-

Hitler likely had genetic condition limiting sexual development: research

Hitler likely had genetic condition limiting sexual development: research

-

Zelensky sanctions associate as corruption scandal engulfs Kyiv

-

Germany agrees to keep military service voluntary

Germany agrees to keep military service voluntary

-

Japan PM Takaichi says she sleeps only 2-4 hours a night

-

South Africa announces plan to bid for Olympic Games

South Africa announces plan to bid for Olympic Games

-

Juan Ponce Enrile, architect of Philippines martial law, dies at 101

-

Stocks waver as US government shutdown ends

Stocks waver as US government shutdown ends

-

Google to pay millions to South African news outlets: watchdog

-

EU probes Google over news site rankings despite Trump threats

EU probes Google over news site rankings despite Trump threats

-

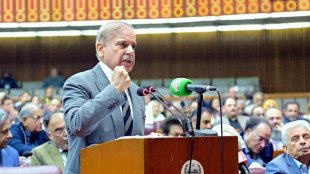

Pakistan grants lifetime immunity to president, current army chief

-

South Africa's Bavuma says winning in India top ambition

South Africa's Bavuma says winning in India top ambition

-

Alldritt back to captain France against Fiji after South Africa loss

-

Juan Ponce Enrile, architect of Philippine martial law, dies at 101: daughter

Juan Ponce Enrile, architect of Philippine martial law, dies at 101: daughter

-

'Ready' Rees-Zammit back in Wales's starting team to face Japan

-

Spinners decide Tests in India, Gill says before South Africa opener

Spinners decide Tests in India, Gill says before South Africa opener

-

K-pop group NewJeans ends feud with record label ADOR

-

Asian stocks rise with focus on Fed, tech as US government reopens

Asian stocks rise with focus on Fed, tech as US government reopens

-

UK economic gloom deepens before budget

-

Scott Barrett returns to skipper All Blacks against England

Scott Barrett returns to skipper All Blacks against England

-

Burberry narrows first half loss on turnaround plan

-

Sri Lanka to stay in Pakistan after bomb, games move to Rawalpindi

Sri Lanka to stay in Pakistan after bomb, games move to Rawalpindi

-

Zanzibar women turn to sponge farming as oceans heat up

-

Stocks rise with focus on Fed, tech as US government reopens

Stocks rise with focus on Fed, tech as US government reopens

-

Curry lifts Warriors over Spurs, Thunder rout Lakers, Jokic shines

-

Mushroom material takes on plastic packaging at Belgian start-up

Mushroom material takes on plastic packaging at Belgian start-up

-

India's top tennis player says denied China visa

-

In Kyrgyzstan, world's largest natural walnut forest thins away

In Kyrgyzstan, world's largest natural walnut forest thins away

-

TV soaps and diplomacy as Bangladesh and Turkey grow closer

-

Striking Boeing defense workers to vote on latest contract

Striking Boeing defense workers to vote on latest contract

-

Australia's opposition ditches commitment to net zero emissions

-

Duffy takes four as New Zealand crush West Indies to seal T20 series

Duffy takes four as New Zealand crush West Indies to seal T20 series

-

South Korea halts flights for college entry exam

-

Trump signs bill to end record-breaking US shutdown

Trump signs bill to end record-breaking US shutdown

-

EU lawmakers to vote on unpicking green business rules

-

Smith says England speed kings could struggle in Ashes

Smith says England speed kings could struggle in Ashes

-

Stocks stutter with focus on Fed, tech after US reopen vote

-

Record-breaking US shutdown ends as political fallout begins

Record-breaking US shutdown ends as political fallout begins

-

France marks decade since harrowing Paris attacks

-

Skubal, Skenes win MLB Cy Young Awards for top pitchers

Skubal, Skenes win MLB Cy Young Awards for top pitchers

-

Record rains turn Argentina's farm-filled Pampas plains to wetlands

-

Solar storm brings new chance of vivid auroras, signal disruptions

Solar storm brings new chance of vivid auroras, signal disruptions

-

Gauff and Fritz back for United Cup against Swiatek's Poland

-

World's fossil fuel emissions to hit new record in 2025: study

World's fossil fuel emissions to hit new record in 2025: study

-

SRH Total Return Fund, Inc. Increases its Quarterly Distribution by 21.2% - Fifth Consecutive Annual Increase

-

Classover Reports Record Third Quarter Results, Delivering Profitability and Accelerating AI Tutor and Digital Asset Strategy

Classover Reports Record Third Quarter Results, Delivering Profitability and Accelerating AI Tutor and Digital Asset Strategy

-

Banyan Gold Intersects 3.66 g/t over 17.6 m Continuing to Extend High-Grade Mineralization in Airstrip Deposit, AurMac Project, Yukon, Canada

-

Pivotree Announces Third Quarter 2025 Results

Pivotree Announces Third Quarter 2025 Results

-

National Energy Services Reunited Corp. Reports Third Quarter 2025 Financial Results

-

Algorithmic Insurance Services Inc., dba American Takaful Insurance Solutions Appointed to Develop Takaful America, the First Large-Scale Takaful Insurance MGU in the United States

Algorithmic Insurance Services Inc., dba American Takaful Insurance Solutions Appointed to Develop Takaful America, the First Large-Scale Takaful Insurance MGU in the United States

-

Skymantics Offers Full-Spectrum AI Services for State and Local Government, From Strategy to Secure Automation

Algorithmic Insurance Services Inc., dba American Takaful Insurance Solutions Appointed to Develop Takaful America, the First Large-Scale Takaful Insurance MGU in the United States

NEWPORT BEACH, CA / ACCESS Newswire / November 13, 2025 / American Takaful Insurance Solutions, the Takaful insurance division of Algorithmic Insurance Services Inc., has been appointed as the exclusive brokerage and advisory firm to support the development and reinsurance placement of Takaful America, the first large-scale Managing General Underwriter (MGU) in the United States based on Takaful-compliant cooperative insurance principles.

Takaful America aims to provide faith-based, ethically grounded property insurance solutions to Muslim families and businesses, beginning in New York, New Jersey, Michigan, Minnesota, and Illinois. This model, well established in multiple international markets, is expected to gain substantial traction through a broker-centric distribution strategy and focused community outreach through religious centers.

"This is a historic step toward offering faith-aligned financial protection at scale to the Muslim community in America," said Lawrence Lipman, co-founder of Algorithmic Insurance Services. "We are honored to lead the design, reinsurance, and regulatory structuring for what will become a pillar of trust and resilience for families and businesses alike."

Empowering the Community Through Values-Aligned Coverage

Takaful is a globally recognized model of mutual insurance built on shared responsibility, transparency, and surplus sharing. Unlike conventional insurance, which is based on risk transfer and profit extraction, Takaful prioritizes ethical principles rooted in Islamic law. Takaful America plans to operate with a participant-first approach, enabling surplus to be returned to policyholders in accordance with Islamic standards.

"As a practicing Muslim and industry professional, I am honored to contribute to the development of a program that brings meaningful representation and choice to our community within the insurance space," said Armin Dzanic, Chief Client Officer- Program Business of Algorithmic Insurance Services. "Takaful America endeavors to empower producers across the country to offer protection that reflects the values and needs of the people we serve, not just as clients, but as neighbors and fellow believers."

In his role, Armin supports the strategic development and launch of Takaful America, helping shape its structure, market positioning, and distribution approach as part of Algorithmic Insurance Services' broader work advising and building emerging MGU and program platforms. American Takaful Insurance Services will soon approach markets with its reinsurance submission and looks forward to an official launch in the near future.

About American Takaful Insurance Solutions

American Takaful Insurance Solutions is a registered DBA of Algorithmic Insurance Services Inc., a California-based insurance and reinsurance brokerage and consulting firm.

Disclaimer

This press release may contain forward-looking statements concerning a product currently under development. Such statements are based on assumptions and expectations that involve risks and uncertainties, and actual results may differ materially. The information contained herein is provided for informational purposes only and shall not be construed as an offer to sell, a solicitation to purchase, or an advertisement for any insurance or reinsurance product or service. The product described, once available, will be offered exclusively on an excess and surplus lines (E&S) basis.

CONTACT:

Steven Griswold, Chief Operating Officer

[email protected]

Armin Dzanic, Chief Client Officer - Program Business

[email protected]

SOURCE: Algorithmic Insurance Services Inc.

View the original press release on ACCESS Newswire

D.Moore--AMWN