-

Irish captain Doris says 'a lot on the line' in South Africa Test

Irish captain Doris says 'a lot on the line' in South Africa Test

-

Zelensky rebuffs US plan to end war, says won't 'betray' Ukraine

-

Tuipulotu keeps Scotland place as Townsend makes 14 changes for Tonga

Tuipulotu keeps Scotland place as Townsend makes 14 changes for Tonga

-

Spotlight on All Blacks coach Robertson ahead of Wales season-ender

-

Man Utd forward Sesko out 'for a few weeks'

Man Utd forward Sesko out 'for a few weeks'

-

Gabriel faces 'weeks' out of action in major blow for Arsenal

-

US stocks creep ahead after tech-fuelled Asia rout

US stocks creep ahead after tech-fuelled Asia rout

-

Arsenal defender Gabriel faces 'weeks' on sidelines

-

EU to seek more tariff exemptions during US commerce secretary visit

EU to seek more tariff exemptions during US commerce secretary visit

-

COP30 deal under threat as nations clash over fossil fuels

-

How US sanctions on Russia's Lukoil hit Bulgaria's largest refinery

How US sanctions on Russia's Lukoil hit Bulgaria's largest refinery

-

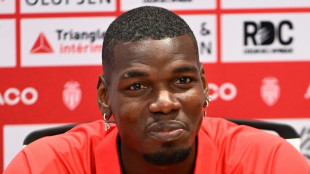

Pogba still 'has the qualities', says Monaco coach Pocognoli

-

Nations at odds over fossil fuels as COP30 draws to a close

Nations at odds over fossil fuels as COP30 draws to a close

-

European stocks fall after tech-fuelled Asia rout

-

Australia's seven-wicket hero Starc ready to go again

Australia's seven-wicket hero Starc ready to go again

-

Pupils, teachers kidnapped from Catholic school in central Nigeria

-

Guardiola says 'season starts now' as Man City hunt Arsenal

Guardiola says 'season starts now' as Man City hunt Arsenal

-

Mercedes chief Wolff sells part of team stake to US businessman

-

Ubisoft shares surge as trading resumes after results 'restatement'

Ubisoft shares surge as trading resumes after results 'restatement'

-

Olympic ski champion Gut-Behrami suffers knee injury

-

Ukraine cornered by US plan heeding Russian demands

Ukraine cornered by US plan heeding Russian demands

-

Europe increasingly 'vulnerable' to shocks: ECB chief

-

Slot says Liverpool will never use Jota grief as 'excuse' for poor form

Slot says Liverpool will never use Jota grief as 'excuse' for poor form

-

Aussie Wilson 'devastated' after Gordon ruled out of France Test

-

Ken Follett: 'There can't be boring bits in my books'

Ken Follett: 'There can't be boring bits in my books'

-

Wales rugby turmoil here to stay as nostalgia battles financial reality

-

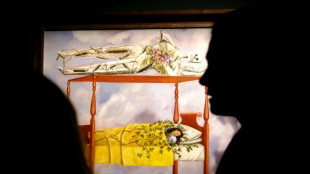

Frida Kahlo painting sells for $54.7 mn in record for female artist

Frida Kahlo painting sells for $54.7 mn in record for female artist

-

Thailand's last hunter-gatherers seek land rights

-

Tech firms lead stock rout as AI bubble fears linger

Tech firms lead stock rout as AI bubble fears linger

-

World's biggest nuclear plant edges closer to restart

-

India's injured Gill out of must-win second South Africa Test

India's injured Gill out of must-win second South Africa Test

-

Japan's eel delicacy faces global conservation pressure

-

Starc takes seven as England rolled for 172 in Ashes opener

Starc takes seven as England rolled for 172 in Ashes opener

-

New York's incoming leftist mayor to face off with Trump

-

Fossil fuel showdown looms on UN climate summit's final day

Fossil fuel showdown looms on UN climate summit's final day

-

Japan's Takaichi insists $135 bn stimulus fiscally 'responsible'

-

Norris tops red-flagged second practice for Las Vegas GP

Norris tops red-flagged second practice for Las Vegas GP

-

Miss Mexico wins Miss Universe contest after host insult drama

-

Texans sack Allen eight times to beat Bills 23-19

Texans sack Allen eight times to beat Bills 23-19

-

Rusty France face 'tired' Australia at end of torrid year

-

Dortmund host new nemesis Stuttgart with title hopes slipping away

Dortmund host new nemesis Stuttgart with title hopes slipping away

-

Munster tragedy 'life-changing' for Springbok coach Erasmus

-

Starc on fire as England slump to 105-4 at lunch in Ashes opener

Starc on fire as England slump to 105-4 at lunch in Ashes opener

-

Taiwan issues 'crisis' guide on preparing for disasters, Chinese attack

-

Washington's abandoned embassies have stories to tell

Washington's abandoned embassies have stories to tell

-

Maxey powers Sixers over Bucks as Spurs beat Hawks

-

Barca hoping Camp Nou return can spark Liga title defence

Barca hoping Camp Nou return can spark Liga title defence

-

All Blacks bid to bounce back for season-ender against struggling Wales

-

Pogba set for long-awaited comeback as Ligue 1 returns

Pogba set for long-awaited comeback as Ligue 1 returns

-

Inter and Milan in early Scudetto clash as Napoli attempt to bounce back

US stocks creep ahead after tech-fuelled Asia rout

US markets crept ahead in early trading while European counterparts marked time Friday in response to sharp losses in Asia at the end of a week which has seen heightened fears of a bursting AI bubble.

A blockbuster earnings report from chip bellwether Nvidia on Wednesday seemed to soothe concerns that vast investments in the artificial intelligence sector may have been overdone.

Those hopes were short-lived, with Nvidia itself losing 1.5 percent in early trading on Wall Street as warnings grew that the tech-led rally across equities -- which has seen several markets hit record highs and companies clock eye-watering capitalisations -- may have run its course.

Adding to unease was mixed US jobs data Thursday that added to expectations that the Federal Reserve could decide against cutting interest rates in December.

That unease spread to Asia, with Tokyo, Hong Kong and Shanghai all ending the week down almost 2.5 percent at the close.

The clouds began to clear to a degree, however, as the Dow, the tech-heavy Nasdaq and the broader-based S&P 500 rose around half of one percent minutes after business began in Wall Street.

In Europe, London and Frankfurt were marginally in the red two hours out from the close while Paris edged into the green, notably as Ubisoft provided a glimmer of light with a nine-percent rise.

The French video game company resumed trading on the Paris stock exchange, a week after stunning investors by postponing its results announcement without an explanation, triggering speculation in the video gaming world, including on a possible takeover operation in a consolidating industry.

The "Assassin's Creed" maker said Friday the move was due to a simple "restatement" of its half-yearly results after new auditors found problems with the way it had accounted for a partnership.

Ubisoft's stock rose 11.5 percent higher at 7.55 euros before dipping back to 7.29 euros -- though they remain some 40 percent lower than a year ago.

"European markets are showing their relative resilience" Friday compared to sharper falls on tech-heavy indices in Asia, noted Joshua Mahony, chief market analyst at trading group Scope Markets.

The rush from risk assets saw bitcoin hit a seven-month low at $81,569.79 -- extending a sell-off suffered since its record high above $126,200 last month.

"The price action across markets has been prolific, and we've seen some truly impressive reversals in risk assets," said analyst Chris Weston at broker Pepperstone.

"Sentiment in so many markets remains highly challenged, and we've seen new evidence that managers are dumping their 2025 winners -- raising expectations that the path of least resistance is for risk to trade lower in the near-term," he added.

On the currency markets, the yen held gains after Japanese Prime Minister Sanae Takaichi said her cabinet had approved a 21.3-trillion yen ($135-billion) stimulus package aimed at easing the pain of inflation on households and firms.

However, there are worries that the spending plan will add to Japan's already colossal debt and has pushed government bond yields to record highs, fanning concerns about the country's fiscal state.

The Japanese currency had fallen this week to the lowest level against the dollar since January.

- Key figures at around 1445 GMT -

New York - Dow: UP 0.4 percent at 45,933.13 points

New York - S&P 500: UP 0.5 percent at 6,569.39

New York - Nasdaq Composite: UP 0.5 percent at 22,197.08

London - FTSE 100: DOWN 0.1 percent at 9,513.45

Paris - CAC 40: UP 0.1 percent at 7,986.11

Frankfurt - DAX: DOWN 0.3 percent at 23,199.73

Tokyo - Nikkei 225: DOWN 2.4 percent at 48,625.88 (close)

Hong Kong - Hang Seng Index: DOWN 2.4 percent at 25,220.02 (close)

Shanghai - Composite: DOWN 2.5 percent at 3,834.89 (close)

Dollar/yen: DOWN at 156.88 yen from 157.55 yen on Thursday

Euro/dollar: DOWN at $1.1506 from $1.1525

Pound/dollar: DOWN at $1.3069 from $1.3070

Euro/pound: DOWN at 88.04 from 88.18 pence

Brent North Sea Crude: DOWN 1.6 percent at $62.38 per barrel

West Texas Intermediate: DOWN 1.9 percent at $57.89 per barrel

A.Rodriguezv--AMWN