-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

-

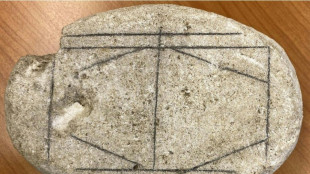

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

-

Instagram CEO to testify at social media addiction trial

Instagram CEO to testify at social media addiction trial

-

Deadly mass shooting in Canada: What we know

-

NATO launches 'Arctic Sentry' mission after Greenland crisis

NATO launches 'Arctic Sentry' mission after Greenland crisis

-

Israel's Netanyahu at White House to push Trump on Iran

-

Canada stunned by deadliest school shooting in decades

Canada stunned by deadliest school shooting in decades

-

US lawmakers grill attorney general over Epstein file release

-

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

-

French court rejects bid to reopen probe into black man's death in custody

-

xAI sees key staff exits, Musk promises moon factories

xAI sees key staff exits, Musk promises moon factories

-

Real Madrid, UEFA reach 'agreement' over Super League dispute

-

Johannesburg residents 'desperate' as taps run dry

Johannesburg residents 'desperate' as taps run dry

-

US hiring soars past expectations as unemployment edges down

-

Stock markets rise as US jobs data beats expectations

Stock markets rise as US jobs data beats expectations

-

Daniel Siad, the modelling scout with close ties to Epstein

-

France lawmakers urge changes to counter dwindling births

France lawmakers urge changes to counter dwindling births

-

Von Allmen focuses on 'here and now' after making Olympic ski history

-

Actor behind Albania's AI 'minister' wants her face back

Actor behind Albania's AI 'minister' wants her face back

-

Von Allmen joins Olympic skiing greats, Kim seeks snowboard history

-

Eat less meat, France urges, for sake of health, climate

Eat less meat, France urges, for sake of health, climate

-

Australia cruise past Ireland at World Cup after skipper Marsh ruled out

-

IOC to try to convince Ukrainian not to wear banned helmet

IOC to try to convince Ukrainian not to wear banned helmet

-

Barca missing Rashford, Raphinha for Atletico cup clash

-

Tractors hit Madrid to protest EU's trade deal with South America

Tractors hit Madrid to protest EU's trade deal with South America

-

US snowboard star Kim stays on track for historic Olympic hat-trick

-

The obstacles to holding war-time elections in Ukraine

The obstacles to holding war-time elections in Ukraine

-

History-maker Von Allmen wins third Olympic gold

-

Depleted Australia reach 182-6 as skipper Marsh ruled out of Ireland clash

Depleted Australia reach 182-6 as skipper Marsh ruled out of Ireland clash

-

Dutch court orders investigation into China-owned Nexperia

Battery X Metals Announces Non-Brokered Private Placement, Proposed Debt Settlement, and Convertible Loan

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

)(FSE:R0W, WKN:A3EMJB)("Battery X Metals" or the "Company") announces it has determined to undertake a non-brokered private placement financing (the "Private Placement"), consisting of the issuance of an aggregate of 12,000,000 units of the Company (each, a "Unit"), at a price of $0.05 per Unit for aggregate gross proceeds of up to $600,000.

Each Unit will consist of one common share in the capital of the Company (each, a "Share") and one transferable common share purchase warrant of the Company (each, a "Warrant"), with each Warrant entitling the holder to acquire on additional Share (each, a "Warrant Share") at a price of $0.075 per Warrant Share for a period of 24 months from the date of closing.

Closing of the Private Placement is anticipated to occur on or about December 20, 2024, and is subject to certain conditions, including, but not limited to, the receipt of all necessary regulatory approvals, including the approval of the Canadian Securities Exchange.

The net proceeds of the Private Placement are intended to be used for general working capital and outstanding payables. The securities issued under the Private Placement will be subject to a statutory hold period expiring four months and one day from the date of issuance.

Proposed Debt Settlement

In line with its continued efforts to strengthen its balance sheet, the Company intends to settle debt totaling $600,000 owed to certain creditors of the Company in consideration for the issuance of an aggregate 12,000,000 units of the Company (each, a "Debt Settlement Unit") at a deemed price of $0.05 per Debt Settlement Unit (the "Debt Settlement").

Each Debt Settlement Unit will consist of one Share (each, a "Debt Share") and one transferable common share purchase warrant (each, a "Debt Settlement Warrant"), with each Debt Settlement Warrant exercisable to purchase one additional common share of the Company (each, a "Debt Settlement Warrant Share") at an exercise price of $0.075 per Debt Settlement Warrant Share for a period of two years from the date of closing of the Debt Settlement. The securities issued under the Debt Settlement will be subject to a statutory hold period expiring four months and one day from the date of issuance.

Closing of the Debt Settlement is expected to occur on or around December 20, 2024.

Insiders may participate in the Private Placement and the Debt Settlement and such participation may constitute a related party transaction under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI61-101"). The Company intends to rely on exemptions from the formal valuation and minority shareholder approval requirements provided under subsections 5.5(a) and 5.7(a) of MI 61-101 on the basis that participation in the Private Placement and Debt Settlement by insiders will not exceed 25% of the fair market value of the Company's market capitalization. No finder's fees are payable in connection with the Private Placement.

Convertible Loan Agreement

The Company also announces that it has entered into a convertible loan agreement dated December 11, 2024 (the "Loan Agreement") with an arm's length third party, with a principal balance outstanding of $101,289.51, which is interest free with a maturity date of 12 months from the date of entry into the Loan Agreement (the "Loan");

Pursuant to the Loan Agreement, the Company may elect to convert the Loan into units of the Company (each, a "Loan Unit") at a deemed price of $0.05 per Loan Unit.

Each Loan Unit will consist of one Share (each, a "Loan Share") and one transferable common share purchase warrant (each, a "Loan Warrant"), with each Loan Warrant exercisable to purchase one additional common share of the Company (each, a "Loan Warrant Share") at an exercise price of $0.075 per Loan Warrant Share for a period of two years from the date of issuance. The securities issued under the Loan Agreement will be subject to a statutory hold period expiring four months and one day from the date of issuance.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the U.S. Securities Act of 1933, as amended (the "1933 Act"), or under any U.S. state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act and applicable state securities laws.

About Battery X Metals Inc.

Battery X Metals (CSE:BATX)(OTCQB:BATXF)(FSE:R0W, WKN:A3EMJB) is committed to advancing the global clean energy transition through the development of proprietary technologies and domestic battery and critical metal resource exploration. The Company focuses on extending the lifespan of electric vehicle (EV) batteries, through its portfolio company, LIBRT1, recovering battery grade metals from end-of-life lithium-ion batteries, and the acquisition and exploration of battery and critical metals resources. For more information, visit batteryxmetals.com.

149% owned Portfolio Company

On Behalf of the Board of Directors

Massimo Bellini Bressi, Director

For further information, please contact:

Massimo Bellini Bressi

Chief Executive Officer

Email: [email protected]

Tel: (604) 741-0444

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws, including statements related to the proposed Private Placement and the Debt Settlement, and the effective date thereof. Forward-looking statements reflect management's current beliefs, expectations, and assumptions based on available information as of the date of this release. However, these statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied. Such risks include, but are not limited to, failure to obtain regulatory approvals required to complete the Private Placement and effect the Debt Settlement. Additional details regarding risks and uncertainties are available in the Company's filings on SEDAR+. The forward-looking statements in this news release are made as of the date hereof, and Battery X Metals disclaims any intention or obligation to update or revise such statements, except as required by law. Investors are cautioned not to place undue reliance on these forward-looking statements.

SOURCE: Battery X Metals

A.Malone--AMWN