-

Pirovano doubles up with second Val di Fassa downhill win

Pirovano doubles up with second Val di Fassa downhill win

-

Rapper-turned-politician Shah unseats former Nepal PM in own constituency

-

Beating Italy is not a 'God-given right', says Wales coach Tandy

Beating Italy is not a 'God-given right', says Wales coach Tandy

-

Sri Lanka to treat Iranian sailors according to 'international law'

-

New Zealand want to 'break a few hearts' in World Cup final

New Zealand want to 'break a few hearts' in World Cup final

-

Farrell welcomes bonus-point win over 'tough' Welsh

-

Iran vows no surrender as air strikes hit Tehran airport

Iran vows no surrender as air strikes hit Tehran airport

-

Hamilton says 'not where we wanted or expected' for Australian GP

-

Pole-sitter Russell says his Mercedes more go-kart than 'bouncing bus'

Pole-sitter Russell says his Mercedes more go-kart than 'bouncing bus'

-

Google gives CEO new pay deal worth up to $692 million

-

Thousands of Taiwan fans turn Tokyo blue at World Baseball Classic

Thousands of Taiwan fans turn Tokyo blue at World Baseball Classic

-

Verstappen baffled by crash in Australian Grand Prix qualifying

-

Russell leads Mercedes 1-2 for Australian GP as Verstappen crashes

Russell leads Mercedes 1-2 for Australian GP as Verstappen crashes

-

'Grateful' Osaka returns to action with Indian Wells win

-

Israel fires 'broad-scale' strikes on Tehran as war hits 2nd week

Israel fires 'broad-scale' strikes on Tehran as war hits 2nd week

-

Rapper-turned-politician looks set for landslide Nepal election win

-

Russian strike on Kharkiv apartment block kills three

Russian strike on Kharkiv apartment block kills three

-

Judge homers as USA cruise past Brazil in World Baseball Classic

-

Russian strike on Kharkiv appartment block kills three

Russian strike on Kharkiv appartment block kills three

-

Grabbing the bull by the tail: Venezuela's cowboy sport

-

Russell tops final practice in Melbourne as Antonelli crashes heavily

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

Trump convenes Latin American leaders to curb crime, immigration

-

Dipylon Medical Expands Access to Clinical Microbiology Equipment for Modern Diagnostic Laboratories

-

Bestday Safaris Launches Affordable Tanzania Safari Tours for International Travelers

Bestday Safaris Launches Affordable Tanzania Safari Tours for International Travelers

-

All Home Care Matters Takes Over Leadership Role of AlzAuthors

-

Venezuela inflation hit 475% in 2025, the world's highest level

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

Kane-less Bayern brush aside Gladbach to continue title march

-

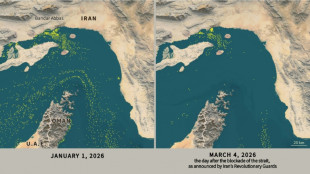

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

Berger extends lead midway through Arnold Palmer Invitational

-

Paralympics open with Russian athletes booed in ceremony

-

Cuba 'next' on agenda, after Iran: Trump

Cuba 'next' on agenda, after Iran: Trump

-

Zverev leads way into Indian Wells third round

Route1 Announces Q3 2024 Financial Results

Route1 Inc. (TSXV:ROI) (the "Company" or "Route1"), an advanced North American provider of data-centric business empowerment solutions, today reported its financial results for the three- and nine-month periods ended September 30, 2024.

Statement of operations In 000s of CAD dollars | Q32024 | Q22024 | Q12024 | Q42023 | Q32023 | Q22023 | ||||||||||||

Revenue | ||||||||||||||||||

Subscription and services | $ | 1,417 | $ | 888 | $ | 906 | $ | 1,064 | $ | 1,148 | $ | 1,159 | ||||||

Devices and appliances | 2,301 | 2,605 | 3,123 | 3,222 | 3,370 | 3,026 | ||||||||||||

Other | (12 | ) | (9 | ) | 3 | 10 | 5 | (1 | ) | |||||||||

Total revenue | 3,706 | 3,484 | 4,032 | 4,296 | 4,523 | 4,184 | ||||||||||||

Cost of revenue | 2,376 | 2,269 | 2,716 | 2,797 | 2,998 | 3,011 | ||||||||||||

Gross profit | 1,331 | 1,215 | 1,317 | 1,499 | 1,525 | 1,173 | ||||||||||||

Operating expenses | 1,418 | 1,457 | 1,431 | 1,558 | 1,542 | 1,533 | ||||||||||||

Operating profit 1 | (87 | ) | (242 | ) | (115 | ) | (59 | ) | (18 | ) | (360 | ) | ||||||

Total other expenses 2 | 196 | 86 | 34 | 223 | 52 | 265 | ||||||||||||

Net income (loss) | $ | (283 | ) | $ | (328 | ) | $ | (149 | ) | $ | (282 | ) | $ | (70 | ) | $ | (625 | ) |

1 Before stock-based compensation

2 Includes gain or loss on asset disposal, stock-based compensation expense, interest expense, income tax recovery, foreign exchange loss or gain, other expenses and acquisition expenses.

Adjusted EBITDA 1 In thousands of Canadian dollars | Q32024 | Q22024 | Q1 2024 | Q4 2023 | Q3 2023 | Q2 2023 | ||||||||||||

Adjusted EBITDA | $ | 147 | $ | 2 | $ | 134 | $ | 226 | $ | 297 | $ | (27 | ) | |||||

Depreciation and amortization | 234 | 245 | 248 | 285 | 314 | 333 | ||||||||||||

Operating profit | $ | (87 | ) | $ | (242 | ) | $ | (115 | ) | $ | (59 | ) | $ | (18 | ) | $ | (360 | ) |

1 Adjusted EBITDA is defined as earnings before interest, income taxes, depreciation and amortization, stock-based compensation, patent litigation, restructuring and other costs. Adjusted EBITDA does not have any standardized meaning prescribed under IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. Adjusted EBITDA allows Route1 to compare its operating performance over time on a consistent basis.

Subscription and services revenue in 000s of CAD dollars | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | ||||||

Application software | $ | 37 | $ | 49 | $ | 129 | $ | 139 | $ | 280 | $ | 343 |

Other services | 1,380 | 839 | 777 | 925 | 868 | 816 | ||||||

Total | $ | 1,417 | $ | 888 | $ | 906 | $ | 1,064 | $ | 1,148 | $ | 1,159 |

Other services revenue in 000s of CAD dollars | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | ||||||

Technology life-cycle maintenance and support | $ | 370 | $ | 356 | $ | 347 | $ | 323 | $ | 314 | $ | 310 |

Professional services | 1,010 | 483 | 430 | 602 | 553 | 506 | ||||||

Total | $ | 1,417 | $ | 839 | $ | 777 | $ | 925 | $ | 867 | $ | 816 |

" Not a dramatic quarter, rather a steady quarter that showed continued operational improvement, revenue growth and improving free cash flow. Route1's fourth quarter should also demonstrate quarter over quarter improvement and set us up for a financially improved fiscal year 2025, said Tony Busseri, Route1's CEO".

Balance Sheet Extracts

In 000s of CAD dollars | Sep 30 2024 | Jun 30 2024 | Mar 31 2024 | Dec 31 2023 | Sep 30 2023 | Jun 30 2023 | |||||||

Cash | $ | (47 | ) | $ | 136 | $ | 27 | $ | 38 | $ | 23 | $ | 27 |

Total current assets | 3,099 | 2,501 | 2,650 | 3,071 | 3,877 | 3,563 | |||||||

Total current liabilities | 8,585 | 7,983 | 7,856 | 8,089 | 8,728 | 8,484 | |||||||

Net working capital | (5,486 | ) | (5,482 | ) | (5,206 | ) | (5,018 | ) | (4,851 | ) | (4,921 | ) | |

Total assets | 8,923 | 8,677 | 9,017 | 9,541 | 10,678 | 10,571 | |||||||

Net bank debt and seller notes | 2,690 | 2,953 | 2,783 | 3,258 | 3,248 | 3,378 | |||||||

Total shareholders' equity | $ | (211 | ) | $ | 47 | $ | 407 | $ | 584 | $ | 838 | $ | 936 |

Business and Operations Metrics

Route1 has established three operating metrics that are critical to the Company's business model, initially creating cash flow stability and then generating sustainable shareholder value. It is the Company's goal to demonstrate success through cash flow generation that provides for meaningful debt reduction and improved returns on invested capital, and additionally demands scaling the business model through acquisition.

In early 2025, the Company will provide shareholders with updated operating metrics for fiscal year 2025 and 2026, better reflecting the next stage in the Company's development - growth.

Gross profit (GP) generated from non-MobiKEY and other Route1 software application sales on a quarterly basis needs to achieve and maintain a minimum value of US $1.15 million ("Benchmark A"). Gross profit is defined as revenue less devices and appliances direct costs but does not include other direct costs including salaries, wages and consulting fees, bad debts and travel expenses.

in US 000s | Q3-24 | Q2-24 | Q1-24 | Q4-23 | Q3-23 | Q2-23 | ||||||

Quarter Value | $ | 1,129 | $ | 998 | $ | 1,064 | $ | 1,170 | $ | 1,124 | $ | 794 |

Recurring ALPR support contracts need to grow to more than US $1.0 million in annualized revenue ("Benchmark B").

Route1 started the 2022 fiscal year at a base of US $595,000 per annum.

in US 000s | Q3-24 | Q2-24 | Q1-24 | Q4-23 | Q3-23 | Q2-23 | Q1-23 | |||||||

Quarter Value | $ | 272 | $ | 261 | $ | 258 | $ | 237 | $ | 235 | $ | 228 | $ | 212 |

Annualized Value | $ | 1,088 | $ | 1,044 | $ | 1,032 | $ | 946 | $ | 941 | $ | 914 | $ | 847 |

Fixed costs including amortization need not exceed CAD $1.65 million per quarter ("Benchmark C").

In CAD 000s | Q3-24 | Q2-24 | Q1-24 | Q4-23 | Q3-23 | Q2-23 | Q1-23 | |||||||

Fixed Costs | $ | 1,418 | $ | 1,457 | $ | 1,431 | $ | 1,558 | $ | 1,542 | $ | 1,533 | $ | 1,805 |

About Route1 Inc.

Route1 Inc. is an advanced North American technology company that empowers their clients with data-centric solutions necessary to drive greater profitability, improve operational efficiency and gain sustainable competitive advantages, while always emphasizing a strong cybersecurity and information assurance posture. Route1 delivers exceptional client outcomes through real-time secure delivery of actionable intelligence to decision makers. Route1 is listed in Canada on the TSX Venture Exchange under the symbol ROI. For more information, visit: www.route1.com.

For More Information, Contact:

Tony Busseri

President and Chief Executive Officer

+1 480 578-0287

[email protected]

This news release, required by applicable Canadian laws, does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

© 2024 Route1 Inc. All rights reserved. No part of this document may be reproduced, transmitted or otherwise used in whole or in part or by any means without prior written consent of Route1 Inc. See https://www.route1.com/terms-of-use/ for notice of Route1's intellectual property.

This news release may contain statements that are not current or historical factual statements that may constitute forward-looking statements or future oriented financial information. These statements are based on certain factors and assumptions, including, expectations regarding the expected growth in the value of support contracts for the LPR business, price and liquidity of the common shares, competition for skilled personnel, expected financial performance and subscription-based revenue, business prospects, technological developments, development activities and like matters. While Route1 considers these factors and assumptions to be reasonable, based on information currently available, they may prove to be incorrect. These statements involve risks and uncertainties, including but not limited to the market demand for the Company's products and services and risk factors described in reporting documents filed by the Company. Actual results could differ materially from those projected as a result of these and other risks and should not be relied upon as a prediction of future events. The Company undertakes no obligation to update any forward-looking statement or future oriented financial information to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, except as required by law. Estimates used in this presentation are from Company sources. Past or forecasted performance is not a guarantee of future performance and readers should not rely on historical results or forward-looking statements or future oriented financial information as an assurance of future results.

SOURCE: Route1, Inc.

F.Bennett--AMWN