-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

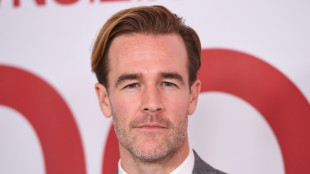

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

-

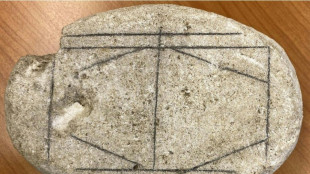

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

-

Instagram CEO to testify at social media addiction trial

Instagram CEO to testify at social media addiction trial

-

Deadly mass shooting in Canada: What we know

-

NATO launches 'Arctic Sentry' mission after Greenland crisis

NATO launches 'Arctic Sentry' mission after Greenland crisis

-

Israel's Netanyahu at White House to push Trump on Iran

-

Canada stunned by deadliest school shooting in decades

Canada stunned by deadliest school shooting in decades

-

US lawmakers grill attorney general over Epstein file release

-

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

-

French court rejects bid to reopen probe into black man's death in custody

-

xAI sees key staff exits, Musk promises moon factories

xAI sees key staff exits, Musk promises moon factories

-

Real Madrid, UEFA reach 'agreement' over Super League dispute

-

Johannesburg residents 'desperate' as taps run dry

Johannesburg residents 'desperate' as taps run dry

-

US hiring soars past expectations as unemployment edges down

-

Stock markets rise as US jobs data beats expectations

Stock markets rise as US jobs data beats expectations

-

Daniel Siad, the modelling scout with close ties to Epstein

-

France lawmakers urge changes to counter dwindling births

France lawmakers urge changes to counter dwindling births

-

Von Allmen focuses on 'here and now' after making Olympic ski history

-

Actor behind Albania's AI 'minister' wants her face back

Actor behind Albania's AI 'minister' wants her face back

-

Von Allmen joins Olympic skiing greats, Kim seeks snowboard history

-

Eat less meat, France urges, for sake of health, climate

Eat less meat, France urges, for sake of health, climate

-

Australia cruise past Ireland at World Cup after skipper Marsh ruled out

Orogen Royalties Sells the Celts Gold Project to Eminent Gold

(TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that the Company has signed a purchase and sale agreement (the "Agreement") with a wholly-owned U.S. subsidiary of Eminent Gold ("Eminent") (TSX.V: EMNT) whereby Eminent has acquired the Celts gold project ("Celts" or the "Project"), located in Nevada, USA.

To acquire a 100% interest in Celts, Eminent will pay a total of US$400,000 consisting of cash and/or shares, subject to regulatory approval, and will grant a 3% net smelter return ("NSR") royalty, of which 1% can be purchased for US$1.5 million.

Pursuant to the terms of a generative alliance (the "Alliance") agreement between Altius Minerals Corporation (TSX:ALS) ("Altius") and Orogen previously announced September 12, 20221, proceeds from the sale of the Project will be split evenly between the Alliance participants whereby each party will receive US$200,000 in cash and/or shares and a 1.5% NSR royalty.

"Celts is one of four projects generated and the second sold to date under the Alliance with Altius, a collaboration of technical expertise to identify targets with geological similarities to the Expanded Silicon project in the Walker Lane Trend, Nevada," commented Orogen's CEO and President, Paddy Nicol. "Celts is representative of Orogen's business model of organic royalty generation, creating exposure to new discoveries with significant leverage to value potential. We are excited to partner with the Eminent team and look forward to their exploration efforts."

Figure 1: Location of the Celts project

About the Celts Gold Project

The 560-hectare Celts project is located in southeastern Nevada, thirteen kilometres northeast of the historic high-sulphidation Goldfield district and one-hundred kilometres northwest of the Silicon discovery (Figure 1). Celts contains a cell of advanced argillic alteration that is recognized to be steam heated alteration within a low-sulphidation system. The steam cap remains undrilled.

The alteration cell at Celts is centered on a Tertiary rhyolite dome with an eight-hundred metre diameter zone of alteration composed of alunite and kaolinite interspersed with regions of fine-grained silica flooding (Figure 2). Celts could be one of the few epithermal systems in Nevada associated with slab window magmatism, like the Silicon (3.4Moz of indicated and 800Koz inferred gold resources) and Merlin (9.05Moz gold resource inferred) deposits, where Orogen holds a 1% NSR royalty.

Similar to the Silicon deposit, there is no gold at surface in the steam cap, but peripheral gold, including grab samples up to 33 grams per tonne, occurs in quartz veins associated with illite and adularia at lower elevations one to two kilometres from the dome (Figure 2). Taken together, the central steam cap and peripheral gold-bearing mineralized structures define a four-square kilometre mineral system.

The property is on road-accessible BLM land with a clear and unencumbered pathway to drill testing.

Transaction Details

Orogen, Altius and Eminent have signed an Agreement whereby Eminent has acquired a 100% interest in the Celts Project by paying US$400,000 consisting of US$30,000 cash and US$45,000 in common shares of Eminent at closing, and US$325,000 consisting of cash and/or shares, at the discretion of Eminent, within six months from the date of signing. Eminent will also grant a 3% net smelter return ("NSR") royalty, of which 1% can be purchased for US$1.5 million.

The issuance of Eminent shares is subject to regulatory approval of the TSX Venture Exchange.

Figure 2: Simplified Geology, Alteration and Gold Geochemistry at Celts

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver mine in Sonora, Mexico (2% NSR royalty) being mined by First Majestic Silver Corp. and the Expanded Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti NA. The Company is well financed with several projects actively being explored under joint ventures.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

[email protected]

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc

J.Oliveira--AMWN