-

Australia's seven-wicket hero Starc ready to go again

Australia's seven-wicket hero Starc ready to go again

-

Pupils, teachers kidnapped from Catholic school in central Nigeria

-

Guardiola says 'season starts now' as Man City hunt Arsenal

Guardiola says 'season starts now' as Man City hunt Arsenal

-

Mercedes chief Wolff sells part of team stake to US businessman

-

Ubisoft shares surge as trading resumes after results 'restatement'

Ubisoft shares surge as trading resumes after results 'restatement'

-

Olympic ski champion Gut-Behrami suffers knee injury

-

Ukraine cornered by US plan heeding Russian demands

Ukraine cornered by US plan heeding Russian demands

-

Europe increasingly 'vulnerable' to shocks: ECB chief

-

Slot says Liverpool will never use Jota grief as 'excuse' for poor form

Slot says Liverpool will never use Jota grief as 'excuse' for poor form

-

Aussie Wilson 'devastated' after Gordon ruled out of France Test

-

Ken Follett: 'There can't be boring bits in my books'

Ken Follett: 'There can't be boring bits in my books'

-

Wales rugby turmoil here to stay as nostalgia battles financial reality

-

Frida Kahlo painting sells for $54.7 mn in record for female artist

Frida Kahlo painting sells for $54.7 mn in record for female artist

-

Thailand's last hunter-gatherers seek land rights

-

Tech firms lead stock rout as AI bubble fears linger

Tech firms lead stock rout as AI bubble fears linger

-

World's biggest nuclear plant edges closer to restart

-

India's injured Gill out of must-win second South Africa Test

India's injured Gill out of must-win second South Africa Test

-

Japan's eel delicacy faces global conservation pressure

-

Starc takes seven as England rolled for 172 in Ashes opener

Starc takes seven as England rolled for 172 in Ashes opener

-

New York's incoming leftist mayor to face off with Trump

-

Fossil fuel showdown looms on UN climate summit's final day

Fossil fuel showdown looms on UN climate summit's final day

-

Japan's Takaichi insists $135 bn stimulus fiscally 'responsible'

-

Norris tops red-flagged second practice for Las Vegas GP

Norris tops red-flagged second practice for Las Vegas GP

-

Miss Mexico wins Miss Universe contest after host insult drama

-

Texans sack Allen eight times to beat Bills 23-19

Texans sack Allen eight times to beat Bills 23-19

-

Rusty France face 'tired' Australia at end of torrid year

-

Dortmund host new nemesis Stuttgart with title hopes slipping away

Dortmund host new nemesis Stuttgart with title hopes slipping away

-

Munster tragedy 'life-changing' for Springbok coach Erasmus

-

Starc on fire as England slump to 105-4 at lunch in Ashes opener

Starc on fire as England slump to 105-4 at lunch in Ashes opener

-

Taiwan issues 'crisis' guide on preparing for disasters, Chinese attack

-

Washington's abandoned embassies have stories to tell

Washington's abandoned embassies have stories to tell

-

Maxey powers Sixers over Bucks as Spurs beat Hawks

-

Barca hoping Camp Nou return can spark Liga title defence

Barca hoping Camp Nou return can spark Liga title defence

-

All Blacks bid to bounce back for season-ender against struggling Wales

-

Pogba set for long-awaited comeback as Ligue 1 returns

Pogba set for long-awaited comeback as Ligue 1 returns

-

Inter and Milan in early Scudetto clash as Napoli attempt to bounce back

-

How England revived their rugby fortunes

How England revived their rugby fortunes

-

A big deal: Robert Therrien's huge sculptures on show in LA

-

In U-turn, US rights report to track gender changes, DEI

In U-turn, US rights report to track gender changes, DEI

-

Afghanistan seeks new trade routes as Pakistan ties sour

-

Iranian director Jafar Panahi ramps up French Oscars campaign

Iranian director Jafar Panahi ramps up French Oscars campaign

-

Cuba battles virus outbreak despite shortages of food, medicine

-

30-plus nations oppose COP30 draft over fossil fuel omission: Colombia

30-plus nations oppose COP30 draft over fossil fuel omission: Colombia

-

Tech firms lead Asian stock rout as AI bubble fears linger

-

Ukraine would give Russia chunk of territory under 28-point US plan

Ukraine would give Russia chunk of territory under 28-point US plan

-

England win toss, bat in first Ashes Test

-

Teen saving India's ponds says everyone can be a leader

Teen saving India's ponds says everyone can be a leader

-

Frida Kahlo painting auctions for $54.6 mn, record for woman artist

-

Arsenal brace for Spurs clash without Gabriel, Man City in pursuit

Arsenal brace for Spurs clash without Gabriel, Man City in pursuit

-

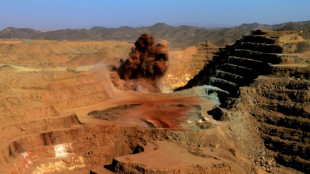

Scramble for Sudan's resources fuels brutal civil war

AIZO Group Announces Solid 21.0% Revenue Growth To RM33.94 Million In Q1 FY2026

KUALA LUMPUR, MY / ACCESS Newswire / November 21, 2025 / AIZO Group Berhad ("AIZO" or the "Company"), today announced its unaudited financial results for the first quarter ended 30 September 2025 ("Q1 FY2026"), recording revenue of RM33.94 million, a 21.0% increase from RM28.05 million recognised in the corresponding quarter last year. The improvement was driven by stronger contributions from the civil engineering, bituminous products and energy segments, supported by more advanced progress in infrastructure works and higher demand for raw bitumen trading.

En. Ahmad Rahizal Bin Dato' Ahmad Rasidi, the Executive Director of AIZO

Gross profit improved to RM4.77 million compared to RM3.41 million a year ago, reflecting higher margins across key operating divisions. Loss before tax ("LBT") narrowed significantly to RM1.42 million from RM2.63 million in Q1 FY2025, attributable to improved operational efficiency, better segmental profitability and disciplined cost controls. The Group also noted stronger performance in the energy division, underpinned by higher plant availability and consistent production output.

On a quarter-on-quarter basis, AIZO posted a revenue of RM33.94 million compared to RM37.02 million in the immediate preceding quarter ("Q5 FY2025"), with the temporary production adjustment at the Selinsing Gold Mine Site affecting civil engineering revenue. However, the bituminous products and energy segments continued to show growth, reflecting sustained demand trends. The Company's LBT improved significantly from RM7.69 million in the previous quarter to RM1.42 million in the current quarter, mainly due to the absence of impairment charges that were recorded previously. Adjusted EBITDA remained positive at RM1.38 million for the quarter, underscoring AIZO's underlying operational resilience.

Additionally, AIZO's bituminous products segment recorded its strongest quarterly performance to date, delivering revenue of RM9.66 million. This was driven by sustained demand for raw bitumen trading and healthier operating margins. This strong performance reflects the segment's growing contribution to the Company's earnings stability and underscores AIZO's strengthening position within Malaysia's bituminous supply chain.

En. Ahmad Rahizal Bin Dato' Ahmad Rasidi, the Executive Director of AIZO commented, "The performance of this quarter reflects AIZO's steady progress as we sharpen our operating model, strengthen project execution and realign our core business verticals. The double-digit revenue growth and significantly reduced losses demonstrate tangible traction in our civil engineering, bituminous products and energy segments. Our solar plant operations continue to remain stable, while higher-margin works in our civil division are beginning to flow through more meaningfully. These improvements reinforce our commitment to turning the Company onto a stronger path of profitability and long-term value creation."

Looking ahead, AIZO remains cautiously optimistic as it navigates a mixed macroeconomic environment. The Company will continue to prioritise operational efficiency, prudent cost management and progress monitoring across infrastructure works, bituminous product manufacturing and renewable energy operations. With the realignment of its financial year-end now completed, AIZO expects clearer synchronisation of project delivery cycles and financial reporting milestones moving forward.

As at the date of this announcement, the Company maintains a healthy asset base of RM179.66 million and continues to monitor its capital commitments and working capital requirements prudently. AIZO remains focused on strengthening its operational fundamentals and enhancing long-term shareholder value as it advances through FY2026.

###

ABOUT AIZO GROUP BERHAD

AIZO Group Berhad ("AIZO" or the "Company"), formerly known as Minetech Resources Berhad is primarily a civil engineering specialist and bituminous products manufacturer that has diversified into renewable energy, as well as oil and gas services. The Company is a registered solar photovoltaic investor with the Sustainable Energy Development Authority Malaysia and owns a 9.99MW AC floating solar power plant.

For more information, visit https://aizo.com.my/

Issued By: Swan Consultancy Sdn. Bhd. on behalf of AIZO Group Berhad (formerly known as Minetech Resources Berhad)

For more information, please contact:

Jazzmin Wan

Email: [email protected]

Stephanie Chow

Email: [email protected]

SOURCE: AIZO Group Berhad

View the original press release on ACCESS Newswire

H.E.Young--AMWN