-

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Security beefed up for Ashes Adelaide Test after Bondi shooting

Security beefed up for Ashes Adelaide Test after Bondi shooting

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

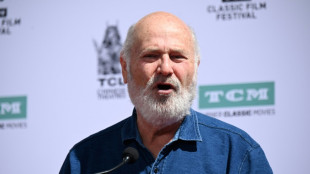

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

US Fed will likely cut again despite economic murkiness from shutdown

The Federal Reserve is expected to announce its second rate cut of the year on Wednesday, despite a lack of clarity over the health of the US economy due to the ongoing government shutdown.

The US central bank's second-to-last rate meeting of the year is taking place against the backdrop of a weeks-long standoff between Republicans and Democrats over healthcare subsidies, resulting in the ceased publication of almost all official data.

Without these key insights into the US economy, Fed officials will be forced to set interest rates without the full spectrum of data they normally rely upon.

Analysts and traders expect the bank will plough ahead with a quarter percentage-point cut, lowering its key lending rate to between 3.75 percent and 4.00 percent, without giving too much away about the final rate cut of the year in December.

The lack of official information complicates the ongoing debate at the Fed over whether to cut rates swiftly in order to support the weakening labor market, or to stand firm in the face of inflation which remains stuck stubbornly above the bank's long-term target of two percent, fueled by Donald Trump's sweeping tariffs on top trading partners.

The US central bank has a dual mandate from Congress to act independently to tackle both inflation and unemployment, which it does by raising, holding, or cutting its benchmark lending rate.

"They'll have to decide how much (inflation) is still to come versus how much is just never going to come, and that's the big question right now," former Fed official Joseph Gagnon told AFP.

The argument has been that "the strength and inflation is only temporary...but the the weakness of unemployment might be more long lasting," he said.

"In my view, that argument is going to continue to hold sway this month, because the data are still in that direction," added Gagnon, who is a senior fellow at the Peterson Institute for International Economics (PIIE).

- 'Blunt tool' -

The only major data point to be published since the shutdown began on October 1 was the US consumer inflation data, which came in hot at 3.0 percent in the 12 months to September, according to delayed Labor Department data published on Friday.

But the figure came in slightly below expectations, cheering the financial markets, which closed at fresh records on the news.

The Fed uses a different measure to gauge inflation, but that guideline also remains stuck well above target, according to data published before the shutdown.

On the other side of the mandate, employment has slowed sharply in recent months, with just 22,000 jobs created in August, even as the unemployment rate hugged close to historic lows at 4.3 percent.

"The goal is to get it just right, and that's a hard thing to do with such a blunt tool," KPMG chief economist Diane Swonk told AFP, referring to the Fed's key interest rate.

Swonk expects the Fed to cut twice more this year, and to announce an end to its program of shrinking its balance sheet next week -- known as quantitative tightening -- in the face of rising liquidity risks.

- Fed under political pressure -

The Fed has been rocked this year by relentless attacks on personnel directed from the White House, with Trump often taking to his Truth Social network to criticize Fed chair Jerome Powell, who steps down next year.

The Trump administration has also gone after Fed governor Lisa Cook, attempting to remove her from her post on accusations of mortgage fraud.

Cook fought back against the legal challenge to remove her, with the case going all the way up to the US Supreme Court, which has said it will hear the arguments against her in January next year.

The timing of that decision means the Supreme Court is unlikely to rule on whether Cook can remain in her post before the end of February, the deadline for when the US central bank's board must decide whether to reappoint regional Fed presidents -- a process that only happens once every five years.

"It seems like the odds that he could do this maneuver are greatly diminished," said Gagnon from PIIE.

D.Sawyer--AMWN