-

How Australia plans to ban under-16s from social media

How Australia plans to ban under-16s from social media

-

Militaries come to aid of Asia flood victims as toll nears 1,000

-

'For him': Australia mum channels grief into social media limits

'For him': Australia mum channels grief into social media limits

-

Thunder down Blazers to avenge lone defeat of season

-

Asian markets mixed as traders eye US data ahead of Fed decision

Asian markets mixed as traders eye US data ahead of Fed decision

-

Migrant domestic workers seek support, solace after Hong Kong fire

-

Experts work on UN climate report amid US pushback

Experts work on UN climate report amid US pushback

-

Spain aim to turn 'suffering' to success in Nations League final second leg

-

Pope to urge unity, bring hope to Lebanese youth on day two of visit

Pope to urge unity, bring hope to Lebanese youth on day two of visit

-

Thousands march in Zagreb against far right

-

Trump confirms call with Maduro, Caracas slams US maneuvers

Trump confirms call with Maduro, Caracas slams US maneuvers

-

Young dazzles as Panthers upset Rams, Bills down Steelers

-

Arms makers see record revenues as tensions fuel demand: report

Arms makers see record revenues as tensions fuel demand: report

-

Trump optimistic after Ukraine talks as Rubio says 'more work' needed

-

Real Madrid title hopes dented at Girona in third straight draw

Real Madrid title hopes dented at Girona in third straight draw

-

Pau beat La Rochelle as Hastoy sent off after 34 seconds

-

Real Madrid drop points at Girona in third straight Liga draw

Real Madrid drop points at Girona in third straight Liga draw

-

Napoli beat rivals Roma to join Milan at Serie A summit

-

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

-

Disney's 'Zootopia 2' rules Thanksgiving at N. American box office

-

Arteta takes heart from Arsenal escape in Chelsea battle

Arteta takes heart from Arsenal escape in Chelsea battle

-

Duplantis and McLaughlin-Levrone crowned 'Athletes of the Year'

-

Rubio says 'more work' required after US-Ukraine talks in Florida

Rubio says 'more work' required after US-Ukraine talks in Florida

-

McLaren boss admits team made strategy blunder

-

West Ham's red-carded Paqueta slams FA for lack of support

West Ham's red-carded Paqueta slams FA for lack of support

-

Ramaphosa labels US attacks on S.Africa 'misinformation'

-

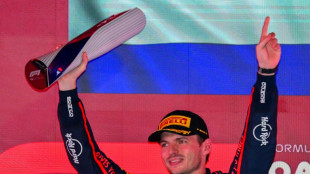

Relaxed Verstappen set for another title showdown

Relaxed Verstappen set for another title showdown

-

Van Graan compares Bath match-winner Arundell to Springbok great Habana

-

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

-

Slot hails 'important' Isak goal as Liverpool beat West Ham

-

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

-

Thauvin double sends Lens top of Ligue 1 for 1st time in 21 years

-

Pope urges Lebanese to embrace reconciliation, stay in crisis-hit country

Pope urges Lebanese to embrace reconciliation, stay in crisis-hit country

-

Arundell stars as Bath top Prem table with comeback win over Saracens

-

Villarreal edge Real Sociedad, Betis win fiery derby

Villarreal edge Real Sociedad, Betis win fiery derby

-

Israel's Netanyahu seeks pardon in corruption cases

-

Verstappen wins Qatar GP to set up final race title showdown

Verstappen wins Qatar GP to set up final race title showdown

-

Afghan suspect in Washington shooting likely radicalized in US: security official

-

Pastor, bride among 26 kidnapped as Nigeria reels from raids

Pastor, bride among 26 kidnapped as Nigeria reels from raids

-

Trump officials host crucial Ukraine talks in Florida

-

OPEC+ reaffirms planned pause on oil output hikes until March

OPEC+ reaffirms planned pause on oil output hikes until March

-

Kohli stars as India beat South Africa in first ODI

-

Long-lost Rubens 'masterpiece' sells for almost 3 mn euros

Long-lost Rubens 'masterpiece' sells for almost 3 mn euros

-

Set-piece theft pays off for Man Utd: Amorim

-

Isak scores first Premier League goal for Liverpool to sink West Ham

Isak scores first Premier League goal for Liverpool to sink West Ham

-

Death toll from Sri Lanka floods, landslides rises to 334: disaster agency

-

Martinez double at Pisa keeps Inter on heels of Serie A leaders AC Milan

Martinez double at Pisa keeps Inter on heels of Serie A leaders AC Milan

-

Swiss reject compulsory civic duty, climate tax for super-rich

-

Moleiro snatches Villarreal late winner at Real Sociedad

Moleiro snatches Villarreal late winner at Real Sociedad

-

Pope arrives in Lebanon with message of peace for crisis-hit country

European stocks steady as US shuts for Thanksgiving

European stock markets steadied Thursday after solid gains in Asia, as markets increasingly expect the US Federal Reserve to cut interest rates next month.

Wall Street was closed for the Thanksgiving holiday.

London dipped as markets digested the UK government's tax-raising budget unveiled Wednesday.

The measures reassured markets, with UK government bond yields and the pound steady.

Paris equities flattened and Frankfurt edged higher in midday deals.

"European markets are showing a distinct lack of direction... and traders shouldn't expect too much given a threadbare economic calendar and US Thanksgiving market closure," noted Joshua Mahony, chief market analyst at Scope Markets.

With recent worries over stretched valuations appearing to be on the back burner, sentiment has been lifted on trading floors this week, boosting riskier assets, including bitcoin.

The cryptocurrency, which recently plunged to a seven-month low just above $80,000 amid the recent market swoon, rose back above $90,000 on Thursday.

However, it is still off its record high above $126,200 touched in early October.

Comments from Fed officials and a string of weak US jobs reports have reinforced expectations that the central bank's next policy meeting in December will end with a third successive reduction in borrowing costs.

Markets are now pricing in around an 80-percent chance of a cut on December 10 and a further three next year. That compares with just three reductions in total that Bloomberg said had been previously expected.

All three main indices on Wall Street pushed higher for a fourth-straight day Wednesday ahead of the holiday.

Tokyo led the way in Asia on Thursday, climbing more than one percent, while Hong Kong and Shanghai closed higher.

On the downside, Tokyo-listed beer titan Asahi fell as it said it would delay its financial results owing to a cyberattack that began in September.

The maker of Asahi Super Dry, one of Japan's most popular beers, announced it was experiencing system troubles on September 29, stopping its ability to receive orders and to ship products. It blamed a ransomware attack.

Meanwhile, South Korea's biggest crypto exchange Upbit said it had suspended deposits and withdrawals following an unauthorised transfer of about $37 million of digital assets.

The announcement came as it emerged that its parent Dunamu would be bought by Naver Financial, one of the country's top tech giants, in a deal valued at more than $13 billion.

Upbit is the world's fourth-largest crypto exchange in terms of trading volume.

- Key figures at around 1100 GMT -

London - FTSE 100: DOWN 0.2 percent at 9,673.21 points

Paris - CAC 40: FLAT at 8,096.43

Frankfurt - DAX: UP 0.2 percent at 23,781.52

Tokyo - Nikkei 225: UP 1.2 percent at 50,167.10 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 25,945.93 (close)

Shanghai - Composite: UP 0.3 percent at 3,875.26 (close)

New York - Dow: UP 0.7 percent at 47,427.12 (close)

Euro/dollar: DOWN at $1.1588 from $1.1598 on Wednesday

Pound/dollar: DOWN at $1.3228 from $1.3239

Dollar/yen: DOWN at 156.27 yen from 156.42 yen

Euro/pound: UP at 87.61 pence from 87.60 pence

Brent North Sea Crude: DOWN 0.2 percent at $62.68 per barrel

West Texas Intermediate: DOWN 0.3 percent at $58.85 per barrel

H.E.Young--AMWN