-

Pete Hegseth: Trump's Iran war attack dog

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

-

Sri Lanka takes control of Iranian ship fearing new US sub attack

Sri Lanka takes control of Iranian ship fearing new US sub attack

-

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

Italy bring back Brex to face England

-

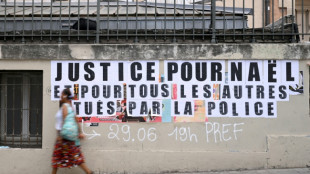

French policeman to be tried over 2023 killing of teen

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Oil prices rise, stocks drop as Middle East war stirs supply concerns

Oil prices rise, stocks drop as Middle East war stirs supply concerns

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

-

Stocks, oil climb as Middle East war stirs volatility

Stocks, oil climb as Middle East war stirs volatility

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

TaxBandits Strengthens Fraud Prevention and Security Measures to Identity Theft and Tax Frauds for the 2024 Tax Year

ROCK HILL, SC / ACCESS Newswire / January 23, 2025 / With the January 31, 2025, tax filing deadline on the horizon, TaxBandits, an IRS-authorized e-file service provider, underscores its steadfast commitment to safeguarding tax professionals and their clients from identity theft and fraud. In alignment with the stringent measures implemented by the IRS, Social Security Administration (SSA), and state tax agencies, TaxBandits has robust fraud prevention measures and security systems already in place to ensure secure and compliant tax filing.

TaxBandits Approach to Fraud Prevention

TaxBandits provides a platform that not only simplifies tax form filing - covering 1099s, W-2s, 940s, 941s, and ACA forms - but also prioritizes user data protection through industry-leading practices.

Recognizing that fraud risks typically escalate during the peak filing season, TaxBandits has rolled out many proactive measures to ensure secure and efficient tax filing processes.

Key Fraud Prevention Measures Implemented by TaxBandits

Proactive Measures to Mitigate Potential Audit Issues

As part of its commitment to fraud prevention, TaxBandits implements advanced measures to identify discrepancies that may trigger potential audits or raise compliance concerns with the IRS, SSA, or other relevant government agencies. When data reported on 1099 and W-2 forms deviate from IRS/SSA or state guidelines-such as unusually high withholding rates-the platform flags these issues for review.

Additionally, when discrepancies are flagged, clients are provided with clear guidance on the required documentation to support the reported data. These proactive measures strengthen compliance efforts while minimizing the risk of delays or complications.

Artificial Intelligence-Powered Fraud Prevention: TaxBandits uses an advanced AI engine to actively monitor user activity and identify any signs of suspicious or fraudulent behavior. The platform can quickly recognize potential threats and take immediate action by implementing AI-driven detection, ensuring a secure tax filing experience while protecting sensitive information.

Comprehensive Identity Verification Measures: TaxBandits implements rigorous identity verification procedures to ensure that only authorized people with verified identities can access and submit tax forms. This essential security step establishes a secure foundation for the entire tax filing process, significantly reducing the risk of unauthorized access and potential fraud.

Privacy Control for Enhanced Data Protection: TaxBandits offers tax professionals comprehensive privacy controls, allowing them to customize data-sharing preferences based on their needs. These controls enable them to:

Specify who can access their tax information

Limit the type of information shared

Revoke access at any time

By providing these privacy settings, TaxBandits ensures that tax professionals maintain complete control over their personal and financial data, fostering greater confidence in data security.

TIN Matching and Real-Time Validations

TaxBandits integrates an enhanced Taxpayer Identification Number (TIN) matching process to verify the accuracy of tax filings and reduce discrepancies. Real-time validations ensure that filings are accurate and compliant, minimizing errors that could lead to delays or fraud.

Layered Security Protection: TaxBandits employs a multi-tiered security approach to keep the client's data protected from unauthorized access through various measures, including:

IP Tracking: TaxBandits tracks and logs IP addresses associated with business and tax professional activities to identify the origin of suspicious behavior. This feature helps detect and address potential security breaches in real-time.

Activity Logs: Tax professionals can access detailed activity logs, which provide transparency and enable them to monitor their accounts for unusual actions. These logs empower them to take control of their tax filing security.

Advanced Security Measures

TaxBandits prioritizes the security of the tax filing process by implementing robust security measures.

Two-factor Authentication (2FA): TaxBandits prioritize the security of sensitive information by offering Two-Factor Authentication (2FA) options to strengthen security further. Tax professionals can enhance their account protection by enabling 2FA using various methods, such as:

Phone number verification

Authentication apps, including Google Authenticator, Microsoft Authenticator, Authy, and LastPass

Recovery codes for emergency access

The 'Remember this Device' feature temporarily allows trusted devices to bypass 2FA, ensuring convenience during this tax season.

Continuous System Monitoring and Auditing: TaxBandits monitors and audits its systems to proactively detect and resolve potential vulnerabilities. This vigilant approach ensures the platform remains at the forefront of security, providing individuals, businesses, and tax professionals with a safe and reliable tax filing experience.

Protection Against Phishing Threats: To combat phishing scams and fraudulent activities, TaxBandits has implemented stringent security protocols to protect user data. It is important to note that TaxBandits will never request sensitive information such as SSN, EIN, credit card details, or bank account information via email or any other communication channel.

SOC 2 Compliance for Data Security: As a SOC 2-certified e-file provider, TaxBandits adheres to stringent security standards established by the American Institute of CPAs (AICPA). Regular audits ensure compliance with strict controls and procedures to maintain client data's confidentiality, integrity, and availability. This certification demonstrates TaxBandits determined commitment to protecting sensitive information.

About TaxBandits

TaxBandits is an IRS-authorized e-file provider specializing in various tax forms, such as Form 941, Form 940, Form 1099, Form W-2, Form 1095-C, Form 1095-B, and Form W-9. Serving businesses, service providers, and tax professionals of every size, TaxBandits offers a complete solution that fulfills all filing needs.

TaxBandits provides another advantage for high-volume filers and software providers. TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms and BOI reporting. Use the developer filing 1099 API to request W-9 and automate the filing efficiently.

About SPAN Enterprises

SPAN Enterprises, headquartered in Rock Hill, South Carolina, has created cutting-edge software solutions for e-filing and business management for over ten years. The company's suite of products includes TaxBandits, Tax990, TaxExemptBonds, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Charles Hardy, VP of Operations at [email protected]

###

SOURCE: TaxBandits

View the original press release on ACCESS Newswire

L.Miller--AMWN