-

Russell leads Mercedes 1-2 for Australian GP as Verstappen crashes

Russell leads Mercedes 1-2 for Australian GP as Verstappen crashes

-

'Grateful' Osaka returns to action with Indian Wells win

-

Israel fires 'broad-scale' strikes on Tehran as war hits 2nd week

Israel fires 'broad-scale' strikes on Tehran as war hits 2nd week

-

Rapper-turned-politician looks set for landslide Nepal election win

-

Russian strike on Kharkiv apartment block kills three

Russian strike on Kharkiv apartment block kills three

-

Judge homers as USA cruise past Brazil in World Baseball Classic

-

Russian strike on Kharkiv appartment block kills three

Russian strike on Kharkiv appartment block kills three

-

Grabbing the bull by the tail: Venezuela's cowboy sport

-

Russell tops final practice in Melbourne as Antonelli crashes heavily

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

Trump convenes Latin American leaders to curb crime, immigration

-

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

-

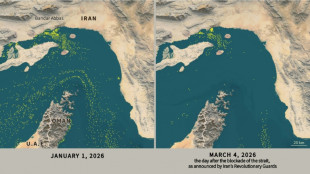

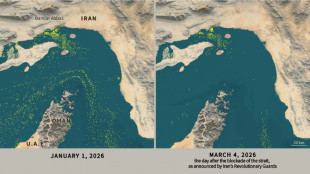

Only nine commercial ships detected crossing Hormuz Strait since Monday

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

-

Paralympics open with Russian athletes booed in ceremony

Paralympics open with Russian athletes booed in ceremony

-

Cuba 'next' on agenda, after Iran: Trump

-

Zverev leads way into Indian Wells third round

Zverev leads way into Indian Wells third round

-

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

-

Anthropic vows court fight in Pentagon row

Anthropic vows court fight in Pentagon row

-

'Harder path': Obama attacks Trump at Jesse Jackson memorial

-

Amber Glenn says will not visit White House to celebrate Olympic gold

Amber Glenn says will not visit White House to celebrate Olympic gold

-

Russian athletes booed as they parade under own flag at Paralympics opening

-

Trump to attend return of six US troops killed in Iran war

Trump to attend return of six US troops killed in Iran war

-

Tom Brady flag football event moved from Saudi to Los Angeles: reports

-

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

-

Middle East war a new shock for financial markets

-

Only nine commercial ships detected crossing the Hormuz Strait since Monday

Only nine commercial ships detected crossing the Hormuz Strait since Monday

-

Mexico unveils 100,000-strong security deployment for World Cup

-

Trump's Iran war violates international law, experts say

Trump's Iran war violates international law, experts say

-

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

-

UK police question three women in Al-Fayed probe

UK police question three women in Al-Fayed probe

-

Oil prices surge as Mideast war rages, stocks fall on US jobs

SideChannel Achieves Full Year Cash Provided by Operations

Financial results conference call on Thursday, December 5 @ 4:30 P.M. ET

SideChannel, Inc. (OTCQB:SDCH) ("SideChannel"), a leading provider of cybersecurity services and technology to emerging and middle market companies, today announced its financial results for the fiscal year ended September 30, 2024.

Fiscal Year 2024 Highlights

● | Revenue of $7.4 million; 12.8% greater than Fiscal Year ("FY") 2023 revenue of $6.6 million. |

● | Gross margin of 47.8%; 290 bps lower than 50.7% for FY 2023. |

● | Operating expenses, excluding intangible asset impairment and business combination related costs, decreased $1.2 million, or 22.0%, compared to FY 2023. |

● | Net loss of $785 thousand or $0.00 per share versus a net loss of $7.0 million or $0.04 per share in FY 2023. |

● | Revenue retention of 69.2%; 180 bps lower than 71.0% for FY 2023. |

● | Cash, cash equivalents, and short-term investments increased by $242 thousand from September 30, 2023, to an ending balance of $1.3 million at September 30, 2024. |

Management Comments

Commenting on the results for the fiscal year ended September 30, 2024, Brian Haugli, President and Chief Executive Officer of SideChannel, said, "We accomplished our goal of establishing sustainable cash provided by operations this year and intend to keep that going during 2025. The next objective we want to achieve is delivering multiple quarters of Enclave revenue growth. We are deploying our cash provided by operations to build a sales team for that purpose. We are also creating awareness about how Enclave's novel approach to microsegmentation is proving to be a significantly cost-effective alternative to hardware."

Haugli continued, "The quantity of new service client leads is increasing and the deal flow through our sales funnel is ahead of this same time last year. Our assessment product is an attractive solution for companies that need to identify priorities and explore options before tapping into our vCISO platform. In the second half of fiscal year 2024, our service delivery team began expanding capacity in a manner that won't negatively impact our gross margins. We expect to see this benefit in our 2025 results."

SideChannel will host a conference call on December 5, 2024, at 4:30 P.M. Eastern Time to discuss its fiscal year 2024 results and provide an update on the Company's initiatives.

CALL INFORMATION

Date: | Thursday December 5, 2024, at 4:30 P.M. Eastern Standard Time. |

Dial In: | Toll Free: 888-506-0062 |

International: 973-528-0011 | |

Participant Access Code: 433384 |

A webcast of the call will also be available: https://www.webcaster4.com/Webcast/Page/2071/49680

Participants may register in advance for the call using the webcast link.

The call will include management remarks and a live question and answer session. Questions may be submitted prior to the meeting using [email protected].

The Company's annual report for the year ended September 30, 2024, will be timely filed on Form 10-K with the Securities and Exchange Commission upon completion of the audit.

Financial tables follow.

SIDECHANNEL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

Twelve Months Ended | ||||||

September 30, | ||||||

2024 | 2023 | |||||

Revenues | $ | 7,416 | $ | 6,572 | ||

Cost of revenues | 3,874 | 3,240 | ||||

Gross profit | 3,542 | 3,332 | ||||

Operating expenses | ||||||

General and administrative | 3,046 | 3,586 | ||||

Selling and marketing | 771 | 1,337 | ||||

Research and development | 546 | 669 | ||||

Intangible asset impairment | - | 4,940 | ||||

Business Combination related costs | - | 214 | ||||

Total operating expenses | 4,363 | 10,746 | ||||

Operating loss | (821 | ) | (7,414 | ) | ||

Other income, net | 41 | 29 | ||||

Net loss before income tax expense | (780 | ) | (7,385 | ) | ||

Income tax expense (benefit) | 5 | (379 | ) | |||

Net loss | $ | (785 | ) | $ | (7,006 | ) |

Net loss per common share - basic and diluted | $ | (0.00 | ) | $ | (0.04 | ) |

Weighted average common shares outstanding - basic and diluted | 222,078,462 | 175,274,762 | ||||

SIDECHANNEL, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

September 30, 2024 | September 30, 2023 | |||

ASSETS | ||||

Current assets | ||||

Cash and cash equivalents | $ | 1,045 | $ | 1,053 |

Short-term investments | 250 | - | ||

Accounts receivable, net | 732 | 834 | ||

Deferred costs | 150 | 180 | ||

Prepaid expenses and other current assets | 379 | 381 | ||

Total current assets | 2,556 | 2,448 | ||

Fixed assets | 33 | 30 | ||

Goodwill | 1,356 | 1,356 | ||

Deferred costs | - | 150 | ||

Total assets | $ | 3,945 | $ | 3,984 |

LIABILITIES & STOCKHOLDERS' EQUITY | ||||

Current liabilities | ||||

Accounts payable and accrued liabilities | $ | 634 | $ | 613 |

Deferred revenue | 499 | 280 | ||

Promissory note payable | - | 50 | ||

Income taxes payable | 3 | 11 | ||

Total current liabilities | 1,136 | 954 | ||

Other liabilities | - | - | ||

Total liabilities | 1,136 | 954 | ||

Commitments and contingencies | - | - | ||

Common stock, $0.001 par value, 681,000,000 shares authorized; 225,975,331 and 213,854,781 shares issued and outstanding as of September 30, 2024, and 2023, respectively | 226 | 214 | ||

Additional paid-in capital | 22,307 | 21,755 | ||

Accumulated deficit | (19,724 | ) | (18,939 | ) |

Total stockholders' equity | 2,809 | 3,030 | ||

Total liabilities and stockholders' equity | $ | 3,945 | $ | 3,984 |

About SideChannel

SideChannel helps emerging and mid-market companies protect their assets. Founded in 2019, we deliver comprehensive cybersecurity plans through a series of actions branded SideChannel Complete.

SideChannel deploys a combination of skilled and experienced talent and technological tools to offer layered defense strategies supported by battle-tested processes. SideChannel also offers Enclave, a network infrastructure platform that eases the journey from zero to zero-trust. Learn more at sidechannel.com.

Investors and shareholders are encouraged to receive press releases and industry updates by subscribing to the investor email newsletter and following SideChannel on X and LinkedIn.

You may contact us at:

SideChannel

146 Main Street, Suite 405

Worcester, MA 01608

Investor Contact

Ryan Polk

[email protected]

Forward-Looking Statements

This press release may contain forward-looking statements, including information about management's view of SideChannel's future expectations, plans and prospects. In particular, when used in the preceding discussion, the words "believes", "hopes", "expects", "intends", "plans", "anticipates", "potential", "could", "should" or "may", and similar conditional expressions are intended to identify forward-looking statements. Examples of forward-looking statements include, among others, statements relating to future sales, earnings, cash flows, results of operations, uses of cash and other measures of financial performance.

Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause SideChannel's actual results and financial condition to differ materially from those expressed or implied in the forward-looking statements. These risk factors include, but are not limited to: that we have incurred net losses since inception, our need for additional funding, the substantial doubt about our ability to continue as a going concern, and the terms of any future funding we raise; our dependence on current management and our ability to attract and retain qualified employees; competition for our products; our ability to develop and successfully introduce new products, improve current products and innovate; unpredictability in our operating results; our ability to retain existing licensees and add new licensees; our ability to manage our growth; our ability to protect our intellectual property (IP), enforce our IP rights and defend against claims that we infringed on the IP of others; the risk associated with the concentration of our cash in one financial institution at levels above the amount protected by FDIC insurance; and other risk factors included from time to time in documents we file with the Securities and Exchange Commission, including, but not limited to, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These reports are available at www.sec.gov.

Other unknown or unpredictable factors also could have material adverse effects that could cause actual results to differ materially from those projected or represented in the forward-looking statements. Further, factors that we do not presently deem material as of the date of this release may become material in the future. The forward-looking statements included in this press release are made only as of the date hereof. SideChannel cannot guarantee future results, levels of activity, performance, or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, SideChannel undertakes no obligation to update these forward-looking statements after the date of this release, except as required by law, nor any obligation to update or correct information prepared by third parties.

SOURCE: SideChannel, Inc.

T.Ward--AMWN