-

California investigating Grok AI over lewd fake images

California investigating Grok AI over lewd fake images

-

Wales's Faletau set to miss bulk of Six Nations

-

England sweating on Fin Smith's fitness for Six Nations opener

England sweating on Fin Smith's fitness for Six Nations opener

-

NASA acknowledges record heat but avoids referencing climate change

-

England rugby league coach Wane quits role

England rugby league coach Wane quits role

-

Oil prices extend gains on Iran worries

-

European basketball pioneer Schrempf lauds 'global' NBA

European basketball pioneer Schrempf lauds 'global' NBA

-

Denmark, Greenland in crunch White House talks as Trump ups pressure

-

Mitchell hits ton as New Zealand down India to level ODI series

Mitchell hits ton as New Zealand down India to level ODI series

-

Syrian army tells civilians to stay away from Kurdish positions east of Aleppo

-

Spurs sign England midfielder Gallagher from Atletico Madrid

Spurs sign England midfielder Gallagher from Atletico Madrid

-

Russian captain tried to avoid North Sea crash: court

-

Battle over Chinese-owned chipmaker Nexperia rages in Dutch court

Battle over Chinese-owned chipmaker Nexperia rages in Dutch court

-

Transatlantic ties 'disintegrating': German vice chancellor

-

Five problems facing Ukraine's new defence chief

Five problems facing Ukraine's new defence chief

-

Italian influencer Ferragni acquitted in Christmas cake fraud trial

-

Ryanair hits out at 'stupid' Belgium over aviation taxes

Ryanair hits out at 'stupid' Belgium over aviation taxes

-

Burkina Faso sack coach Traore after AFCON exit

-

African manufacturers welcome US trade deal, call to finalise it

African manufacturers welcome US trade deal, call to finalise it

-

What happens when fire ignites in space? 'A ball of flame'

-

Death of author's baby son puts Nigerian healthcare in spotlight

Death of author's baby son puts Nigerian healthcare in spotlight

-

France bans 10 British anti-migrant activists

-

2025 was third hottest year on record: climate monitors

2025 was third hottest year on record: climate monitors

-

Hydrogen planes 'more for the 22nd century': France's Safran

-

Julio Iglesias, the Spanish crooner who won global audience

Julio Iglesias, the Spanish crooner who won global audience

-

'We can't make ends meet': civil servants protest in Ankara

-

UK prosecutors appeal Kneecap rapper terror charge dismissal

UK prosecutors appeal Kneecap rapper terror charge dismissal

-

UK police chief blames AI for error in evidence over Maccabi fan ban

-

Oil prices extend gains on Iran unrest

Oil prices extend gains on Iran unrest

-

France bans 10 UK far-right activists over anti-migrant actions

-

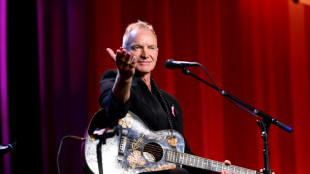

Every cent you take: Sting, ex-Police band mates in royalty battle

Every cent you take: Sting, ex-Police band mates in royalty battle

-

Thailand crane collapses onto train, killing 32

-

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

-

Italian influencer Ferragni awaits verdict in Christmas cake fraud trial

-

Louvre and other French museums fare hikes for non-European visitors

Louvre and other French museums fare hikes for non-European visitors

-

Japan's Takaichi to dissolve parliament for snap election

-

Dutch court hears battle over Nexperia

Dutch court hears battle over Nexperia

-

World-first ice archive to guard secrets of melting glaciers

-

Ted Huffman, the New Yorker aiming to update top French opera festival

Ted Huffman, the New Yorker aiming to update top French opera festival

-

Ofner celebrates early then loses in Australian Open qualifying

-

Singer Julio Iglesias accused of 'human trafficking' by former staff

Singer Julio Iglesias accused of 'human trafficking' by former staff

-

Luxury retailer Saks Global files for bankruptcy

-

Asian markets mostly up with politics bump for Tokyo

Asian markets mostly up with politics bump for Tokyo

-

China's trade surplus hit record $1.2 trillion in 2025

-

Trail goes cold in UK abandoned babies mystery

Trail goes cold in UK abandoned babies mystery

-

Japan's Takaichi set to call February snap election: media

-

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

-

From bricklayer to record-breaker: Brentford's Thiago eyes World Cup berth

-

Keys overcomes serve demons to win latest Australian Open warm-up

Keys overcomes serve demons to win latest Australian Open warm-up

-

As world burns, India's Amitav Ghosh writes for the future

Oil prices extend gains on Iran worries

Oil prices rose further Wednesday on the political instability in major crude producer Iran and the possibility of a US intervention, which also helped push safe-haven gold to a new record high while weighing on the dollar.

Wall Street's main stock indices fell despite US retail sales posting a higher-than-expected 0.6 percent increase in November and several major US banks beating earnings expectations.

"Things are looking a little softer at the moment, reflecting a heightened sense of uncertainty in the air," said Briefing.com analyst Patrick O'Hare.

"Some of that uncertainty revolves around the path of monetary policy after this morning's economic data worked against the notion of needing to cut rates again soon," he noted.

Recent data has indicated the US economy continues to hum, the labour market has not seen a major degradation and inflation is holding at a moderate level above the US Federal Reserve's target.

The Fed has tipped it would probably wait to make further cuts in interest rates, and most investors expect it will likely hold off for several months.

O'Hare also pointed to traders waiting for a possible US Supreme Court ruling on Wednesday on the legality of US President Donald Trump's sweeping tariffs.

A ruling against the government would prove a temporary setback to its economic and fiscal plans, though officials have said that tariffs can be reimposed by other means.

Meanwhile, China said its trade last year reached a "new historical high", surpassing 45 trillion yuan ($6.4 trillion) for the first time.

Global demand for Chinese goods has held firm despite a slump in exports to the United States after Trump hiked tariffs.

Other trade partners more than filled the gap, increasing Chinese exports overall by 5.5 percent in 2025.

"We expect this resilience to continue through 2026," said Zichun Huang, China economist at Capital Economics.

Much attention among traders remained on Iran, with Tehran warning it was capable of responding to any US attack, as Washington appeared to be pulling personnel out of a base that Iran targeted in a strike last year.

"Traders are closely watching the political unrest in Iran and possible US intervention, which could threaten disruption to the country's... oil production," said Helge Andre Martinsen, senior energy analyst at DNB Carnegie.

In European stocks trading London set a fresh all-time high thanks to gains in mining stocks, but Frankfurt and Paris slid lower.

Asian stock markets mostly gained.

Tokyo shares jumped by 1.5 percent while the yen slumped to its lowest value since mid-2024 amid media reports that Prime Minister Sanae Takaichi planned to hold an election as soon as February 8.

Takaichi's cabinet -- riding high in opinion polls -- has approved a record 122.3-trillion-yen ($768 billion) budget for the fiscal year from April 2026.

She has vowed to get parliamentary approval as soon as possible to address inflation and shore up the world's fourth-largest economy.

"We are seeing a shift in sentiment that could see European and Asian equities gain ground on their US counterparts," said Joshua Mahony, chief market analyst at Scope Markets.

On the corporate front, British energy giant BP revealed a write-down of up to $5 billion linked to its energy transition efforts that will be reflected in the company's upcoming annual results.

Its share price traded lower most of the day but closed the day with a gain of 1.5 percent.

- Key figures at around 1630 GMT -

Brent North Sea Crude: UP 0.8 percent at $65.96 per barrel

West Texas Intermediate: UP 0.7 percent at $61.35 per barrel

New York - Dow: DOWN 0.1 percent at 49,124.17 points

New York - S&P 500: DOWN 0.7 percent at 6,917.81

New York - Nasdaq Composite: DOWN 1.1 percent at 23,440.38

London - FTSE 100: UP 0.5 percent at 10,184.35 (close)

Paris - CAC 40: DOWN 0.2 percent at 8,330.97 (close)

Frankfurt - DAX: DOWN 0.5 percent at 25,286.24 (close)

Tokyo - Nikkei 225: UP 1.5 percent at 54,341.23 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 26,999.81 (close)

Shanghai - Composite: DOWN 0.3 percent at 4,126.09 (close)

Euro/dollar: UP at $1.1656 from $1.1643 on Tuesday

Pound/dollar: UP at $1.3448 from $1.3426

Dollar/yen: DOWN at 158.25 yen from 159.15 yen

Euro/pound: DOWN at 86.66 pence from 86.71 pence

burs-rl/cw

P.Silva--AMWN