-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

-

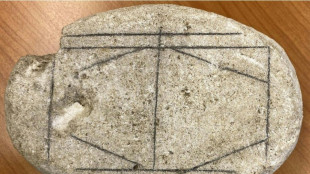

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

American Critical Minerals Closes Oversubscribed Private Placement and Finalizes Name Change and Consolidation

(the"Company") (CSE:KCLI)(OTC PINK:APCOF)(Frankfurt:2P3) is pleased to announce that it has closed its non-brokered private placement offering (the "Offering"). The Offering was oversubscribed and on closing the Company issued 13,455,000 units (each, a "Unit"), at a price of $0.08 per Unit, for gross proceeds of $1,076,400 (the "Offering"). Each Unit consists of one common share and one-half of one common share purchase warrant (each whole warrant, a "Warrant"). Each Warrant is exercisable to acquire an additional common share at a price of $0.15 until December 19, 2026.

In connection with completion of the Offering, the Company paid to certain arms-length parties $57,323 in finder's fees and issued 716,538 finders' warrants exercisable on the same terms as the Warrants. Pursuant to applicable Canadian securities laws, all securities issued in connection with closing of the Offering are subject to a statutory hold period expiring on April 20, 2025.

The Company intends to use the proceeds from the Offering to advance the Company's Green River Project focusing on both Potash and Lithium evaluation and exploration and for general working capital purposes.

In addition, the Company confirms that it has changed its name from "American Potash Corp." to "American Critical Minerals Corp." (the "Name Change"), to better reflect the Company's dual focus on Potash and Lithium, critical to US Agricultural, Food, Energy and Industrial Security. It has also consolidated its outstanding common share capital (the "Consolidation") at a ratio of 2.5 pre-Consolidation shares to 1 post-Consolidation share. As a result of the Consolidation and following completion of the Offering, the number of issued and outstanding common shares will be reduced from 137,077,449 to 54,830,980 shares, subject to adjustment for rounding. The common shares are expected to commence trading on a post-Consolidation basis on the Canadian Securities Exchange, under the new symbol "KCLI", effective as of market open on or about December 23, 2024.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities offered in the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws.

Simon Clarke, President and CEO stated,"this over-subscribed financing comes at the end of a highly successful year for the Company. After an 8 year process, the Company secured 11 potash prospecting licenses across 25,480 acres of its Green River Project, Utah, within the Federally administered Red Wash Potash Leasing Area in the heart of the historic Major Potash Zone in the Paradox Basin., close to existing Potash Solution Mining. Combined with its State Licenses and approvals, the Company now has a total of 7 exploratory drill holes authorized.

The Company also recently rounded out and strengthened its Board and with this re-branding now complete, financing closed and a tighter capital structure, the Company will enter 2025 well positioned to implement the steps needed for brownfield / confirmation drilling. Such drilling will focus on the validation of its large 43-101 Potash Exploration Target* as well as historic oil & gas data across, and surrounding, the Green River Project and recent lithium discoveries to the North and South of the Company's acreage. The Company will also target Maiden Resources for both Potash and Lithium."

*Agapito Associates Inc. Technical report (October 2012) quantifies the Green River Potash Project's potash exploration potential in the form of a NI 43-101 Exploration Target. The Exploration Target estimate was prepared in accordance with the National Instrument 43-101 -Standards of Disclosure for Mineral Projects ("NI 43-101"). It should be noted that Exploration Targets are conceptual in nature and there has been insufficient exploration to define them as Mineral Resources, and, while reasonable potential may exist, it is uncertain whether further exploration will result in the determination of a Mineral Resource under NI 43-101. The Exploration Target stated in the Agapito Report is not being reported as part of any Mineral Resource or Mineral Reserve.

Qualified Person

The Technical content of this news release has been reviewed and approved by Dean Besserer, P.Geo. the Chief Operations Officer ("COO") of the Company and a qualified person for the purposes of NI 43-101.

Engagement of Market One Media Group

The Company has also entered into a media services agreement with Market One Media Group Inc. ("Market One"). Market One, with offices in Vancouver and Toronto, is a multiplatform media solution for the capital markets operating in editorial, video and digital media. The media message is distributed via broadcast, digital and social media channels, including media platforms such as BNN Bloomberg.

Market One's engagement is for a term of twelve months. Market One will provide services including editorial and video. The Company will pay Market One a fee of $50,000 plus GST for the services provided, which will be payable within thirty days.

The Company does not propose to issue any securities to Market One in consideration for the services to be provided to the Company. Further, Market One and the Company are unrelated and unaffiliated entities and, at the time of the agreement, neither Market One nor any of its principals have an interest, directly or indirectly, in the securities of the Company. Market One can be contacted through Brett Yelland ([email protected]) or 440 West Hastings Street, Suite 320, Vancouver, British Columbia, V6B 1L1.

Engagement of Evolux Capital

The Company also announces that it entered into an agreement with 1822053 Alberta Ltd. (d/b/a Evolux Capital) ("Evolux") to provide marketing services to the Company. The services are expected to include the creation and distribution of social media advertising, development and implementation of communications strategies, assisting with brand development, and coordinating with social media and advertising partners.

Evolux is an arm's-length marketing firm and has been engaged for an initial six-month term ending June 17, 2025 for total consideration of $80,000 which is payable upfront. The Company does not propose to issue any securities to Evolux in consideration for the services to be provided to the Company. Evolux can be contacted at ([email protected]) or 126 Mitchell Crescent, Blackfalds, Alberta, T4M 0H6.

On behalf of the Board of Directors

Simon Clarke, President & CEO

Contact: (604)-551-9665

Cautionary Statements Regarding Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable securities legislation. Forward-looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. Such statements include, without limitation, statements regarding the intended use of proceeds from the Offering. Although the Company believes that such statements are reasonable, it can give no assurances that such expectations will prove to be correct. All such forward-looking information is based on certain assumptions and analyses made by the Company in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. This information, however, is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Important factors that could cause actual results to differ from this forward-looking information include those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not intend, and expressly disclaims any obligation to, update or revise the forward-looking information contained in this news release, except as required by law. Readers are cautioned not to place undue reliance on forward-looking information.

SOURCE: American Critical Minerals Corp

L.Harper--AMWN