-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

-

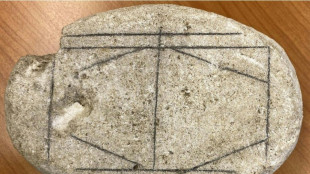

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

-

Instagram CEO to testify at social media addiction trial

Instagram CEO to testify at social media addiction trial

-

Deadly mass shooting in Canada: What we know

-

NATO launches 'Arctic Sentry' mission after Greenland crisis

NATO launches 'Arctic Sentry' mission after Greenland crisis

-

Israel's Netanyahu at White House to push Trump on Iran

-

Canada stunned by deadliest school shooting in decades

Canada stunned by deadliest school shooting in decades

-

US lawmakers grill attorney general over Epstein file release

-

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

-

French court rejects bid to reopen probe into black man's death in custody

-

xAI sees key staff exits, Musk promises moon factories

xAI sees key staff exits, Musk promises moon factories

-

Real Madrid, UEFA reach 'agreement' over Super League dispute

-

Johannesburg residents 'desperate' as taps run dry

Johannesburg residents 'desperate' as taps run dry

-

US hiring soars past expectations as unemployment edges down

-

Stock markets rise as US jobs data beats expectations

Stock markets rise as US jobs data beats expectations

-

Daniel Siad, the modelling scout with close ties to Epstein

-

France lawmakers urge changes to counter dwindling births

France lawmakers urge changes to counter dwindling births

-

Von Allmen focuses on 'here and now' after making Olympic ski history

-

Actor behind Albania's AI 'minister' wants her face back

Actor behind Albania's AI 'minister' wants her face back

-

Von Allmen joins Olympic skiing greats, Kim seeks snowboard history

-

Eat less meat, France urges, for sake of health, climate

Eat less meat, France urges, for sake of health, climate

-

Australia cruise past Ireland at World Cup after skipper Marsh ruled out

Barton Gold Completes $5 Million Gold Sale

HIGHLIGHTS

June 2024 sale of ~1,400oz gold produced from mill cleanout and preservation program, with previous 90% Provisional Payment received totalling USD $2.82 million (AUD $4.25 million)1

Final Payment of ~USD $495,000 (~AUD $775,000) now received to complete sale2

Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or the Company) is pleased to confirm the final results of its June 2024 processing and sale of gold concentrates recovered from a December 2022 cleanout and preservation program at Barton's Central Gawler Mill in South Australia.1

Following final analyses and reconciliations, a total of ~1,425 gold ounces have been sold via a treatment and refining contract, the general terms and details of which include the following:

independent third party weighing, sampling and moisture determination (WSMD) which confirmed a final ~11.1 dry metric tonnes of concentrates processed;

independent third party sampling and assay of all concentrate materials (Assays) which determined a final weighted average gold concentrate grade of ~3,997 g/t Au for all materials;

market competitive treatment (TC) and refining charges (RC) and Au payability (Payability); and

other terms and conditions standard for a gold refining and sale contract of this type.

In June 2024 Barton received a 90% initial payment against provisional assays and gold pricing totalling USD $2.82 million (AUD $4.25 million) (Provisional Payment), pending final WSMD and Assays.1 Barton has now received a final payment based upon these analyses and the average London AM/PM July gold price of ~USD $2,392 / oz Au, totalling ~USD $495,000 (~AUD $775,000) (Final Payment).2

Barton estimates the total costs of recovering and processing these materials to be approximately $800,000 (inclusive of the full capital cost of its mill works program and all royalties payable), representing a total net profit margin of approximately $4.2 million, or approximately AUD $2,950 per ounce sold.

Commenting on the completion of Barton's gold sale, Barton Managing Director Alex Scanlon said:

"We are very pleased to have completed this gold sale on very competitive terms for the June 2024 gold market. This outcome reflects both a great deal of hard work by our management team, and its broader commercial skill. Instead of a significant capital cost, our team converted the opportunity into a more than $4 million profit.

"Barton continues to differentiate itself not only via the cost-efficient advancement of its development projects, but also a track record of asset monetisation which has now generated over $10 million in non-dilutive cash.

"Since our June 2021 IPO, these proceeds have covered 100% of our corporate overhead costs and extended our cost-efficient exploration programs. This has minimised the equity dilution which would otherwise have been required to complete such extensive works, and preserved considerable value for Barton Gold shareholders."

1 Refer to ASX announcements dated 20 Dec 2022, 21 Aug 2023, 27 Mar, 29 Apr and 18 Jun 2024; USD/AUD FX rate 0.6667 as at 18 June 2024

2 Based upon USD/AUD FX rate of 0.64 as at the date of this announcement

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the renowned central Gawler Craton of South Australia.*

Tarcoola Gold Project

Tunkillia Gold Project *

Infrastructure

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcements dated 4 March and 16 July 2024. Total Barton JORC (2012) Mineral Resources include 833koz Au (26.9Mt @ 0.96 g/t Au) in Indicated and 754koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

P.Stevenson--AMWN