-

US, Venezuela restore ties as Washington pushes for minerals access

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

-

US says Venezuela to protect mining firms as diplomatic ties restored

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Sri Lanka takes control of Iranian ship fearing new US sub attack

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

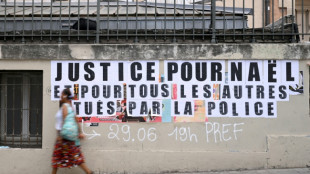

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Oil prices rise, stocks drop as Middle East war stirs supply concerns

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

At CES 2025, METAVISIO - THOMSON Computing Signed an Agreement with ARC Group Limited for a Listing on Nasdaq or NYSE, Based on a Minimum Indicative Valuation Estimated at $70 Million (Derived From Audited Annual Data for FY 2023 and Audited Data for H1 2024)

METAVISIO (THOMSON Computing) (FR00140066X4; code mnemo / Ticker: ALTHO), a pioneer in innovative computing solutions, announces at CES 2025 the signing of a letter of engagement with ARC Group Limited. This partnership aims to support METAVISIO in its listing on the Nasdaq or New York Stock Exchange in the United States, based on a minimum indicative valuation of $70 million, derived from audited annual data for FY 2023 and audited data for H1 2024.

According to the terms of the agreement, ARC Group will act as METAVISIO's exclusive financial advisor, providing strategic guidance for accessing U.S. public markets through a De-SPAC, a reverse takeover (RTO), or an initial public offering (IPO).

This important milestone reflects METAVISIO's ambition to strengthen its European leadership and expand its global presence in the technology industry by leveraging the significantly more lucrative opportunities offered by U.S. financial markets.

Key Objectives of the Engagement

Comprehensive Market Strategy: ARC Group will analyze current market conditions to determine the best strategy for METAVISIO's entry into U.S. public markets.

Capital Market Services: This includes SPAC sourcing, company valuation, and corporate restructuring for De-SPAC/RTO, or drafting S-1 filings for an IPO.

Pre-IPO Capital Raising: ARC Group will assist the company in raising the necessary funds to support METAVISIO's ambitious growth strategy, based on a higher valuation reflecting the efforts and positive results achieved in 2023, 2024, and projected for 2025.

In 2022, during its transfer to the Euronext Growth market through a capital increase of €4.2 million, the company's post-IPO valuation already stood at €44.9 million.

The new valuation of METAVISIO is expected to be determined based on the estimated revenue and EBITDA for 2025, providing a clear and updated financial benchmark in preparation for the initial public offering.

For example, if the revenue in 2025 reaches $120 million, the estimated valuation would range between $420 million and $600 million, based on a revenue multiple of 3.5x to 5.0x.

"We are excited to support METAVISIO in their process to enter the US Capital markets and unlock the huge potential behind the Company's innovative solutions by listing in the deepest, most sophisticated market in the world." said Jesus Hoyos, Managing Partner of ARC Group

"This partnership marks a key milestone in METAVISIO's evolution, providing access to the U.S. financial market, one of the largest and most dynamic in the world. We are thrilled to partner with ARC Group to achieve our goal of becoming a global leader in computing solutions," added Stephan Français, President of METAVISIO.

The agreement complies with the regulatory requirements of the SEC in the United States and the AMF in France, ensuring full compliance throughout the process.

The 2025 presentation of METAVISIO, including its latest updates and plans for 2025, is available on the company's website at: https://www.metavisio.eu/#intro25

About ARC Group

ARC Group is a Global Investment Bank and Management Consultancy Firm with deep roots in Asia, specializing in bridging markets across Asia, the US, and Europe. Since 2015, we have become a global leader in IPO and SPAC advisory, earning accolades such as Best Global Mid-Market Investment Bank (2020) and Deal of the Year (2024). Combining investment banking and management consulting expertise, we deliver tailored solutions in IPOs, SPACs, M&A, strategic consulting, and asset management. With a presence in 12 countries across 3 continents, we are united by a shared vision: Your achievement is the reason for our existence, and your growth is our passion.

ARC Group was the financial advisor for the near 9 billion USD merger of Digital World Acquisition with Trump Media & Technology Group.

For more information: www.arc-group.com

About METAVISIO-THOMSON Computing

Founded in 2013, METAVISIO - THOMSON Computing (FR00140066X4 - ALTHO), designs and markets innovative computing solutions. With a strong commitment to quality and sustainability, the company has become synonymous with technological excellence in the global market.

METAVISIO is eligible for the PEA-PME (French SME Equity Savings Plan) and holds the status of an Innovative Company (FCPI).

For More information: www.metavisio.eu

Contact press and investors: Gabriel Rafaty [email protected]

SOURCE: METAVISIO (THOMSON COMPUTING)

P.Stevenson--AMWN