-

Sri Lanka denounces war deaths, houses Iran sailors

Sri Lanka denounces war deaths, houses Iran sailors

-

Inoue primed for 'historic' Nakatani clash in Tokyo

-

Italy challenges EU over key climate tool

Italy challenges EU over key climate tool

-

Home hero Piastri edges Antonelli in second Australian GP practice

-

Australia forces porn sites to block under-18s from Monday

Australia forces porn sites to block under-18s from Monday

-

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

-

Aston Martin chief Newey says no quick fix to vibration problems

Aston Martin chief Newey says no quick fix to vibration problems

-

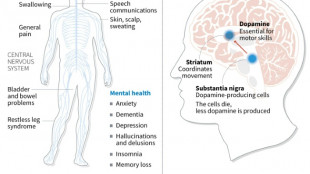

Japan approves stem-cell treatment for Parkinson's in world first

-

Heavy attacks hit Tehran as Israel says war in 'new phase'

Heavy attacks hit Tehran as Israel says war in 'new phase'

-

North Korea thrash Bangladesh in Women's Asian Cup warning

-

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

-

Eight dead, four missing in Brazil seniors home collapse

-

Paralympics brace for tense opening as Russia comes in from the cold

Paralympics brace for tense opening as Russia comes in from the cold

-

Leclerc edges Hamilton to go fastest in first Australian GP practice

-

Equities mostly drop as Mideast crisis rages, though oil dips

Equities mostly drop as Mideast crisis rages, though oil dips

-

Nepal counts votes after key post-uprising election

-

Italy half-backs can make difference against England: ex-coach Mallett

Italy half-backs can make difference against England: ex-coach Mallett

-

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

-

French starlet Seixas to take on Pogacar at Strade Bianche

French starlet Seixas to take on Pogacar at Strade Bianche

-

Brazil's Petrobras sees profit soar on record output

-

Arsenal, Chelsea aim to avoid FA Cup upsets

Arsenal, Chelsea aim to avoid FA Cup upsets

-

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

Iran missile barrage sparks explosions over Tel Aviv

-

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Lifeloc Technologies Secures $750,000 Financing to Support Growth and Innovation

Lifeloc Technologies, Inc. (OTC PINK:LCTC), a leading provider of portable breath alcohol testing devices and related solutions, today announced the successful closing of a $750,000 financing transaction through a subordinated debenture agreement with Diamond Bridge Capital, LP. The financing also includes a warrant granting Diamond Bridge Capital the right to purchase up to 62,500 shares of Lifeloc's common stock at a strike price of $4.50 per share.

The subordinated debenture carries an annual interest rate of 8.25% and matures on December 31, 2030. The proceeds will be used to support the Company's ongoing growth initiatives, fund research and development efforts, including commercialization of Lifeloc's SpinDx technology, and strengthen its financial position as it continues to innovate in the field of alcohol detection and drug screening technologies. The financing agreement also provides for registration rights, obligating the Company to file a registration statement with the SEC for the resale of the shares underlying the warrant issued to Diamond Bridge Capital. This demonstrates Lifeloc's commitment to transparency and its ongoing focus on creating value for shareholders.

"This financing marks an important step forward for Lifeloc as we expand our capabilities and build on our legacy of innovation," said Wayne Willkomm, CEO of Lifeloc Technologies. "The commitment from Diamond Bridge Capital reflects confidence in our business model and future growth prospects. With these funds, we intend to focus on bringing our SpinDx technology to market, expanding our industry-leading testing solutions into a new and growing market."

"At the beginning of the computer age, data was gathered and then sent to an outside service center for processing," said Vern Kornelsen, Lifeloc's Chief Financial Officer and largest individual shareholder. "Later, with the evolution of the personal computer, data was gathered and processed locally. We believe SpinDx™ will drive the same evolution in drug testing."

Under current industry practice, testing samples are collected and sent to an outside lab for analysis, with the results available a day later, sometimes several days later - at a usual cost of upwards of $100 - $300 per test. Lifeloc expects SpinDx™ to make it possible to collect a sample and get the results locally within minutes - at a cost expected to be in the range of $25 per test.

"There are efforts underway by others to capture this market," said Kornelsen. "However, SpinDx™ is unique in its ability to accurately and quickly process the sample and provide a quantitative result versus the very few devices available today."

Lifeloc's extensive in-house testing has confirmed that the technology "works." The reader's ability to produce accurate output using samples provided by Anschutz Medical Center has been demonstrated, with next steps being the achievement of entire analysis within the disk followed by the SpinDx™ reader's subsequent placement with several beta test sites where it will be further validated. The company also intends to reduce the current prototype reader's size by 25% to make it more market friendly. Initially, Lifeloc expects the analytical disk to be produced and supplied in small quantities by a large international microfluidics company. By the time the system is market ready, currently planned for Q4 of 2025, the Company plans to have acquired high volume automation equipment, and to have identified microfluidics-experienced personnel such that Lifeloc is able to produce the disk in quantity in house.

Lifeloc has prepared the following forward-looking financial projections, contemplating the potential effect of commercialization and market adoption of its SpinDx™ technology:

2024 | 2025 | 2026 | 2027 | 2028 | ||||||

Sales | 8,543,099 | 7,736,250 | 9,070,100 | 13,133,300 | 19,526,100 | |||||

Cost of Goods Sold | 5,036,244 | 4,641,750 | 5,351,358 | 7,617,314 | 11,129,876 | |||||

Gross Profit | 3,506,855 | 3,094,500 | 3,718,742 | 5,515,986 | 8,396,224 | |||||

Operating expenses including interest, before R&D | 2,591,495 | 2,804,233 | 3,013,102 | 3,067,079 | 3,120,636 | |||||

Profit before R&D | 915,360 | 290,267 | 705,640 | 2,448,907 | 5,275,588 | |||||

R&D | 2,156,625 | 1,943,072 | 970,572 | 970,572 | 970,572 | |||||

Profit (loss) before tax | (1,241,265 | ) | (1,652,805 | ) | (264,932 | ) | 1,478,335 | 4,305,016 | ||

Lifeloc anticipates that its standing in the alcohol breathalyzer market will provide an edge in introducing the SpinDx™ drug detection product to the market. After commercialization of the initial SpinDx™ product, the company plans to begin teaming SpinDx™ with Lifeloc's alcohol breathalyzer, with the goal of developing a marijuana breathalyzer.

"The strategic funding we're receiving from Diamond Bridge Capital not only reinforces our financial stability but also enables us to stay at the forefront of technological advancements in safety and public health," Willkomm added. "We are excited about the opportunities this investment creates and look forward to driving value for all our stakeholders."

About Lifeloc Technologies

Lifeloc Technologies, Inc. (OTC: LCTC) is a trusted U.S. manufacturer of evidential breath alcohol testers and related training and supplies for Workplace, Law Enforcement, Corrections and International customers. Lifeloc stock trades over-the-counter under the symbol LCTC. We are a fully reporting Company with our SEC filings available on our web site, www.lifeloc.com/investor.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including certain forward-looking financial projections that reflect the Company's current expectations for its financial performance in future periods. These projections include estimates of revenue, operating expenses, and other financial metrics and are intended to provide investors with insights into the Company's anticipated financial performance. The projections are based on a variety of assumptions that the Company believes are reasonable as of the date hereof. However, they should not be relied upon as a definitive representation of the Company's future results. These forward-looking financial projections may differ materially from the Company's actual performance and are subject to risks and uncertainties, including, but not limited to, the possibility that the Company may fail to successfully commercialize its SpinDx™ technology within the contemplated time frame or at all, that the Company may fail to achieve expected market adoption of its technology solutions, that the Company may be unable to produce its solutions at the cost it currently anticipates, to offer its solution at the prices it currently expects, or to achieve the profit margin it anticipates, and that the Company may fail to raise sufficient additional capital to complete its research and development plans, in addition to those additional risks outlined in the Company's filings with the Securities and Exchange Commission, including but not limited to those risk factors outlined in the Company's annual report on Form 10-K. Investors should not rely on these projections and should review them in the context of the Company's overall financial disclosures and risk factors.

Contact:

Investor Relations

Lifeloc Technologies, Inc.

Email: [email protected]

Phone: (303) 431-9500

SOURCE: Lifeloc Technologies, Inc.

L.Miller--AMWN