-

Bridgeman powers to six-shot lead over McIlroy at Riviera

Bridgeman powers to six-shot lead over McIlroy at Riviera

-

Artist creates 'Latin American Mona Lisa' with plastic bottle caps

-

Malinin highlights mental health as Shaidorov wears panda suit at Olympic skating gala

Malinin highlights mental health as Shaidorov wears panda suit at Olympic skating gala

-

Timberwolves center Gobert suspended after another flagrant foul

-

Guardiola hails Man City's 'massive' win over Newcastle

Guardiola hails Man City's 'massive' win over Newcastle

-

PSG win to reclaim Ligue 1 lead after Lens lose to Monaco

-

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

-

Man City close gap on Arsenal after O'Reilly sinks Newcastle

-

Finland down Slovakia to claim bronze in men's ice hockey

Finland down Slovakia to claim bronze in men's ice hockey

-

More than 1,500 request amnesty under new Venezuela law

-

US salsa legend Willie Colon dead at 75

US salsa legend Willie Colon dead at 75

-

Canada beat Britain to win fourth Olympic men's curling gold

-

Fly-half Jalibert ruled out of France side to face Italy

Fly-half Jalibert ruled out of France side to face Italy

-

Russell restart try 'big moment' in Scotland win, says Townsend

-

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

-

Liga leaders Real Madrid stung by late Osasuna winner

-

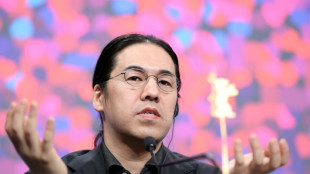

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

-

England's Genge says thumping Six Nations loss to Ireland exposes 'scar tissue'

-

Thousands march in France for slain far-right activist

Thousands march in France for slain far-right activist

-

Imperious Alcaraz storms to Qatar Open title

-

Klaebo makes Olympic history as Gu forced to wait

Klaebo makes Olympic history as Gu forced to wait

-

Late Scotland try breaks Welsh hearts in Six Nations

-

Lens lose, giving PSG chance to reclaim Ligue 1 lead

Lens lose, giving PSG chance to reclaim Ligue 1 lead

-

FIFA's Gaza support 'in keeping' with international federation - IOC

-

First all-Pakistani production makes history at Berlin film fest

First all-Pakistani production makes history at Berlin film fest

-

Gu forced to wait as heavy snow postpones Olympic halfpipe final

-

NASA chief rules out March launch of Moon mission over technical issues

NASA chief rules out March launch of Moon mission over technical issues

-

Dutch double as Bergsma and Groenewoud win Olympic speed skating gold

-

At least three dead as migrant boat capsizes off Greek island

At least three dead as migrant boat capsizes off Greek island

-

Struggling Juventus' woes deepen with home loss to Como

-

Chelsea, Aston Villa held in blow to Champions League hopes

Chelsea, Aston Villa held in blow to Champions League hopes

-

Thousands march in France for slain far-right activist under heavy security

-

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

-

Canada beat USA to take bronze in Olympic women's curling

-

Hunger and belief key to Ireland's win, says Sheehan

Hunger and belief key to Ireland's win, says Sheehan

-

Pegula sees off Svitolina to win Dubai WTA 1000 title

-

Trump hikes US global tariff rate to 15%

Trump hikes US global tariff rate to 15%

-

AI revolution looms over Berlin film fest

-

Gibson-Park guides Ireland to record-breaking win in England

Gibson-Park guides Ireland to record-breaking win in England

-

Defence the priority for France against Italy, says Dupont

-

Juventus end bad week with 2-0 loss against Como

Juventus end bad week with 2-0 loss against Como

-

Libya's Ramadan celebrations tempered by economic woes

-

Norway's cross-country king Klaebo wins sixth gold of Milan-Cortina Winter Olympics

Norway's cross-country king Klaebo wins sixth gold of Milan-Cortina Winter Olympics

-

Iranian students chant anti-government slogans, as US threats loom

-

Hezbollah vows resistance after deadly Israeli strike

Hezbollah vows resistance after deadly Israeli strike

-

'Stormy seas' of Gaza row overshadow Berlin film fest finale

-

Pakistan-New Zealand Super Eights clash delayed by rain

Pakistan-New Zealand Super Eights clash delayed by rain

-

Werder Bremen cancel US tour citing 'political reasons'

-

South Africa's De Kock says handling pressure key in India clash

South Africa's De Kock says handling pressure key in India clash

-

French volunteer bakes for Ukraine amid frosts and power outages

Climate change risk stirs oil market

From forest fires to hurricanes and other natural disasters: climate change risk is increasingly influencing oil prices, just as the world is struggling to shift away from high-polluting fossil fuels.

Hurricane Beryl became the latest weather phenomenon to jangle market nerves, boosting crude prices as it passed through Texas earlier this month.

Texas accounts for some 42 percent of total US crude oil production, according to Energy Information Administration data. It also possesses the largest number of crude oil refineries among US states.

"Almost half of the total US petroleum refining capacity is located along the Gulf, with Texas accounting for one-third of total US refining capacity," Exinity analyst Han Tan told AFP.

And industry experts fear Beryl could herald a "super charged" hurricane season this year, according to Tan.

The World Meteorological Organization has warned that Beryl's early formation and swift intensification could foreshadow similarly severe storms in the future.

Earlier this year meanwhile, oil market sentiment was jarred in May as forest fires broke out in Canada.

Traders took flight as out-of-control wildfires threatened to spread to the crude-producing hub of Fort McMurray, the nation's largest oil sands mining facility.

- 'More visible and more extreme' -

Traders, more used to pricing in geopolitical turmoil, are now also weighing up the risks arising from the climate crisis.

"Climate change and its effect is a major source of risk in the oil markets, and I expect that that risk will only increase in the coming years as the effects of climate change become more visible and extreme," Rystad Energy analyst Jorge Leon told AFP.

"Geopolitical risk is –- at least partly -– manageable by different actors. For example, international diplomacy could prevent a war.

"However, climate risk is less manageable in the short and medium run. In the long run, you can manage it by trying to reduce emissions," he added.

At the same time, climate disruption is also having an increasingly visible impact on the operations of oil and gas companies, which are frequently slammed by environmentalists over their role in global warming.

"Climate change has been and will be affecting production," summarised Tamas Varga, analyst at PVM Oil Associates.

He added that it also impacted refinery utilisation rates because "hot weather leads to malfunctioning" of the facilities.

Many European refineries were designed in the 1960s and 1970s to withstand colder rather than warmer temperatures, according to Tan.

Fossil fuels -- coal, gas and oil -- are responsible for over 75 percent of global greenhouse gas emissions, according to estimates from the United Nations.

At the COP28 UN climate conference in Dubai last December, almost 200 countries agreed to a call for a transition away from fossil fuels and a tripling of renewable energy capacity this decade.

However, the text crucially stopped short of a direct call for phasing out fossil fuels, while there were major concessions to the oil and gas industry and producer countries.

- 'Economics can't find solution' -

Analysts argue that the oil market participants are simply focused on generating profit rather than saving the environment.

That throws the onus onto the world's politicians and regulators, they add.

"Investors can't be rationally expected to reverse the phenomenon when they try to maximise profits," SwissQuote analyst Ipek Ozkardeskaya told AFP.

"Unless financial costs of climate damages outweigh the financial benefits, the economics can't find the solution to the climate problem."

"So, the ball is in politicians' hands. Only concrete, sharp and worldwide regulatory changes with meaningful financial impact/incentives... could shift capital toward clean and sustainable energies."

D.Kaufman--AMWN