-

Farrell says Hansen 'ready and able' to step-in at full-back for Ireland

Farrell says Hansen 'ready and able' to step-in at full-back for Ireland

-

Osimhen strikes twice as Nigeria keep World Cup hopes alive

-

Bad Bunny in box seat as Latin Grammys hit Vegas

Bad Bunny in box seat as Latin Grammys hit Vegas

-

We need to talk about our fossil fuel addiction: UNEP chief

-

Wales boss Tandy 'excited' to see Rees-Zammit start against Japan

Wales boss Tandy 'excited' to see Rees-Zammit start against Japan

-

UK artist turns 'money for old rope' into £1m art exhibition

-

Nagelsmann backs Woltemade to shine for injury-hit Germany

Nagelsmann backs Woltemade to shine for injury-hit Germany

-

Zelensky sanctions associate as fraud scandal rocks Ukraine

-

Starbucks baristas launch strike on chain's 'Red Cup Day'

Starbucks baristas launch strike on chain's 'Red Cup Day'

-

Fiji unchanged for France Autumn Nations Series trip

-

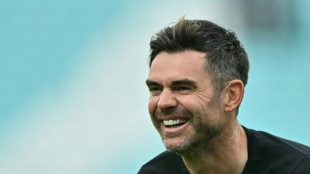

All Blacks boss Robertson at ease with 'respectful' England challenge to haka

All Blacks boss Robertson at ease with 'respectful' England challenge to haka

-

Stocks on the slide despite end of US shutdown

-

Church bells ring as France marks decade since Paris attacks

Church bells ring as France marks decade since Paris attacks

-

France scrum-half Serin commits for two more seasons to Toulon

-

Starlink, utilised by Myanmar scam centres, sees usage fall nationwide

Starlink, utilised by Myanmar scam centres, sees usage fall nationwide

-

YouTube superstar MrBeast opens pop-up park in Saudi Arabia

-

'Black Klimt' steps out of shadows and into political tug-of-war

'Black Klimt' steps out of shadows and into political tug-of-war

-

Study flags 'complicity' of oil-supplying states in Gaza war

-

US shutdown scorecard: Who cashed in, who crashed out

US shutdown scorecard: Who cashed in, who crashed out

-

'Bleak' future for seals decimated by bird flu, scientists warn

-

Australia turn to O'Connor in search of Ireland inspiration

Australia turn to O'Connor in search of Ireland inspiration

-

Mexican car industry fears higher tariffs on China will drive its demise

-

Battle brews over Australia or Turkey hosting next COP

Battle brews over Australia or Turkey hosting next COP

-

Hansen and Prendergast start for Ireland against Australia

-

McIlroy two shots off the lead as Kim top after round one in Dubai

McIlroy two shots off the lead as Kim top after round one in Dubai

-

Stocks sluggish as US government shutdown ends

-

De Minaur knocks out Fritz to keep ATP Finals hopes alive

De Minaur knocks out Fritz to keep ATP Finals hopes alive

-

Ikitau and O'Connor return as Wallabies make changes for Ireland

-

EU backs small parcel duties to tackle China import flood

EU backs small parcel duties to tackle China import flood

-

Europe court orders Poland pay damages to woman who aborted abroad

-

EU lawmakers back proxy voting for pregnant women, new mothers

EU lawmakers back proxy voting for pregnant women, new mothers

-

England great Anderson to play on for Lancashire

-

Swiss economy minister back in Washington for tariff talks

Swiss economy minister back in Washington for tariff talks

-

Race for first private space station heats up as NASA set to retire ISS

-

France lifts travel ban on Telegram founder Durov

France lifts travel ban on Telegram founder Durov

-

Quesada sticks with Italy's Wallabies heroes for Springboks Test

-

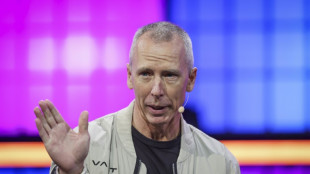

Amazon robotics lead casts doubt on eye-catching humanoids

Amazon robotics lead casts doubt on eye-catching humanoids

-

Springboks ring changes for Italy clash

-

How embracing 'ickiness' helped writer Szalay win Booker Prize

How embracing 'ickiness' helped writer Szalay win Booker Prize

-

World oil market 'lopsided' as supply outpaces demand: IEA

-

Alldritt 'takes up the torch' for France against Fiji after South Africa loss

Alldritt 'takes up the torch' for France against Fiji after South Africa loss

-

Hitler likely had genetic condition limiting sexual development: research

-

Zelensky sanctions associate as corruption scandal engulfs Kyiv

Zelensky sanctions associate as corruption scandal engulfs Kyiv

-

Germany agrees to keep military service voluntary

-

Japan PM Takaichi says she sleeps only 2-4 hours a night

Japan PM Takaichi says she sleeps only 2-4 hours a night

-

South Africa announces plan to bid for Olympic Games

-

Juan Ponce Enrile, architect of Philippines martial law, dies at 101

Juan Ponce Enrile, architect of Philippines martial law, dies at 101

-

Stocks waver as US government shutdown ends

-

Google to pay millions to South African news outlets: watchdog

Google to pay millions to South African news outlets: watchdog

-

EU probes Google over news site rankings despite Trump threats

Stocks on the slide despite end of US shutdown

Global stocks slid back sharply on Thursday, dashing hopes that President Donald Trump's signing of a spending bill to end a record US government shutdown might enliven trading floors.

Investors had sought a fillip after lawmakers in Washington voted to end the 43-day stoppage that closed key services and suspended the release of data crucial to gauging the state of the world's top economy.

But the main exchanges in Europe and on Wall Street were down across the board, following modest gains in Asia earlier.

"While it's unclear whether the shutdown was ever a real drag on equities -– given that stocks largely rallied through it -– the question now is whether the market's recent exuberance has run its course," said Fawad Razaqzada, market analyst at StoneX.

London was pegged back after data showed the UK economy slowed in the third quarter, dealing another blow to the Labour government ahead of its annual budget this month.

- 'Overstretched' tech -

Investors are bracing for long-awaited reports that have been held up by the closure of vital services in the US -- particularly as the Federal Reserve assesses whether to cut rates next month, as is widely expected.

However, the White House said figures on jobs and consumer prices for October were not likely to be released as statistics agencies had been unable to collect the necessary data.

Concerns also mounted that this year's AI-led market rally may have pushed valuations too high and led to a bubble in the tech sector that could burst at any time.

"Big Tech valuations and big spending will remain front of mind for investors until Microsoft, for example, can say that AI-boosted software sales have exploded -- and that's not yet the case," said Ipek Ozkardeskaya, Senior Analyst at Swissquote bank.

Razaqzada said technology shares look "increasingly overvalued and overstretched" but he added it was "far too early to call a top in this cycle" as investors were still enthusiastic about AI.

Oil prices advanced after plunging around four percent on Wednesday following OPEC's monthly crude market report, which forecast an oversupply in the third quarter.

Easing tensions in the Middle East and increased output by OPEC and other key producers have put the commodity's price under pressure.

- Key figures at around 1645 GMT -

New York - Dow: DOWN 0.8 percent at 47,793.10 points

New York - S&P 500: DOWN 1.2 percent at 6,764.82

New York - Nasdaq Composite: DOWN 1.9 percent at 22,957.73

London - FTSE 100: DOWN 1.0 percent at 9,807.68 (close)

Paris - CAC 40: DOWN 0.1 percent at 8,232.49 (close)

Frankfurt - DAX: DOWN 1.4 percent at 24,042.91 (close)

Tokyo - Nikkei 225: UP 0.4 percent at 51,281.83 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 27,073.03 (close)

Shanghai - Composite: UP 0.7 percent at 4,029.50 (close)

Dollar/yen: DOWN at 154.28 yen from 154.80 yen on Wednesday

Euro/dollar: UP at $1.1647 from $1.1587

Pound/dollar: UP at $1.3203 from $1.3129

Euro/pound: DOWN at 88.21 pence from 88.25 pence

Brent North Sea Crude: UP 0.8 percent at $63.22 per barrel

West Texas Intermediate: UP 0.8 percent at $58.95 per barrel

S.F.Warren--AMWN