-

US health agency edits official website to reflect anti-vax views

US health agency edits official website to reflect anti-vax views

-

US unemployment up even as hiring beat expectations in delayed report

-

US honors conservative titan Cheney, with Trump off guest list

US honors conservative titan Cheney, with Trump off guest list

-

Nigerian court jails Biafran separatist leader Kanu for life for 'terrorism'

-

Spain fight back against Czech Republic to reach Davis Cup semis

Spain fight back against Czech Republic to reach Davis Cup semis

-

UN chief calls for 'ambitious compromise' at climate talks

-

Comet sparks scientific fascination, online furor over 'alien' origins

Comet sparks scientific fascination, online furor over 'alien' origins

-

German Christmas market opens year after deadly car attack

-

Stocks rise as Nvidia overshadows US jobs report

Stocks rise as Nvidia overshadows US jobs report

-

Irish veterans Ringrose and van der Flier return for South Africa Test

-

Vietnam flooding submerges homes, kills 41, after relentless rain

Vietnam flooding submerges homes, kills 41, after relentless rain

-

Nigeria convicts Biafran separatist leader Kanu for 'terrorism'

-

Varney misses Italy's Chile Test with rib fracture

Varney misses Italy's Chile Test with rib fracture

-

'Exciting prospect' Gordon recalled by Australia coach Schmidt

-

US unemployment up even as hiring beats expectations in delayed report

US unemployment up even as hiring beats expectations in delayed report

-

Nigeria convicts Biafran separatist leader Nnamdi Kanu for 'terrorism'

-

UN nuclear watchdog demands Iran open up bombed nuclear sites

UN nuclear watchdog demands Iran open up bombed nuclear sites

-

Walmart earnings beat expectations as shoppers seek savings

-

South Africa back to full strength for 'colossal challenge' of Irish

South Africa back to full strength for 'colossal challenge' of Irish

-

Greenpeace says clothes sold by Shein break EU chemicals rules

-

Italy to face Northern Ireland in 2026 World Cup playoffs

Italy to face Northern Ireland in 2026 World Cup playoffs

-

Inexperienced Gordon recalled by Australia coach Schmidt

-

Walmart lifts outlook in quarterly results with e-commerce boost

Walmart lifts outlook in quarterly results with e-commerce boost

-

EU moves to bar 'green' labels for fossil fuel investments

-

Lufthansa enters race for TAP stake against Air France-KLM

Lufthansa enters race for TAP stake against Air France-KLM

-

Daily pill helps people lose 10% of weight in 18 months: study

-

Barca go 'back to the future' for renovated Camp Nou reopening

Barca go 'back to the future' for renovated Camp Nou reopening

-

Youth activist turning trauma into treatment in Lebanon

-

The US plan for ending the Ukraine war: What do we know?

The US plan for ending the Ukraine war: What do we know?

-

Stocks mostly rise as Nvidia calms AI fears

-

Alldritt keeps France captaincy as Fickou returns against Australia

Alldritt keeps France captaincy as Fickou returns against Australia

-

Israel launches fresh strikes on Gaza, Qatar warns of escalation

-

Veteran Fickou returns for France against Australia

Veteran Fickou returns for France against Australia

-

Spain court orders Meta to compensate media for 'unfair competition'

-

Australia's Smith takes pre-Ashes swipe at 'Mastermind' Panesar

Australia's Smith takes pre-Ashes swipe at 'Mastermind' Panesar

-

Deaves to debut for Wales against New Zealand

-

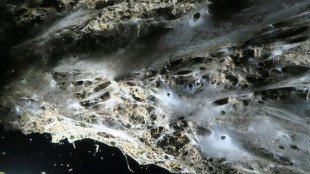

Giant spider web found in Greek-Albanian border cave: study

Giant spider web found in Greek-Albanian border cave: study

-

Chinese woman who faked nationality to become Philippine mayor jailed for trafficking

-

New Zealand ring changes for Wales Test

New Zealand ring changes for Wales Test

-

Most markets rise as Nvidia earnings override Fed rate concern

-

Vietnam flooding submerges homes, kills 16, after relentless rain

Vietnam flooding submerges homes, kills 16, after relentless rain

-

The case of Africa's 'vanishing' carbon deals

-

Stokes tells England to 'write our own history' in Ashes

Stokes tells England to 'write our own history' in Ashes

-

Young Nepalis drive a new wave of voters and candidates

-

Bangladesh's Mushfiqur joins elite club with ton in 100th Test

Bangladesh's Mushfiqur joins elite club with ton in 100th Test

-

Memory chip crunch set to drive up smartphone prices

-

Vietnam flooding death toll rises to 16

Vietnam flooding death toll rises to 16

-

Pacific islands rue lost chance to host COP climate summit

-

Australia's Weatherald and Doggett to debut in first Ashes Test

Australia's Weatherald and Doggett to debut in first Ashes Test

-

Sengun powers Rockets over Cavs as Thunder reach 15-1

| RYCEF | 1.53% | 14.37 | $ | |

| SCS | -0.17% | 15.703 | $ | |

| RBGPF | 2.47% | 79.04 | $ | |

| CMSC | -0.38% | 23.58 | $ | |

| NGG | -0.11% | 76.005 | $ | |

| RIO | 0.84% | 70.02 | $ | |

| GSK | -0.18% | 46.255 | $ | |

| BCC | 1.39% | 68.17 | $ | |

| RELX | -0.34% | 39.665 | $ | |

| BTI | 0.23% | 54.865 | $ | |

| BP | 0.59% | 36.165 | $ | |

| VOD | -0.33% | 11.97 | $ | |

| CMSD | 0.08% | 23.772 | $ | |

| JRI | 0.38% | 13.301 | $ | |

| AZN | 0.6% | 89.53 | $ | |

| BCE | -0.31% | 22.72 | $ |

Stocks mostly rise as Nvidia calms AI fears

Most stock markets rallied on Thursday after strong earnings from chip titan Nvidia eased fears of an AI bubble.

Investors' attention turned to the delayed US September jobs report, due later in the day, for clues about the outlook for interest rates.

London, Paris and Frankfurt all advanced after a largely positive session in Asia.

Japan surged around three percent, while Hong Kong ended flat and Shanghai closed slightly lower.

Global equities have struggled recently on warnings that tech valuations may be due a pullback after this year's record-breaking rally.

But Wednesday's report from AI bellwether Nvidia topped expectations on fierce demand for its advanced chips, with chief executive Jensen Huang brushing off fears of a bubble.

"Nvidia's results have completely changed the market mood and pushed out any bubble fears for another day," said Jim Reid, managing director at Deutsche Bank.

Shares in the firm -- which last month became the world's first $5 trillion stock -- rose more than five percent in post-market trade, while S&P 500 and Nasdaq futures also soared.

Tech stocks led the gains in Asia. South Korea's Samsung and SK hynix, Taiwan's TSMC and Japanese investment giant SoftBank all enjoyed a strong day.

However, SPI Asset Management's Stephen Innes warned: "This is still a market balancing on a wire stretched between AI euphoria and debt-filled reality."

The upbeat report helped counterbalance minutes from the Federal Reserve's October policy meeting, which suggested officials are against cutting rates for the third time in a row next month.

A run of soft labour market reports had previously boosted bets on a string of rate reductions, lifting equities in turn.

But Fed boss Jerome Powell dampened the mood last month when he warned that a December cut was "not a foregone conclusion".

Thursday's release of US jobs data for September -- delayed by the government shutdown -- will be closely watched.

"Unless we see a particularly concerning jobs report today, it looks likely that the next rate cut comes in 2026," said Joshua Mahony, chief market analyst at Scope Markets.

The data carries extra weight as the Bureau of Labor Statistics said it would not publish its October figures, instead rolling them into November's full report on December 16.

The pullback in US rate cut expectations sent the dollar to its strongest level against the yen since January, spurring talk of an intervention by Japanese authorities.

The yen was already under pressure from concerns about Japan's fiscal outlook before the expected release of a stimulus package by Prime Minister Sanae Takaichi.

Worries that she will push for more borrowing have hit the currency and sent bond yields to record highs.

In company news, shares in Games Workshop jumped more than 10 percent on London's FTSE 100 after it forecast strong earnings and increased dividends.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.8 percent at 9,579.48 points

Paris - CAC 40: UP 0.8 percent at 8,020.69

Frankfurt - DAX: UP 1.1 percent at 23,408.01

Tokyo - Nikkei 225: UP 2.7 percent at 49,823.94 (close)

Hong Kong - Hang Seng Index: FLAT at 25,835.57 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,931.05 (close)

New York - Dow: UP 0.1 percent at 46,138.77 (close)

Dollar/yen: UP at 157.47 yen from 157.01 yen on Wednesday

Euro/dollar: DOWN at $1.1518 from $1.1526

Pound/dollar: UP at $1.3066 from $1.3048

Euro/pound: DOWN at 88.14 from 88.33 pence

West Texas Intermediate: UP 0.9 percent at $59.95 per barrel

Brent North Sea Crude: UP 0.7 percent at $63.97 per barrel

G.Stevens--AMWN