-

Tornado kills six, wrecks town in Brazil

Tornado kills six, wrecks town in Brazil

-

Norris wins Sao Paulo GP sprint, Piastri spins out

-

Ireland scramble to scrappy win over Japan

Ireland scramble to scrappy win over Japan

-

De Ligt rescues draw for Man Utd after Tottenham turnaround

-

Israel identifies latest hostage body, as families await five more

Israel identifies latest hostage body, as families await five more

-

England's Rai takes one-shot lead into Abu Dhabi final round

-

Tornado kills five, injures more than 400 in Brazil

Tornado kills five, injures more than 400 in Brazil

-

UPS, FedEx ground MD-11 cargo planes after deadly crash

-

Luis Enrique not rushing to recruit despite key PSG trio's absence

Luis Enrique not rushing to recruit despite key PSG trio's absence

-

Flick demands more Barca 'fight' amid injury crisis

-

Israel names latest hostage body, as families await five more

Israel names latest hostage body, as families await five more

-

Title-chasing Evans cuts gap on Ogier at Rally Japan

-

Russian attack hits Ukraine energy infrastructure: Kyiv

Russian attack hits Ukraine energy infrastructure: Kyiv

-

Kagiyama tunes up for Olympics with NHK Trophy win

-

Indonesia probes student after nearly 100 hurt in school blasts

Indonesia probes student after nearly 100 hurt in school blasts

-

UPS grounds its MD-11 cargo planes after deadly crash

-

Taliban govt says Pakistan ceasefire to hold, despite talks failing

Taliban govt says Pakistan ceasefire to hold, despite talks failing

-

Trump says no US officials to attend G20 in South Africa

-

Philippines halts search for typhoon dead as huge new storm nears

Philippines halts search for typhoon dead as huge new storm nears

-

Bucks launch NBA Cup title defense with win over Bulls

-

Chinese ship scouts deep-ocean floor in South Pacific

Chinese ship scouts deep-ocean floor in South Pacific

-

Taiwan badminton star Tai Tzu-ying announces retirement

-

New York City beat Charlotte 3-1 to advance in MLS Cup playoffs

New York City beat Charlotte 3-1 to advance in MLS Cup playoffs

-

'Almost every day': Japan battles spike in bear attacks

-

MLS Revolution name Mitrovic as new head coach

MLS Revolution name Mitrovic as new head coach

-

Trump gives Hungary's Orban one-year Russia oil sanctions reprieve

-

Owners of collapsed Dominican nightclub formally charged

Owners of collapsed Dominican nightclub formally charged

-

US accuses Iran in plot to kill Israeli ambassador in Mexico

-

Quanta SLS Capital Group - SLS-Covered Notes Backed by A/AA-Rated Insurance for Project Funding

Quanta SLS Capital Group - SLS-Covered Notes Backed by A/AA-Rated Insurance for Project Funding

-

New Zealand 'Once Were Warriors' director Tamahori dies

-

Hungary's Orban wins Russian oil sanctions exemption from Trump

Hungary's Orban wins Russian oil sanctions exemption from Trump

-

More than 1,000 flights cut in US shutdown fallout

-

Turkey issues genocide arrest warrant against Netanyahu

Turkey issues genocide arrest warrant against Netanyahu

-

Countries agree to end mercury tooth fillings by 2034

-

Hamilton faces stewards after more frustration

Hamilton faces stewards after more frustration

-

World's tallest teen Rioux sets US college basketball mark

-

Trump pardons three-time World Series champ Strawberry

Trump pardons three-time World Series champ Strawberry

-

Worries over AI spending, US government shutdown pressure stocks

-

Verstappen suffers setback in push for fifth title

Verstappen suffers setback in push for fifth title

-

Earth cannot 'sustain' intensive fossil fuel use, Lula tells COP30

-

Wales boss Tandy expects Rees-Zammit to make bench impact against the Pumas

Wales boss Tandy expects Rees-Zammit to make bench impact against the Pumas

-

James Watson, Nobel prize-winning DNA pioneer, dead at 97

-

Medical all-clear after anti-Trump package opened at US base

Medical all-clear after anti-Trump package opened at US base

-

Sabalenka beats Anisimova in pulsating WTA Finals semi

-

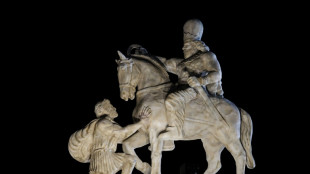

Iran unveils monument to ancient victory in show of post-war defiance

Iran unveils monument to ancient victory in show of post-war defiance

-

MLS Revolution name Mitrovic as hew head coach

-

Brazil court reaches majority to reject Bolsonaro appeal against jail term

Brazil court reaches majority to reject Bolsonaro appeal against jail term

-

Norris grabs pole for Brazilian Grand Prix sprint race

-

More than 1,200 flights cut across US in govt paralysis

More than 1,200 flights cut across US in govt paralysis

-

NFL Cowboys mourn death of defensive end Kneeland at 24

Quanta SLS Capital Group - SLS-Covered Notes Backed by A/AA-Rated Insurance for Project Funding

Structured Insurance-Backed Preferred Notes

Institutional-Grade, Actuarially Secured Funding Platform

NEW YORK, NY / ACCESS Newswire / November 8, 2025 / Quanta SLS Capital Group, a division of Quanta Global Capital Limited, provides institutional-scale project financing through Structured Insurance-Backed Preferred Notes - an actuarially validated model designed to secure capital and preserve investor principal.

Each issuance is fully collateralized by a diversified portfolio of Senior Life Settlement (SLS) insurance policies issued by A-rated or

Under this structure:

Principal is secured and repaid through maturities of the SLS portfolio.

Interest (7.5% p.a.) is paid from project revenues.

Coverage ratios are maintained at a minimum of 125% of note value.

Funds and maturities will be held in trust with JPMorgan Chase Bank, N.A., ensuring full segregation and fiduciary oversight.

Independent actuarial audits and Big-Four verification confirm portfolio sufficiency, IFRS 9 compliance, and Basel III capital-preservation standards.

Each transaction - typically USD 100 million or more - provides long-term, insurance-backed capital stability for renewable energy, infrastructure, biotechnology, and advanced-technology developments. The SLS policies are managed by A-rated insurers under strict custodial and compliance frameworks, with annual actuarial reporting and transparent lender-beneficiary rights.

This structure delivers institutional-grade security, predictable returns, and verified asset protection, representing a modern intersection of actuarial science, insurance, and structured finance.

Legal Disclaimer

This summary is provided solely for informational purposes and does not constitute an offer to sell or a solicitation to buy any securities. The Quanta Preferred Notes are available exclusively to accredited and institutional investors. These instruments are not qualified for distribution in Canada and may not be offered, sold, or delivered-directly or indirectly-to Canadian residents or entities.

A Division of Quanta Global Capital Limited

600 Annette Street, Toronto, Ontario M6S 2C4, Canada

www.quantaslscapitalgroup.com

For procedure and inquiries: [email protected]

SOURCE: Quanta SLS Capital Group

View the original press release on ACCESS Newswire

L.Harper--AMWN