-

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

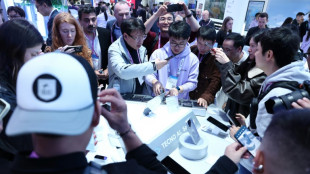

Second-hand phones surf rising green consumer wave

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

-

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

-

Trump warns of longer Iran war as violence spreads

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

WidePoint Highlights 2024 Operational Developments and 2025 Strategic Priorities

FAIRFAX, VA / ACCESS Newswire / February 18, 2025 / WidePoint Corporation(NYSE American:WYY), an innovative leader in enterprise cybersecurity and mobile technology, today announced its fiscal 2024 financial outlook, operational highlights, and strategic priorities for fiscal 2025.

Fourth Quarter and Full Year 2024 Financial Outlook

Based on preliminary, unaudited financial results, WidePoint expects to exceed its full-year 2024 revenue guidance and meet or surpass its full year 2024 guidance for adjusted EBITDA and Free cash flow.

WidePoint expects its fourth quarter 2024 results to mark the 30th consecutive quarter of positive adjusted EBITDA and the 5th consecutive quarter of positive free cash flow, reflecting a full year of positive free cash flow for 2024. Federal contract backlog remained strong at approximately $300 million as of December 31, 2024.

Management Commentary

WidePoint CEO Jin Kang, stated: "As we closed out 2023, we focused on driving momentum into 2024 through three key initiatives: sales and marketing investments, operational execution, and technical innovations. I am proud to report that we've exceeded our goals in these areas. Our sales and marketing investments delivered exceptional results, positioning us to exceed the high end of our revenue guidance. We also secured significant new contract in both federal and commercial sectors, most notably the Spiral 4 contract, showcasing the strength of our team and strategy. We expect this momentum to carry into 2025.

"In our forward-looking efforts, we are exploring strategic partnerships to tap into shared client networks, expand our customer portfolios, and grow contract backlog. These initiative includes a Direct to Consumer (D2C) program with a Mobile Virtual Network Operator (MVNO) partner for MobileAnchor. Additionally, we've been working closely with members of the new presidential administration to help identify federal-related fraud, waste, and abuse. We are also excited to soon announce a new Chief Strategist who will lead our Strategic Partnership efforts, focusing on government efficiency and cybersecurity.

"On the technical front, the successful deployment of MobileAnchor and launch of M365 Analyzer have positioned WidePoint as an industry leader, enhancing both our credibility and competitiveness. The completion of integration of ITA into the WidePoint further strengthens our capabilities allowing us to leverage synergies as a unified organization. These advancements are pivotal to our 2025 strategy, driving new opportunities across both federal and commercial markets.

"The progress made over the past year sets the stage for WidePoint to achieve our goal of positive earnings per share for the full year 2025. Our primary focus this year will be preparing for the U.S. Department of Homeland Security's CWMS 3.0 recompete, where we are highly competitive due to our excellent past performance, technical innovations, our solid relationships with DHS, and our dedicated team. We also have assembled a dedicated team led by Michelle Richards, our DHS CWMS Program Manager, to ensure our success in this recompete process. Additionally, our Device as a Service (DaaS) partnership program presents significant potential, especially in the commercial sector. With a solid contract backlog, we are well-positioned to maximize financial benefits to support our 2025 goals. With the right team, resources, and strategic plan in place, we are primed to deliver another year of top- and bottom-line growth and look forward to a robust 2025."

2024 Operational Highlights

WidePoint continued to execute its organic growth strategy, evidenced by the technical advancements, full-scale implementations, and contractual actions that position the Company for significant growth in 2025. Notable achievements include:

$52.7 million contract awards in 2024, of which $45.2 million was from Federal agencies and $7.5 million from commercial organizations.

Successful development, testing, and deployment of the MobileAnchor Digital Credential solution. Company signed two contracts with federal defense and civilian agencies in connection with its MobileAnchor solution.

FedRAMP status advanced to the in-process "finalization" phase, the last step before achieving FedRAMP "Authorized" status.

Subsidiary Soft-Ex Communications launched M365 Analyzer.

Maintained Authority to Operate (ATO) with both DHS and the U.S. Department of Justice confirming the strength of WidePoint's cybersecurity infrastructure.

Finalized the integration of its subsidiary, IT Authorities, which helps WidePoint become a full-service federal integrator.

Fully implemented notable contracts, including Federal Emergency Management Agency (FEMA) and a major quasi-government agency.

Notable contractual awards, including being selected for the $2.7 billion Spiral 4 contract and awarded the $254 million ceiling increase in its DHS CWMS 2.0 contract.

2025 Strategic Priorities

Since 2023, WidePoint has prioritized continued investment in its sales and marketing team and capabilities, yielding strong results that have driven its financial growth through 2024. Looking ahead, WidePoint plans to maintain its focus on sales and marketing strategies while exploring strategic partnerships to leverage its resources and relationships. This approach aims to strengthen customer relationships, expand WidePoint's reach, and unlock new opportunities to secure additional contracts.

The development of MobileAnchor, launch of M365 Analyzer, the full integration of its subsidiary IT Authorities, and continued investments in sales and marketing have positioned WidePoint to maintain its momentum into 2025. With much of the work surrounding MobileAnchor focused on SaaS revenue, the Company is well-positioned to capture a significant share of the mobile digital credential market, further diversifying WidePoint's revenue streams. Additionally, the recent launch of M356 Analyzer by Soft-ex offers businesses and government agencies a valuable tool for optimizing their Microsoft infrastructures.

An example of the strategic partnerships WidePoint aims to pursue is the recent Device as a Service (DaaS) partnership program with one of the industry's most respected systems integrators. This DaaS opportunity provides WidePoint with a new avenue in the commercial sector that is expected to result in strong returns. Additionally, more than 90% of the opportunities seen across the DaaS program are commercial clients, particularly across highly regulated industries such as finance, healthcare, and transportation, further expanding WidePoint's commercial pipeline and diversifying its customer portfolio outside of governmental entities.

WidePoint remains optimistic and anticipates receiving FedRAMP Authorized status in the coming months. The FedRAMP initiative represents a multi-year investment that will set WidePoint apart from our industry peers. Achieving the highest security standards serves as a seal of trust and credibility, demonstrating that WidePoint's ITMS solution is both reliable and capable of safeguarding sensitive federal data against cyber threats. FedRAMP full Authorized status unlocks substantial business opportunities within the U.S. government sector. WidePoint intends to leverage both MobileAnchor and its upcoming FedRAMP full authorization status to expand its contract backlog, secure meaningful work from IDIQ contracts such as Spiral 4, and position itself competitively for upcoming billion-dollar federal contract opportunities to drive bottom-line growth in 2025.

Kang added, "In line with our business development strategies, we are proud to announce that WidePoint's solutions have been recognized in Gartner's new Market Guide for Telecom Expense Management Services, Global. The Market Guide provides a comprehensive overview of the TEM industry and includes market trends and customer feedback. Inclusion in the Gartner's TEM Market Guide confirms WidePoint's position in the marketplace as a major TEM provider."

Further details and discussion of operational and financial results will be included in the fourth quarter and full year 2024 earnings release and conference call.

About WidePoint

WidePoint Corporation (NYSE American:WYY) is a leading technology Managed Solution Provider (MSP) dedicated to securing and protecting the mobile workforce and enterprise landscape. WidePoint is recognized for pioneering technology solutions that include Identity & Access Management (IAM), Mobility Managed Services (MMS), Telecom Management, Information Technology as a Service, Cloud Security, and Analytics & Billing as a Service (ABaaS). To learn more, visit https://www.widepoint.com

WidePoint Investor Relations:

Gateway Group, Inc.

Matt Glover or John Yi

949-574-3860

[email protected]

SOURCE: WidePoint Corporation

View the original press release on ACCESS Newswire

J.Williams--AMWN