-

Messi kicks off MLS season in key World Cup year

Messi kicks off MLS season in key World Cup year

-

Teen burnout to Olympic gold: Alysa Liu 'looking to inspire others'

-

Cunningham stars as NBA-leading Pistons ease past Knicks

Cunningham stars as NBA-leading Pistons ease past Knicks

-

Andre Gomes joins MLS side Columbus Crew

-

Scottish inconsistency 'bugs everyone' says former international Beattie

Scottish inconsistency 'bugs everyone' says former international Beattie

-

England turn to Pollock for Six Nations boost against Ireland

-

Arsenal aim to banish title jitters in Spurs showdown

Arsenal aim to banish title jitters in Spurs showdown

-

Scrutiny on Flick rises as Barca seek recovery

-

Leipzig host red-hot Dortmund with Champions League hopes slipping away

Leipzig host red-hot Dortmund with Champions League hopes slipping away

-

Nvidia nears deal for scaled-down investment in OpenAI: report

-

Japan inflation eases in welcome news for PM Takaichi

Japan inflation eases in welcome news for PM Takaichi

-

McIlroy shares Riviera clubhouse lead as Rai charges, Scheffler fades

-

Philippines' Duterte earned global infamy, praise at home

Philippines' Duterte earned global infamy, praise at home

-

Stocks drop, oil rises after Trump Iran threat

-

As European heads roll from Epstein links, US fallout muted

As European heads roll from Epstein links, US fallout muted

-

Families of Duterte's drug war victims eye Hague hearing hopefully

-

Russian decision is a betrayal: Ukrainian Paralympics chief

Russian decision is a betrayal: Ukrainian Paralympics chief

-

Venezuela parliament unanimously approves amnesty law

-

Martinez missing as Inter limp to Lecce after Bodo/Glimt humbling

Martinez missing as Inter limp to Lecce after Bodo/Glimt humbling

-

India chases 'DeepSeek moment' with homegrown AI models

-

World leaders to declare shared stance on AI at India summit

World leaders to declare shared stance on AI at India summit

-

'Everything was removed': Gambians share pain with FGM ban in balance

-

Kim Jong Un opens rare party congress in North Korea

Kim Jong Un opens rare party congress in North Korea

-

Ex-Philippine leader Duterte faces pre-trial ICC hearing

-

Japanese star Sakamoto 'frustrated' at missing Olympic skating gold

Japanese star Sakamoto 'frustrated' at missing Olympic skating gold

-

Japan inflation eases in welcome news for Takaichi

-

FIFA to lead $75m Palestinian soccer rebuilding fund

FIFA to lead $75m Palestinian soccer rebuilding fund

-

Chicago Bears take key step in proposed Indiana stadium move

-

Liu captures Olympic figure skating gold as US seal hockey glory

Liu captures Olympic figure skating gold as US seal hockey glory

-

North Korea opens key party congress

-

Los Angeles sues Roblox over child exploitation claim

Los Angeles sues Roblox over child exploitation claim

-

Golden Liu puts US women back on top of Olympic women's figure skating

-

Hodgkinson sets women's 800m world indoor record

Hodgkinson sets women's 800m world indoor record

-

USA's Alysa Liu wins Olympic women's figure skating gold

-

Man Utd cruise into Women's Champions League quarters

Man Utd cruise into Women's Champions League quarters

-

Gu reaches Olympic halfpipe final after horror crash mars qualifiers

-

Keller overtime strike gives USA Olympic women's ice hockey gold

Keller overtime strike gives USA Olympic women's ice hockey gold

-

NASA delivers harsh assessment of botched Boeing Starliner test flight

-

US Fed Governor Miran scales back call for rate cuts this year

US Fed Governor Miran scales back call for rate cuts this year

-

Gu qualifies for Olympic halfpipe final marred by horror crash

-

Trump issues Iran with ultimatum as US ramps up military presence

Trump issues Iran with ultimatum as US ramps up military presence

-

Peru's brand-new president under fire for child sex comments

-

UK police hold ex-prince Andrew for hours in unprecedented blow

UK police hold ex-prince Andrew for hours in unprecedented blow

-

Former Olympic freeski halfpipe champion Sharpe crashes heavily

-

Former Olympic champion Sharpe suffers heavy halfpipe crash

Former Olympic champion Sharpe suffers heavy halfpipe crash

-

Belarus says US failed to issue visas for 'Board of Peace' meeting

-

Forest boss Pereira makes perfect start with Fenerbahce rout in Europa play-offs

Forest boss Pereira makes perfect start with Fenerbahce rout in Europa play-offs

-

Alcaraz fights back to book last four berth in Qatar

-

England captain Itoje warns of 'corrosive' social media after abuse of Ireland's Edogbo

England captain Itoje warns of 'corrosive' social media after abuse of Ireland's Edogbo

-

War-weary Sudanese celebrate as Ramadan returns to Khartoum

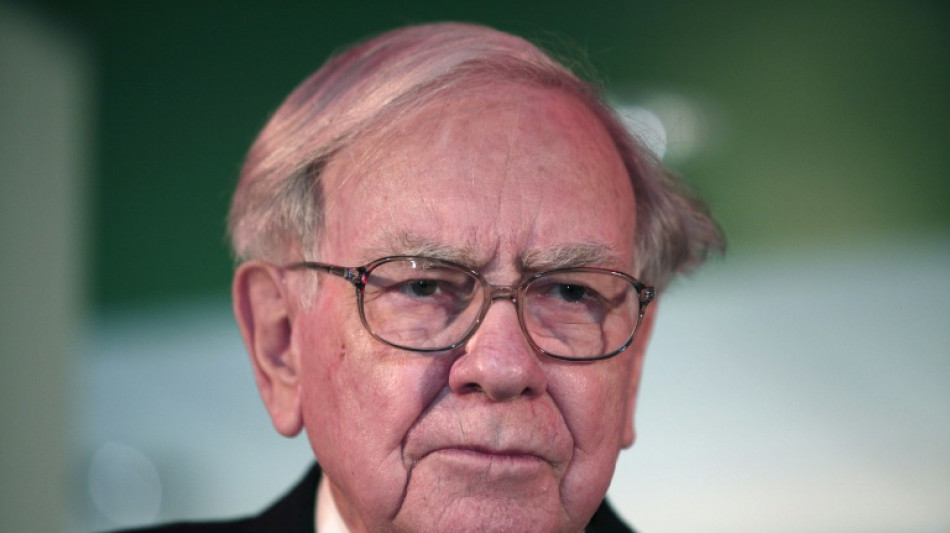

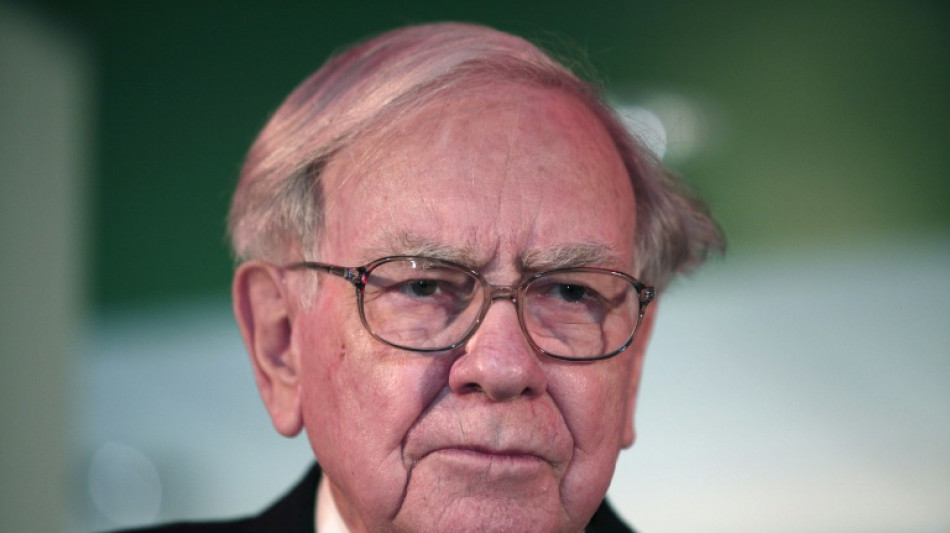

Chinese electric carmaker BYD plummets after Buffett sale

Shares in Chinese electric carmaker BYD plunged on Wednesday after its largest backer, Warren Buffett's Berkshire Hathaway, reduced its stake amid speculation of a potential exit.

Hong Kong-listed shares of the EV manufacturer fell by as much as 13 percent, a day after a regulatory filing showed Berkshire reducing its holdings from 20.04 percent to 19.92 percent.

It ended the day 7.9 percent lower, while its Shenzhen-listed stock finished 7.4 percent down.

The sale of around 1.33 million securities was valued at approximately $47 million.

Electronic carmakers in China were left scrambling after the government response to coronavirus outbreaks this year disrupted supply chains, with plants across the country suspending production for weeks.

While the Shenzhen-based firm reported strong earnings this week, rumours have swelled that the legendary American investor behind Berkshire may be looking to offload his entire stake.

Berkshire first bought 225 million BYD shares in 2008 and has been the biggest stakeholder in the company, now China's largest EV manufacturer and a major rival to Tesla.

Berkshire sold around 6.3 million shares in BYD between June 30 and August 24, Bloomberg News reported, citing filings from both companies.

BYD told Chinese media that there was "no need to over-interpret" the stake sale, adding that the company was operating normally and had no major moves to disclose.

On Monday, the Shenzhen-based company reported that net income had tripled to 3.6 billion yuan ($521 million) from a year earlier, overcoming supply chain disruptions caused by the pandemic and China's economic slowdown.

BYD said in a filing that it achieved record output and sales in the first half, with revenue jumping 66 percent year-on-year to 151 billion yuan.

The carmaker added that it was leading the domestic new energy vehicle sector with 24.7 percent market share in the first six months, citing data from the China Automobile Association.

"Investors could interpret this as the beginning of Berkshire closing its position in BYD," Bridget McCarthy, a market research analyst at hedge fund Snow Bull Capital, told Bloomberg.

"I would expect arguably one of the world's greatest investors to take some profits after over a decade, especially on his highest-returning investment, percentage-wise."

Some analysts have argued that BYD's strong fundamentals, coupled with Beijing's push to develop its domestic green energy sector, means the company still has room to grow.

"Despite the short term share price struggle, there is value to invest in the company with its solid business model in the medium to long term," Andy Wong, fund manager at LW Asset Management Advisors in Hong Kong, said.

Last month, a stake identical to the size of Berkshire's holdings was entered into Hong Kong's Central Clearing and Settlement System.

Hong Kong requires anyone who owns more than five percent of a listed company to notify the stock exchange when initiating a trade that changes the stake percentage into the next whole number.

F.Schneider--AMWN