-

Taiwan issues 'crisis' guide on preparing for disasters, Chinese attack

Taiwan issues 'crisis' guide on preparing for disasters, Chinese attack

-

Washington's abandoned embassies have stories to tell

-

Maxey powers Sixers over Bucks as Spurs beat Hawks

Maxey powers Sixers over Bucks as Spurs beat Hawks

-

Barca hoping Camp Nou return can spark Liga title defence

-

All Blacks bid to bounce back for season-ender against struggling Wales

All Blacks bid to bounce back for season-ender against struggling Wales

-

Pogba set for long-awaited comeback as Ligue 1 returns

-

Inter and Milan in early Scudetto clash as Napoli attempt to bounce back

Inter and Milan in early Scudetto clash as Napoli attempt to bounce back

-

How England revived their rugby fortunes

-

A big deal: Robert Therrien's huge sculptures on show in LA

A big deal: Robert Therrien's huge sculptures on show in LA

-

In U-turn, US rights report to track gender changes, DEI

-

Afghanistan seeks new trade routes as Pakistan ties sour

Afghanistan seeks new trade routes as Pakistan ties sour

-

Iranian director Jafar Panahi ramps up French Oscars campaign

-

Cuba battles virus outbreak despite shortages of food, medicine

Cuba battles virus outbreak despite shortages of food, medicine

-

30-plus nations oppose COP30 draft over fossil fuel omission: Colombia

-

Tech firms lead Asian stock rout as AI bubble fears linger

Tech firms lead Asian stock rout as AI bubble fears linger

-

Ukraine would give Russia chunk of territory under 28-point US plan

-

England win toss, bat in first Ashes Test

England win toss, bat in first Ashes Test

-

Teen saving India's ponds says everyone can be a leader

-

Frida Kahlo painting auctions for $54.6 mn, record for woman artist

Frida Kahlo painting auctions for $54.6 mn, record for woman artist

-

Arsenal brace for Spurs clash without Gabriel, Man City in pursuit

-

Scramble for Sudan's resources fuels brutal civil war

Scramble for Sudan's resources fuels brutal civil war

-

Livestream giant Twitch to ban under-16s in Australia

-

Ukraine would cede Donbas to Russia under 28-point US plan

Ukraine would cede Donbas to Russia under 28-point US plan

-

Spain and Germany reach Davis Cup semi-finals

-

'Black Panther' star Chadwick Boseman gets Hollywood star

'Black Panther' star Chadwick Boseman gets Hollywood star

-

Trump plans massive expansion of offshore oil drilling

-

South Korean Lee So-mi grabs LPGA Tour Championship lead

South Korean Lee So-mi grabs LPGA Tour Championship lead

-

Fire breaks out at UN climate talks, forcing delay at critical phase

-

Carpenter strikes for Chelsea but Barca hold on for draw in Women's Champions League

Carpenter strikes for Chelsea but Barca hold on for draw in Women's Champions League

-

Rams-Bucs and Steelers-Bears match NFL division leaders

-

ExxonMobil relaunches natural gas project in Mozambique

ExxonMobil relaunches natural gas project in Mozambique

-

Colombia's Petro in hot water as records reveal Lisbon strip club visit

-

Stocks lose steam on AI concerns as jobs data cloud rate cut hopes

Stocks lose steam on AI concerns as jobs data cloud rate cut hopes

-

Messi's Inter to open Miami stadium in April against Austin

-

US health agency edits website to reflect anti-vax views

US health agency edits website to reflect anti-vax views

-

US denies ending South Africa G20 boycott

-

Iniesta's company rebranding Israel Premier Tech cycling team

Iniesta's company rebranding Israel Premier Tech cycling team

-

US plan 'good' for Russia, Ukraine: White House

-

Piastri ready to forget struggles and enjoy Vegas GP

Piastri ready to forget struggles and enjoy Vegas GP

-

US peace plan 'good' for Russia, Ukraine: White House

-

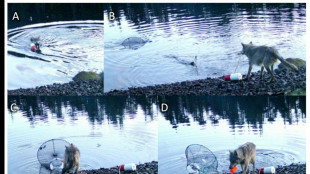

Researchers stunned by wolf's use of crab traps to feed

Researchers stunned by wolf's use of crab traps to feed

-

Colombia shows first treasures recovered from 300-year-old shipwreck

-

England's Daly ready for aerial challenge against Argentina

England's Daly ready for aerial challenge against Argentina

-

Covid inquiry finds UK inaction cost thousands of lives

-

Italy probes Tod's executives over labour exploitation

Italy probes Tod's executives over labour exploitation

-

Trump floats death penalty for 'seditious' Democrats

-

Fire forces evacuation at UN climate talks

Fire forces evacuation at UN climate talks

-

South Africa says US asks to join G20 summit, ending boycott

-

Montpellier deny 'racism' allegations in Fowler's book

Montpellier deny 'racism' allegations in Fowler's book

-

UK Covid inquiry says thousands of lives could have been saved

Tech firms lead Asian stock rout as AI bubble fears linger

Tech firms led more steep losses across Asian markets Friday as investors struggled to shake off fears about an AI bubble and after a sell-off on Wall Street sparked by jobs data dealt a further blow to hopes for a US interest rate cut.

A blockbuster earnings report from chip bellwether Nvidia on Wednesday seemed to settle nerves that vast investments in the artificial intelligence sector may have been overdone.

But the euphoria was short-lived as warnings grow that the tech-led rally across equities -- which has seen several markets hit records and companies clock eye-watering capitalisations -- may have run its course, and a correction could be in hand.

In unveiling Nvidia's forecast-topping report, boss Jensen Huang dismissed fears of a bubble that has caused global equities to wobble.

"From our vantage point, we see something very different," he said.

After his firm sparked an Asia rally on Thursday, Wall Street began on a strong note, but later went into sharp reverse, with selling compounded by worries over the US labour market.

Data showed that while more jobs were created in September, the unemployment rate crept higher.

The reading did little to alter investors' belief that the Federal Reserve will stand pat on borrowing costs when it meets next month, with officials more focused on stubbornly high inflation.

Expectations had already been dampened by recent comments from decision-makers, including boss Jerome Powell, that were on the hawkish side.

Tracking New York, Asian markets were a sea of red, with tech giants leading the way.

Seoul-listed Samsung Electronics sank nearly five percent and rival SK hynix more than nine percent -- the firms are two of the world's leading memory chip makers.

Another chip titan, TSMC, tanked nearly four percent in Taiwan, while Japan's SoftBank plunged more than 10 percent in Tokyo.

That led broader markets lower.

Tokyo, Hong Kong, Seoul, Sydney and Taipei were all down between 1.6 percent and 3.2 percent. There were also losses in Shanghai, Singapore and Wellington.

The rush from risk assets also saw bitcoin fall below the $93,000 mark for the first time since April, extending a sell-off suffered since its record high above $126,200 touched just last month.

"The price action across markets has been prolific, and we've seen some truly impressive reversals in risk assets," said Chris Weston at Pepperstone.

"Sentiment in so many markets remains highly challenged, and we've seen new evidence that managers are dumping their 2025 winners -- raising expectations that the path of least resistance is for risk to trade lower in the near-term.

"The market seems far more sensitive and ready to de-risk on emerging news, almost seeking reasons to take positioning down when that news could easily be seen as a positive in a more bullish set-up."

Eyes are also on Tokyo, where there is talk that Japanese Prime Minister Sanae Takaichi will unveil a huge stimulus package worth around $130 billion to boost the stuttering economy.

But government bond yields have soared in recent days on warnings that the spending will likely need even more borrowing, fanning concerns about the country's fiscal state and putting huge pressure on the yen.

The Japanese currency has fallen this week to its lowest level against the dollar since January, though it got a little support from data showing core inflation ticked up last month, giving the Bank of Japan some room to hike interest rates.

- Key figures at around 0200 GMT -

Tokyo - Nikkei 225: DOWN 1.8 percent at 48,947.66

Hong Kong - Hang Seng Index: DOWN 1.7 percent at 25,393.93

Shanghai - Composite: DOWN 1.0 percent at 3,892.76

Dollar/yen: DOWN at 157.38 yen from 157.55 yen on Thursday

Euro/dollar: UP at $1.1535 from $1.1525

Pound/dollar: UP at $1.3083 from $1.3070

Euro/pound: DOWN at 88.15 from 88.18 pence

West Texas Intermediate: DOWN 1.1 percent at $58.36 per barrel

Brent North Sea Crude: DOWN 1.0 percent at $62.73 per barrel

New York - Dow: DOWN 0.8 percent at 45,752.26 (close)

London - FTSE 100: UP 0.2 percent at 9,527.65 (close)

A.Jones--AMWN