-

US September consumer inflation rose less than expected, delayed data shows

US September consumer inflation rose less than expected, delayed data shows

-

Rubio seeks quick deployment of international Gaza force

-

UK says allies should boost Ukraine's long-range missile reach

UK says allies should boost Ukraine's long-range missile reach

-

US consumer inflation rose less than expected in September, delayed data shows

-

WHO pleads for sick Gazans to be allowed to leave

WHO pleads for sick Gazans to be allowed to leave

-

Sheffield Wednesday hit with 12-point penalty after entering administration

-

Delap close to Chelsea return, says Maresca

Delap close to Chelsea return, says Maresca

-

Trump says all Canada trade talks 'terminated' over 'fake' ad

-

Sheffield Wednesday file for administration

Sheffield Wednesday file for administration

-

Russia cuts key interest rate, warns of tepid growth

-

Palestinian prisoners freed in hostage swap go from jail to exile

Palestinian prisoners freed in hostage swap go from jail to exile

-

Liverpool boss Slot backs Salah to end goal drought

-

China vows massive high-tech sector development in next decade

China vows massive high-tech sector development in next decade

-

French government faces threat of censure over wealth tax

-

Stocks diverge tracking US-China trade progress

Stocks diverge tracking US-China trade progress

-

King Charles hosts Zelensky ahead of London meeting on Ukraine missiles

-

Pope Leo offers olive branch in allowing traditional mass

Pope Leo offers olive branch in allowing traditional mass

-

EU accuses Meta, TikTok of breaking digital content rules

-

French prosecutor demands maximum sentence for schoolgirl's murder

French prosecutor demands maximum sentence for schoolgirl's murder

-

Families search Mexican forest for remains of over 100 missing

-

Ace Tabuena lights up home course as Sarit leads in Philippines

Ace Tabuena lights up home course as Sarit leads in Philippines

-

Acosta leaves it late to go fastest in Malaysian MotoGP practice

-

Patrick Reed: Bad press stings, but leave my kids out of it

Patrick Reed: Bad press stings, but leave my kids out of it

-

George Clooney explores passage of time in Netflix film 'Jay Kelly'

-

Young bodybuilders lift Japan's ailing care sector

Young bodybuilders lift Japan's ailing care sector

-

Stocks rally as traders cheer Trump-Xi meeting plan

-

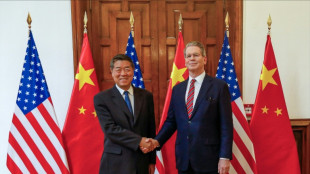

China, US 'can find ways to resolve concerns' as negotiators set to meet

China, US 'can find ways to resolve concerns' as negotiators set to meet

-

Trump says all Canada trade talks 'terminated'

-

New Japan PM vows to take US ties to 'new heights' with Trump

New Japan PM vows to take US ties to 'new heights' with Trump

-

Women sue over sexual abuse in Australian military

-

South Korea says 'considerable' chance Kim, Trump will meet next week

South Korea says 'considerable' chance Kim, Trump will meet next week

-

Brazil's Lula says would tell Trump tariffs were 'mistake'

-

Trump's Asia tour set to spotlight trade challenges

Trump's Asia tour set to spotlight trade challenges

-

Ivorian brothers dream of transforming cocoa industry

-

Over 1,000 enter Thailand from Myanmar after scam hub raid

Over 1,000 enter Thailand from Myanmar after scam hub raid

-

Top Nigerian environmentalist sees little coming out of COP30

-

Europe must nurse itself after US aid cuts: WHO director

Europe must nurse itself after US aid cuts: WHO director

-

Venezuela's Maduro to US: 'No crazy war, please!'

-

US, Japanese firms unwittingly hired North Korean animators: report

US, Japanese firms unwittingly hired North Korean animators: report

-

Precision timing for Britain's Big Ben as clocks go back

-

False claim spreads of Japan 'mass deportations' ministry

False claim spreads of Japan 'mass deportations' ministry

-

Alaska Airlines grounds entire fleet over IT outage

-

Ecuador's president says he was target of attempted poisoning

Ecuador's president says he was target of attempted poisoning

-

Rybakina seals WTA Finals spot in reaching Tokyo semis

-

Aldeguer fastest in rain-hit Malaysian MotoGP practice

Aldeguer fastest in rain-hit Malaysian MotoGP practice

-

Herbert's three TD passes lead Chargers NFL rout of Vikings

-

Gilgeous-Alexander hits career-high 55 in Thunder double overtime win

Gilgeous-Alexander hits career-high 55 in Thunder double overtime win

-

Rebuilding wrecked Syria vital for regional stability: UN

-

India trials Delhi cloud seeding to combat deadly smog

India trials Delhi cloud seeding to combat deadly smog

-

Top 14 offers France scrum-halves last audition as Dupont replacement

Stocks diverge tracking US-China trade progress

European stock markets dipped Friday following solid gains in Asia as investors reacted to fresh optimism over US-China trade relations and as they awaited US inflation data delayed by a government shutdown.

The White House confirmed President Donald Trump would meet China's Xi Jinping next week, stoking optimism for a cooling of trade tensions between the economic superpowers.

Gains for Asian equities, which followed a strong performance Thursday on Wall Street, came as a surge in oil prices sputtered.

Crude futures soared this week after Washington imposed sanctions on two Russian oil giants in a bid to bring an end to the Ukraine war.

"News on trade is supporting risk sentiment across the board into the weekend," noted Neil Wilson, UK investor strategist at Saxo Markets.

"But given this is Trump and brinkmanship goes hand in glove with showmanship, talks with Xi could go either way.

"And indeed the trade picture is not so optimistic everywhere we look. The Canadian dollar fell after Trump said he would halt all trade negotiations with the country," Wilson added.

European stock markets were lower despite positive data on the business activity in the eurozone and Britain, as investors booked profits heading into the weekend break.

Investors were keenly awaiting Friday's release of US consumer price data, which has been delayed by the government shutdown in Washington.

Ahead of the data, markets widely expected the Federal Reserve to cut US interest rates when it meets next week.

The rouble showed little reaction after Russia's central bank on Friday had cut its key interest rate to 16.5 percent.

It added that the country's growth had slowed to almost zero, as the economy sags under the cost of the Ukraine offensive and Western sanctions.

- Key figures at around 1000 GMT -

London - FTSE 100: DOWN 0.1 percent at 9,566.70 points

Paris - CAC 40: DOWN 0.5 percent at 8,185.64

Frankfurt - DAX: DOWN 0.1 percent at 24,192.33

Tokyo - Nikkei 225: UP 1.4 percent at 49,299.65 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,160.15 (close)

Shanghai - Composite: UP 0.7 percent at 3,950.31 (close)

New York - Dow: UP 0.3 percent at 46,734.61 (close)

Euro/dollar: UP at $1.1616 from $1.1615 on Thursday

Pound/dollar: DOWN at $1.3320 from $1.3323

Dollar/yen: UP at 152.95 from 152.60 yen

Euro/pound: UP at 87.21 pence from 87.18 pence

Brent North Sea Crude: UP 0.1 percent at $66.04 per barrel

West Texas Intermediate: UP 0.1 percent at $61.82 per barrel

burs-bcp/rl

M.Thompson--AMWN