-

Julio Iglesias, the Spanish crooner who won global audience

Julio Iglesias, the Spanish crooner who won global audience

-

'We can't make ends meet': civil servants protest in Ankara

-

UK prosecutors appeal Kneecap rapper terror charge dismissal

UK prosecutors appeal Kneecap rapper terror charge dismissal

-

UK police chief blames AI for error in evidence over Maccabi fan ban

-

Oil prices extend gains on Iran unrest

Oil prices extend gains on Iran unrest

-

France bans 10 UK far-right activists over anti-migrant actions

-

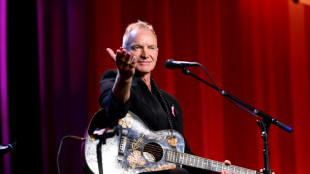

Every cent you take: Sting, ex-Police band mates in royalty battle

Every cent you take: Sting, ex-Police band mates in royalty battle

-

Thailand crane collapses onto train, killing 32

-

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

-

Italian influencer Ferragni awaits verdict in Christmas cake fraud trial

-

Louvre and other French museums fare hikes for non-European visitors

Louvre and other French museums fare hikes for non-European visitors

-

Japan's Takaichi to dissolve parliament for snap election

-

Dutch court hears battle over Nexperia

Dutch court hears battle over Nexperia

-

World-first ice archive to guard secrets of melting glaciers

-

Ted Huffman, the New Yorker aiming to update top French opera festival

Ted Huffman, the New Yorker aiming to update top French opera festival

-

Ofner celebrates early then loses in Australian Open qualifying

-

Singer Julio Iglesias accused of 'human trafficking' by former staff

Singer Julio Iglesias accused of 'human trafficking' by former staff

-

Luxury retailer Saks Global files for bankruptcy

-

Asian markets mostly up with politics bump for Tokyo

Asian markets mostly up with politics bump for Tokyo

-

China's trade surplus hit record $1.2 trillion in 2025

-

Trail goes cold in UK abandoned babies mystery

Trail goes cold in UK abandoned babies mystery

-

Japan's Takaichi set to call February snap election: media

-

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

-

From bricklayer to record-breaker: Brentford's Thiago eyes World Cup berth

-

Keys overcomes serve demons to win latest Australian Open warm-up

Keys overcomes serve demons to win latest Australian Open warm-up

-

As world burns, India's Amitav Ghosh writes for the future

-

Actor Kiefer Sutherland arrested for assaulting ride-share driver

Actor Kiefer Sutherland arrested for assaulting ride-share driver

-

Gilgeous-Alexander shines as Thunder halt Spurs losing streak

-

West Bank Bedouin community driven out by Israeli settler violence

West Bank Bedouin community driven out by Israeli settler violence

-

Asian markets mixed, Tokyo up on election speculation

-

US official says Venezuela freeing Americans in 'important step'

US official says Venezuela freeing Americans in 'important step'

-

2025 was third hottest year on record: EU, US experts

-

Japan, South Korea leaders drum up viral moment with K-pop jam

Japan, South Korea leaders drum up viral moment with K-pop jam

-

LA28 organizers promise 'affordable' Olympics tickets

-

Danish foreign minister heads to White House for high-stakes Greenland talks

Danish foreign minister heads to White House for high-stakes Greenland talks

-

US allows Nvidia to send advanced AI chips to China with restrictions

-

Sinner in way as Alcaraz targets career Grand Slam in Australia

Sinner in way as Alcaraz targets career Grand Slam in Australia

-

Rahm, Dechambeau, Smith snub PGA Tour offer to stay with LIV

-

K-pop heartthrobs BTS to begin world tour from April

K-pop heartthrobs BTS to begin world tour from April

-

Boeing annual orders top Airbus for first time since 2018

-

Nextech3D.ai's KraftyLab Accelerates Global Scale with Launch of In-Person Experiences and AI-Driven Platform Automation

Nextech3D.ai's KraftyLab Accelerates Global Scale with Launch of In-Person Experiences and AI-Driven Platform Automation

-

SLAM Cuts High Grade Gold & Silver in Channel Samples

-

Horizon Aircraft Provides Business Update and Second Quarter of Fiscal 2026 Results

Horizon Aircraft Provides Business Update and Second Quarter of Fiscal 2026 Results

-

Black Book's 2026 Physician Practice Management Solutions Report Quantifies Platform-Level Operational Performance Signals Across Ambulatory Care

-

International Star Inc. Appoints Buster Cox as Strategic Advisor for AI and Digital Asset Expansion

International Star Inc. Appoints Buster Cox as Strategic Advisor for AI and Digital Asset Expansion

-

Zomedica Announces "Fourth Friday at Four" Webinar on January 23rd Focused on Digital Innovation & Technology-Driven Growth

-

Jaguar Mining Inc. Reports Fourth Quarter and Full Year 2025 Operating Results

Jaguar Mining Inc. Reports Fourth Quarter and Full Year 2025 Operating Results

-

Sartorius Expands Bio-Circular Product Offering for More Sustainable Bioprocesses

-

Who Is the Best Facelift Surgeon in the U.S.?

Who Is the Best Facelift Surgeon in the U.S.?

-

Form 990 Reminder for Tax-Exempt Organizations as the Upcoming January 15 Deadline Approaches

Form 990 Reminder for Tax-Exempt Organizations as the Upcoming January 15 Deadline Approaches

Don't let the January 15th deadline stress you out! File Form 990 series, including amendments, and meet IRS requirements with Tax1099.

FAYETTEVILLE, AR, AND DALLAS, TX / ACCESS Newswire / January 14, 2026 / With the January 15, 2026 deadline approaching, Tax1099 is reminding tax-exempt organizations of the requirement to file Form 990 series returns on time to remain compliant with IRS regulations.

Submitting Form 990 on time helps organizations avoid losing their tax-exempt status. An organization can also get penalized if the form is not completed on time.

Form 990 Deadline: Which Nonprofits Must File by January 15, 2026?

Fiscal-Year Filers (Organizations with a September-August Fiscal Year)

Tax-exempt organizations operating on a fiscal year that starts on September 1, 2024, and ends on August 31, 2025, must file their Form 990 by January 15, 2026.

Extended Filers (Organizations Filing Under an Extension)

Organizations that have requested an extension using Form 8868 on July 15, 2025, also need to submit their completed Form 990 by January 15, 2026.

To support nonprofit organizations during this filing period, Tax1099 has expanded its IRS-authorized eFile platform to include Form 990 series filings, allowing nonprofits to securely prepare, validate, and submit required returns, including amended filings, through a streamlined digital process.

What's At Stake?

Timely, accurate Form 990 filings reinforce nonprofit credibility and transparency by showing the IRS how funds are used and whether they support the organization's mission. As a public document, Form 990 also gives donors, grant makers, and other stakeholders clear insight into an organization's financial health, leadership, and programs.

Failing to file Form 990 by the required deadline exposes nonprofits to avoidable compliance risks and IRS penalties, and missing filings for three consecutive years can trigger automatic revocation of tax-exempt status. Consistently filing on time also signals strong financial stewardship and organizational accountability.

Tips for a Smooth 990 Filing Process

In order to avoid any last-minute filing stress and reduce their risk of errors, tax-exempt organizations are encouraged to plan ahead and use an IRS-authorized e-filing platform like Tax1099.

"Filing delays usually happen because organizations underestimate the time and coordination involved," said Ed Pratt, COO & co-founder of Tax1099. "Tax1099 helps nonprofits stay ahead of deadlines with tools like automated deadline alerts, error checks before submission, secure document storage, and confirmation that filings have been accepted by the IRS."

Tax1099 offers an IRS-authorized e-filing platform for the full Form 990 series, including Forms 990, 990-EZ, 990-N, 990-PF, and Form 990-T. The platform provides step-by-step, guided filing to help organizations complete required sections and select the correct form based on their filing requirements.

Built-in data validation, including TIN checks and error checks, helps identify missing or incorrect information before submission. The platform also offers real-time updates on filing status and corrections. If a return is rejected, corrections can be made and retransmitted without additional filing fees.

Additional features such as secure document storage, automated deadline reminders, and multi-user access help organizations stay organized and prepared. Together, these features help tax-exempt organizations file with confidence and maintain compliance while meeting deadlines with less effort.

About Zenwork Tax1099

Tax1099, an IRS-authorized e-filing service, simplifies tax compliance for over 750,000 businesses and 70,000 CPA firms nationwide. Supporting 40+ federal and state-compliant forms, including Form 941, Tax1099 offers robust features like bulk filing, TIN matching, API integration, and 24/7 support. Backed by over 10 years of experience in tax processing and customer service, the platform offers a suite of capabilities to suit diverse needs. Learn more at www.tax1099.com

About Zenwork Inc.

Zenwork Inc., the parent company of Tax1099, is a leader in digital tax compliance and regulatory reporting. The company leverages automation to revolutionize business tax compliance, providing a modern SaaS and API platform that adapts to evolving regulatory reporting requirements, risk mitigation, and compliance needs.

Learn more about Zenwork and its products at www.zenwork.com, www.tax1099.com, and www.compliancely.com

Contact : Ed Pratt

Zenwork Inc.

[email protected]

SOURCE: ZENWORK INC

View the original press release on ACCESS Newswire

F.Bennett--AMWN