-

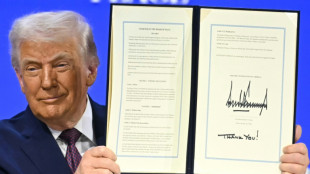

TikTok in the US goes American, but questions remain

TikTok in the US goes American, but questions remain

-

France probes deaths of two babies after powdered milk recall

-

Across the globe, views vary about Trump's world vision

Across the globe, views vary about Trump's world vision

-

UN rights council decries 'unprecedented' crackdown in Iran, deepens scrutiny

-

Suryakumar, Kishan star as India thrash New Zealand in second T20

Suryakumar, Kishan star as India thrash New Zealand in second T20

-

Gold nears $5,000, silver shines as stocks slip on turbulent week

-

Spanish prosecutors dismiss sex abuse case against Julio Iglesias

Spanish prosecutors dismiss sex abuse case against Julio Iglesias

-

Suspected Russia 'shadow fleet' tanker bound for French port

-

UK PM slams Trump for saying NATO troops avoided Afghan front line

UK PM slams Trump for saying NATO troops avoided Afghan front line

-

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

-

Ex-Canadian Olympian turned drug lord arrested: FBI chief

Ex-Canadian Olympian turned drug lord arrested: FBI chief

-

Snow and ice storm set to sweep US

-

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

-

Ukraine-Russia-US talks open in Abu Dhabi as Moscow demands Donbas region

-

Ferrari unveil 2026 car with Hamilton ready for 'massive challenge'

Ferrari unveil 2026 car with Hamilton ready for 'massive challenge'

-

Welsh full-back Williams retires from international rugby

-

Gold nears $5,000, global stocks muted ending turbulent week

Gold nears $5,000, global stocks muted ending turbulent week

-

Ex-Canadian Olympian turned drug lord arrested: US media

-

A look back at Ukraine war talks

A look back at Ukraine war talks

-

France trolls US, Russia misinformation on X

-

Carrick keen for Man Utd to build around 'quality' Mainoo

Carrick keen for Man Utd to build around 'quality' Mainoo

-

Danish PM visits Greenland for talks after Trump climbdown

-

Reed seizes halfway lead at Dubai Desert Classic

Reed seizes halfway lead at Dubai Desert Classic

-

UN expert urges world to reject Myanmar 'sham' election

-

Sarajevo reels under 'extreme' pollution, alert issued

Sarajevo reels under 'extreme' pollution, alert issued

-

Williams to miss opening F1 test due to car delays

-

Ski chief confident of Olympic preparations

Ski chief confident of Olympic preparations

-

Man City chasing 'world's best' in Arsenal, says Guardiola

-

Outrage after Trump claims NATO troops avoided Afghan front line

Outrage after Trump claims NATO troops avoided Afghan front line

-

German auto supplier ZF axes electric projects as demand stalls

-

ECB chief thanks Davos 'euro-bashers' as welcome wake-up call

ECB chief thanks Davos 'euro-bashers' as welcome wake-up call

-

UK woman felt 'violated, assaulted' by deepfake Grok images

-

France PM survives no-confidence vote over forced budget

France PM survives no-confidence vote over forced budget

-

McCall to step down after 15 years as director of rugby at Saracens

-

Volatile security blocks UN from Syria IS-linked camp

Volatile security blocks UN from Syria IS-linked camp

-

Odermatt retains Kitzbuehel super-G in Olympic broadside

-

Did Trump make Davos great again?

Did Trump make Davos great again?

-

Fisilau among new faces in England Six Nations squad

-

Long-awaited first snowfall brings relief to water-scarce Kabul

Long-awaited first snowfall brings relief to water-scarce Kabul

-

Danish, Greenland PMs to meet after Trump climbdown

-

Gold nears $5,000, stocks muted after turbulent week

Gold nears $5,000, stocks muted after turbulent week

-

Liverpool on the up as new signings hit form, says Slot

-

Stars turn out for Valentino's funeral in Rome

Stars turn out for Valentino's funeral in Rome

-

Israeli Bedouin say hope for better life crushed after deadly crackdown

-

Russia demands Ukraine's Donbas region ahead of Abu Dhabi talks

Russia demands Ukraine's Donbas region ahead of Abu Dhabi talks

-

Iran lambasts Zelensky after Davos 'bully' warning

-

Gauff hopes to copy 'insane' Osaka fashion statement, but not yet

Gauff hopes to copy 'insane' Osaka fashion statement, but not yet

-

Australian Open to start earlier Saturday over forecast 40C heat

-

Alcaraz warns he's getting 'better and better' at Australian Open

Alcaraz warns he's getting 'better and better' at Australian Open

-

Vietnam's To Lam 'unanimously' re-elected party chief

Gold nears $5,000, silver shines as stocks slip on turbulent week

Global stocks were subdued and precious metals hit fresh highs Friday after a turbulent week that saw US President Donald Trump back down from threats to seize Greenland and hit European allies with fresh tariffs.

Gold -- a safe-haven asset -- pushed closer to a record $5,000 an ounce despite "a calmer end to a chaotic week on the markets", said Dan Coatsworth, head of markets at AJ Bell.

Fellow safe haven silver also continued its rise, blasting through $101 an ounce amid worries over what Trump may say, or actually do, next.

"Gold nudged ahead... as investors were reluctant to let go of their safety blanket, just in case Donald Trump woke up with another controversial idea," said Coatsworth.

Sentiment has calmed over the past two days after the US president pulled back from his threat to hit several European nations with levies because of their opposition to Washington taking over the Danish autonomous territory.

European markets sought direction in vain, Frankfurt closing just in the green as London and Paris fell the red side of the line at the end of the week.

Wall Street was a similar picture, with the Dow losing 0.6 percent around two hours into trading although the broader-based S&P and the tech-heavy Nasdaq were just in positive territory.

Intel plunged 16 percent after lacklustre expectations on the chip maker's earnings.

Asian markets closed higher.

- Powell under pressure -

Trump's latest salvo against allies revived trade war fears and uncertainty about US investment, putting downward pressure on the dollar this week.

Analysts said there was no guarantee that Europe-US relations had improved durably.

The US president's willingness to threaten tariffs over any issue had rattled confidence on trading floors, boosting safe-haven metals, analysts said.

Investors were also preparing for next week's Federal Reserve meeting following economic data broadly in line with forecasts and after US prosecutors took aim at boss Jerome Powell, which has raised fears over the bank's independence.

The bank is tipped to hold interest rates, having cut them in the previous three meetings.

The meeting also comes as Trump considers candidates to replace Powell when the Fed chair's term comes to an end in May.

The Bank of Japan left its key interest rate unchanged ahead of the country's snap election next week, which could impact government spending plans.

After sharp volatility in the wake of the announcement, the yen traded slightly higher.

Next week's US earnings calendar is packed with results from Apple, Microsoft, Boeing, Tesla, Meta and other corporate giants.

- Key figures at around 1650 GMT -

New York - Dow: DOWN 0.6 percent at 49,114.15 points

New York - S&P 500: UP 0.2 percent at 6,917.18

New York - NASDAQ: UP 0.4 percent at 23,531.81

London - FTSE 100: DOWN 0.1 percent at 10,143.44 (close)

Paris - CAC 40: DOWN 0.1 percent at 8,143.05 (close)

Frankfurt - DAX: UP 0.2 percent at 24,900.71 (close)

Tokyo - Nikkei 225: UP 0.3 percent at 53,846.87 (close)

Hong Kong - Hang Seng Index: UP 0.5 percent at 26,749.51 (close)

Shanghai - Composite: UP 0.3 percent at 4,136.16 (close)

Euro/dollar: UP at $1.1774 from $1.1751 on Thursday

Pound/dollar: UP at $1.3593 from $1.3500

Dollar/yen: DOWN at 157.52 yen from 158.39 yen

Euro/pound: DOWN at 86.63 pence from 87.05 pence

West Texas Intermediate: UP 2.8 percent at $61.02 per barrel

Brent North Sea Crude: UP 2.7 percent at $65.80 per barrel

Y.Aukaiv--AMWN