deals with Xi

-

Chicago Fire, Portland Timbers advance with MLS Cup wild card wins

Chicago Fire, Portland Timbers advance with MLS Cup wild card wins

-

King Charles to hold historic prayer with Pope Leo

-

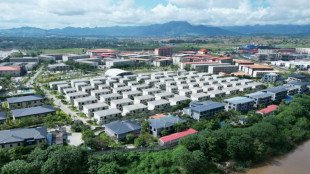

Cambodian police arrest 57 South Koreans accused of cyberscams

Cambodian police arrest 57 South Koreans accused of cyberscams

-

Spurs' Wembanyama scores 40 in triumphant NBA return

-

Taiwan detects first cases of swine fever

Taiwan detects first cases of swine fever

-

Tigers in trouble as Malaysian big cat numbers dwindle

-

Myanmar scam centre raid sends hundreds fleeing to Thailand

Myanmar scam centre raid sends hundreds fleeing to Thailand

-

Inside India's RSS, the legion of Hindu ultranationalists

-

EU seeks to shore up Ukraine as Trump wavers on peace push

EU seeks to shore up Ukraine as Trump wavers on peace push

-

Chicago Fire top Orlando 3-1 to advance in MLS Cup playoffs

-

Climate crunch time in Brussels as EU leaders meet

Climate crunch time in Brussels as EU leaders meet

-

Crude spikes as Trump threatens Russian giants, stocks turn lower

Oil spikes as Trump targets Russia giants, US-China hopes lift stocks

Crude prices spiked more than two percent Thursday after US President Donald Trump said he would impose heavy sanctions on two Russian oil companies.

Meanwhile equity markets rallied after Beijing said it would hold tariff talks with Washington from Friday, tempering trade fears over reports of potential US curbs on software exports to China.

Both main oil contracts jumped more than three percent -- having climbed more than two percent Wednesday -- on news of the measures after Trump said Ukraine peace efforts with Russian President Vladimir Putin "don't go anywhere".

The move was joined by another round of punishments by the European Union as part of attempts to pressure Moscow to end its three-and-a-half-year invasion of Ukraine.

Trump decided on the sanctions after plans for a fresh summit with Putin in Budapest collapsed this week.

"Every time I speak with Vladimir, I have good conversations, and then they don't go anywhere," the US president said in response to a question from an AFP journalist in the Oval Office.

But he hoped the "tremendous sanctions" on oil giants Rosneft and Lukoil would be short-lived, and that "the war will be settled".

Brent and WTI were both sitting at near two-week highs after the spikes, helped by Trump's claims that India agreed to cut its purchases of the commodity from Russia as part of a US trade deal.

New Delhi has neither confirmed nor denied any policy shift.

Bloomberg on Thursday cited unnamed Indian refinery sources as saying that flows from Russian crude were expected to plunge almost to zero as a result of the US sanctions.

Equity markets fortunes were not as good in the morning but bounced as the day progressed as Beijing said Chinese Vice Premier He Lifeng would hold talks with top US officials in Malaysia on October 24-27.

The news helped soothe recent concerns about China-US relations, with a report Wednesday saying the White House was looking at curbing shipments of software-powered exports to China, including laptops and jet engines, owing to Beijing's rare earths controls.

Those mineral controls prompted a round of tit-for-tat exchanges between the superpowers that sparked fresh trade war worries, including Trump's threat of 100 percent tariffs on China.

The negotiations come amid expectations that Trump will meet Chinese leader Xi Jinping next week at the APEC summit in South Korea.

"Everything is on the table," US Treasury Secretary Scott Bessent replied when asked about limits on software exports to China.

"If these export controls, whether it's software, engines or other things happen, it will likely be in coordination with our G7 allies," he added, according to Bloomberg News.

The talk of software curbs "inject a degree of doubt into the collective's consensus position that we will ultimately see a positive resolution in the US–China trade negotiations," said Pepperstone's Chris Weston.

But he added: "The ingrained belief remains that Trump's threat of 100 percent additional import tariffs on China is unlikely to take effect on 1 November -- or, if they do, that they'll be rolled back soon enough -- and that China is unlikely to retaliate with punchy tariffs of its own."

Hong Kong rose, while Shanghai, Sydney, Singapore, Wellington, Manila and Mumbai were also up with London, Frankfurt and Paris.

Tokyo, Seoul, Taipei and Jakarta all retreated.

Gold climbed more than one percent at around $4,100, recovering some of the previous two days' losses but still well down from the record high above $4,381 touched earlier in the week.

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: DOWN 1.4 percent at 48,641.61 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,967.98 (close)

Shanghai - Composite: UP 0.2 percent at 3,922.41 (close)

London - FTSE 100: UP 0.1 percent at 9,526.62

Euro/dollar: DOWN at $1.1604 from $1.1606 on Wednesday

Pound/dollar: DOWN at $1.3354 from $1.3356

Dollar/yen: UP at 152.47 from 151.99 yen

Euro/pound: DOWN at 86.88 pence from 86.90 pence

West Texas Intermediate: UP 3.3 percent at $60.44 per barrel

Brent North Sea Crude: UP 3.2 percent at $64.61 per barrel

New York - Dow: DOWN 0.7 percent at 46,590.41 (close)

B.Finley--AMWN