-

Duffy takes four as New Zealand crush West Indies to seal T20 series

Duffy takes four as New Zealand crush West Indies to seal T20 series

-

South Korea halts flights for college entry exam

-

Trump signs bill to end record-breaking US shutdown

Trump signs bill to end record-breaking US shutdown

-

EU lawmakers to vote on unpicking green business rules

-

Smith says England speed kings could struggle in Ashes

Smith says England speed kings could struggle in Ashes

-

Stocks stutter with focus on Fed, tech after US reopen vote

-

Record-breaking US shutdown ends as political fallout begins

Record-breaking US shutdown ends as political fallout begins

-

France marks decade since harrowing Paris attacks

-

Skubal, Skenes win MLB Cy Young Awards for top pitchers

Skubal, Skenes win MLB Cy Young Awards for top pitchers

-

Record rains turn Argentina's farm-filled Pampas plains to wetlands

-

Solar storm brings new chance of vivid auroras, signal disruptions

Solar storm brings new chance of vivid auroras, signal disruptions

-

Gauff and Fritz back for United Cup against Swiatek's Poland

-

World's fossil fuel emissions to hit new record in 2025: study

World's fossil fuel emissions to hit new record in 2025: study

-

US jury: Boeing owes $28 mn to family of Ethiopian Airlines crash victim

-

G7 calls for urgent Ukraine ceasefire, de-escalation in Sudan

G7 calls for urgent Ukraine ceasefire, de-escalation in Sudan

-

Bayern stun Arsenal, Man Utd sink PSG in Women's Champions League

-

New Epstein emails claim Trump 'knew about the girls'

New Epstein emails claim Trump 'knew about the girls'

-

Brazil tribal chief ready to give Lula a 'talking-to'

-

Clippers' Beal to have season-ending surgery - report

Clippers' Beal to have season-ending surgery - report

-

Dow ends at record on hopes US government will reopen

-

Portugal's Ronaldo hoping Ireland fans boo him

Portugal's Ronaldo hoping Ireland fans boo him

-

England set for Etihad start to Euro 2028 tournament campaign

-

Sinner cruises past Zverev and into last four of ATP Finals

Sinner cruises past Zverev and into last four of ATP Finals

-

US presses final penny after more than 230 years

-

Baxter says England must be 'selfless' to see off All Blacks

Baxter says England must be 'selfless' to see off All Blacks

-

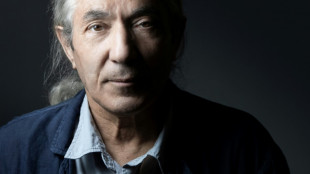

Pardoned French-Algerian writer Sansal arrives in Germany

-

Bayern battle back to shock Arsenal in Women's Champions League

Bayern battle back to shock Arsenal in Women's Champions League

-

China hopes US will 'some day' return to climate fold, official tells AFP

-

Trump 'knew about the girls,' new Epstein emails claim

Trump 'knew about the girls,' new Epstein emails claim

-

Scotland 'optimistic' Russell will be fit to face Argentina

-

Big platforms chart gradual path to self-driving at Web Summit

Big platforms chart gradual path to self-driving at Web Summit

-

Jane Goodall honored in Washington by conservationists including DiCaprio

-

Tuberculosis killed 1.23 million last year: WHO

Tuberculosis killed 1.23 million last year: WHO

-

New Zealand coach Robertson says Twickenham visit is 'why I'm doing the job'

-

Hopes of US shutdown deal fail to sustain market rally

Hopes of US shutdown deal fail to sustain market rally

-

US military personnel do not risk prosecution for drug strikes: Justice Dept

-

Jailed writer Sansal on way to Germany after Algeria pardon

Jailed writer Sansal on way to Germany after Algeria pardon

-

Ukraine ministers resign over major corruption scandals

-

Record-breaking US shutdown to end as political fallout begins

Record-breaking US shutdown to end as political fallout begins

-

Wallets, not warming, make voters care about climate: California governor

-

Astronomers spot storm on another star for first time

Astronomers spot storm on another star for first time

-

G7 foreign ministers seek to boost Ukraine war effort

-

Released Epstein emails allege Trump 'knew about the girls'

Released Epstein emails allege Trump 'knew about the girls'

-

Rees-Zammit back in Wales 'happy place' after Test return

-

Chelsea winger Sterling's house burgled

Chelsea winger Sterling's house burgled

-

Auger-Aliassime beats Shelton to get off mark at ATP Finals

-

Argentina's Milei to follow Trump in skipping S.Africa G20: spokesperson

Argentina's Milei to follow Trump in skipping S.Africa G20: spokesperson

-

Back on track: Belgian-Dutch firm rescues Berlin to Paris sleeper train

-

Los Angeles 2028 Olympic Games schedule revealed

Los Angeles 2028 Olympic Games schedule revealed

-

Wolves appoint Edwards as manager in bid to avoid relegation

Stocks stutter with focus on Fed, tech after US reopen vote

Asian markets trod water Thursday as euphoria over the end of a record US government shutdown petered, with focus back on Federal Reserve interest rates and tech bubble worries.

Lawmakers in Washington voted Wednesday night to send Donald Trump legislation to end the 43-day stoppage that shuttered key services and suspended the release of data crucial to gauging the state of the world's top economy.

However, even with the US president expected to sign the bill, the mood on trading floors was less upbeat than earlier in the week, when a deal was announced.

Investors will now be able to get a long-awaited glimpse of the reports that have been held up by the closure, particularly the Fed as it decides whether or not to meet expectations and cut rates next month.

Even then, the White House said figures on jobs and consumer prices for October were not likely to be released as statistics agencies were unable to collect the necessary data.

"Reopening also doesn't mean an instant snap-back to normal for the real economy. When you starve a system of staffing and pay for six weeks, the backlog doesn't vanish just because a bill passed at 8 pm," wrote Stephen Innes at SPI Asset Management.

"The shutdown ends with a vote and a signature; the aftershocks show up in queues, call centres and cash-flow stress far away from the Capitol dome."

Meanwhile, concerns continue to mount that this year's AI-led market rally may have pushed valuations too high and led to a bubble in the tech sector that could burst at any time.

Some have warned that the hundreds of billions invested in artificial intelligence has been overdone and the return could take time to come through.

Observers suggested that the recent tepid performance in several high-flying firms may be a sign of that, with the Nasdaq dropping for two days.

The S&P 500 has also struggled of late, though the Dow on Wednesday ended at a record amid speculation that traders are shifting from tech into industrials.

The mixed showing on Wall Street was reflected in Asia, where Hong Kong, Sydney, Seoul, Singapore, Taipei, Manila and Wellington fell.

Tokyo edged up while Jakarta and Shanghai were flat.

Oil prices extended losses after plunging around four percent Wednesday after OPEC's monthly crude market report forecast an oversupply in the third quarter.

That came just a month after it had predicted a deficit in the period.

The commodity has come under pressure of late amid easing tensions in the Middle East and increasing output by OPEC and other key producers.

And the International Energy Agency earlier this year estimated a record surplus in 2026.

Attention is also on Tokyo after Japanese Finance Minister Satsuki Katayama said Wednesday the government was keeping an eye on currency markets as the yen continued to weaken.

She told parliament that "the government is watching for any excessive and disorderly moves with a high sense of urgency".

Since her remarks, the unit has weakened further to around 155 per dollar, prompting speculation that authorities could step in to provide support.

The currency has come under pressure following dovish comments from Japan's central bank that tempered best on another interest rate hike and as the US moved towards reopening its government.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.2 percent at 51,166.78 (break)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 26,894.91

Shanghai - Composite: FLAT at 4,000.55

Dollar/yen: UP at 154.90 yen from 154.80 yen on Wednesday

Euro/dollar: DOWN at $1.1585 from $1.1587

Pound/dollar: DOWN at $1.3118 from $1.3129

Euro/pound: UP at 88.32 pence from 88.25 pence

West Texas Intermediate: DOWN 0.3 percent at $58.29 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $62.55 per barrel

New York - Dow: UP 0.7 percent at 48,254.82 (close)

London - FTSE 100: UP 0.1 percent at 9,911.42 (close)

O.Norris--AMWN