-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

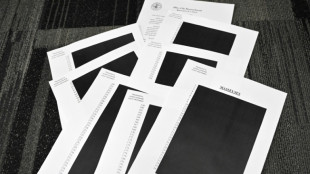

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

PSG penalty hero Safonov ended Intercontinental win with broken hand

-

French court rejects Shein suspension

-

'It's so much fun,' says Vonn as she milks her comeback

'It's so much fun,' says Vonn as she milks her comeback

-

Moscow intent on pressing on in Ukraine: Putin

-

UN declares famine over in Gaza, says 'situation remains critical'

UN declares famine over in Gaza, says 'situation remains critical'

-

Guardiola 'excited' by Man City future, not pondering exit

-

Czechs name veteran coach Koubek for World Cup play-offs

Czechs name veteran coach Koubek for World Cup play-offs

-

PSG penalty hero Safonov out until next year with broken hand

China central bank cuts benchmark lending rate to boost economy

China's central bank on Tuesday cut a key benchmark lending rate used to price mortgages, as Beijing seeks to boost its flagging growth.

Officials in China have struggled to kickstart economic growth as they battle a range of headwinds, including a prolonged property-sector crisis, soaring youth unemployment and a global slowdown that has hammered demand for Chinese goods.

The five-year loan prime rate (LPR) was lowered from 4.2 to 3.95, the People's Bank of China announced -- its first cut since June.

It is the largest cut to the rate since it was introduced in 2019, according to Bloomberg, and lower than that expected by economists polled by the financial news wire.

The one-year LPR, which serves as a benchmark for corporate loans, remained unchanged at 3.45 percent. The one-year rate was last lowered in August, while the five-year LPR had previously been reduced in June.

Tuesday's moves are aimed at encouraging commercial banks to grant more credit and at more advantageous rates.

They come in stark contrast to most other major economies, where rates have been raised in a bid to curb inflation -- part of a global slowdown that is hitting demand for China's exports, long a key driver of growth.

The decision follows a series of mixed indicators for the world's second-largest economy.

China last year recorded one of its worst annual growth rates since 1990, dampening hopes for a rapid economic recovery following the end of draconian Covid restrictions in late 2022.

Activity is also being hit hard by an unprecedented crisis in real estate, a key engine of Chinese growth that has long represented more than a quarter of the country's GDP.

In January, consumer prices fell at their quickest rate in more than 14 years, piling pressure on the government to make more aggressive moves to revive the battered economy.

Deflation can be a brake on the profitability of companies and harms employment and demand in the long term.

Last month, Beijing announced it would cut the amount banks must hold in reserve, known as the reserve requirement ratio.

Policymakers have in recent months announced a series of targeted measures as well as the issuance of billions of dollars in sovereign bonds, aimed at boosting infrastructure spending and spurring consumption.

But that, and recent announcements including central bank interest rate cuts and measures to boost lending, have had little impact so far.

Analysts say a "bazooka" stimulus plan is needed to restore confidence.

There were some bright spots, however. Official data showed Sunday that consumption rebounded during the recent Chinese New Year holidays, exceeding even pre-pandemic levels.

But analysts cautioned that the slightly longer-than-usual holiday period this year meant a comparison would likely be distorted.

A.Malone--AMWN