-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

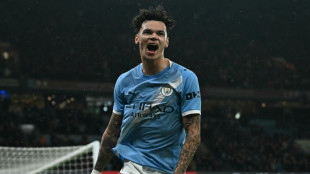

Guardiola eyes rest for 'exhausted' City stars

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

Swiatek fights back to reach Qatar Open quarter-finals

-

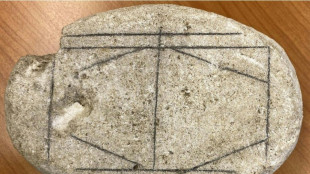

AI cracks Roman-era board game

South Star Battery Metals Announces Upsize of Non-Brokered Private Placement to Raise Up to US$3.20M, Extends Closing and Amended and Restated Stream Agreement

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES

South Star Battery Metals Corp. ("South Star" or the "Company") (TSXV:STS)(OTCQB:STSBF), is pleased to announce that as a result of demand, it is increasing the size of its previously announced non-brokered private placement (the "Private Placement") to up to an aggregate total of US$3,200,000 (CA$4,480,000). The Private Placement is comprised of units (the "Units"), each Unit consisting of one common share (a "Share") priced at US$0.43 (CA$0.602) and one common share purchase warrant (a "Warrant"). Each Warrant is exercisable into one Share at a price of US$0.89 (CA$1.246) for five years from the date of issue and is subject to an acceleration clause as detailed below.

The Company has been granted an extension by the TSX Venture Exchange (the "TSXV") to close on or before January 10, 2025. Closing of the Private Placement is subject to customary closing conditions, including, but not limited to, the receipt of all necessary approvals, including the approval of the TSXV. Proceeds from the Private Placement will be used for accelerating exploration, development, construction activities, corporate G&A and general working capital requirements.

The Company may pay finders' fees to eligible finders, in accordance with applicable securities laws and the policies of the TSXV. All securities issued pursuant to the Private Placement will be subject to a four-month hold period.

Insiders may participate in the Private Placement including subscriptions from related parties of the Company as defined in Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The participation of insiders in the Private Placement is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to exemptions contained in sections 5.5(c) and 5.7(1)(a) of MI 61-101.

Acceleration Clause

The Warrants and Finder's Warrants will be subject to an acceleration clause that provides that, if, during any period of ten consecutive trading days between the date that is (a) four months following the closing of the Private Placement, and (b) the expiry of the Warrants and Finder's Warrants, the daily volume weighted average trading price of the Shares on the TSXV (or such other stock exchange where the majority of the trading volume occurs) is equal to or exceeds US$1.79 (C$2.506) on each day, the Company may, within 30 days of such an occurrence, give notice, via news release, to the holders of the Warrants and Finder's Warrants that all unexercised Warrants and Finder's Warrants will expire at 4:00 p.m. (Vancouver time) on the 30th day following the giving of such notice. Upon receipt of such notice, the holders of the Warrants and Finder's Warrants will have 30 days to exercise their Warrants and Finder's Warrants and any Warrants and Finder's Warrants that have not been exercised will expire.

Amended and Restated Stream Agreement

The Company is also pleased to announce that on December 20, 2024, it amended and restated its metals purchase and sale agreement with Sprott Private Resource Streaming and Royalty Corp. dated April 4, 2022, as amended on October 4, 2022 (the "Stream Agreement"). The Stream Agreement was amended and restated primarily to reflect that South Star dissolved a subsidiary, which was a party to the Steam Agreement, in connection with internal changes to how it transacts certain business matters. Additional changes were also made to, among other things, add a "Designated Jurisdiction" and provide for off-shore sales.

# # #

About South Star Battery Metals Corp.

South Star is a Canadian battery-metals project developer focused on the selective acquisition and development of near-term production projects in the Americas. South Star's Santa Cruz Graphite Project, located in Southern Bahia, Brazil is the first of a series of industrial- and battery-metals projects that will be put into production. Brazil is the second-largest graphite-producing region in the world with more than 80 years of continuous mining. Santa Cruz has at-surface mineralization in friable materials, and successful large-scale pilot-plant testing (> 30 tonnes) has been completed. The results of the testing show that approximately 65% of graphite concentrate is +80 mesh with good recoveries and 95%-99% graphitic carbon (Cg). With excellent infrastructure and logistics, South Star Phase 1 is ramping up commercial production with first shipments completed in October 2024. Santa Cruz Phase 1 commercial production has a nameplate capacity of 12,000 tpy and is the first new graphite production in the Americas since 1996. Phase 2 production (25,000 tpy) is partially funded and planned for 2026, while Phase 3 (50,000 tpy) is scheduled for 2028.

South Star's second project in the development pipeline is strategically located in Alabama, U.S.A. in the center of a developing electric-vehicle, aerospace, and defense hub in the southeastern United States. The BamaStar Project includes a historic mine active during the First and Second World Wars. A NI 43-101 Preliminary Economic Assessment was filed on SEDAR+ in November 2024. Trenching, Phase 1 drilling, sampling, analysis, and preliminary metallurgical testing have been completed. The testing included a traditional crush/grind/flotation concentration circuit that achieved grades of approximately 94-99% Cg with approximately 90% recoveries. The vertically integrated production facilities include a mine and industrial concentrator in Coosa County, AL and a downstream value-add plant in Mobile, AL, which will be upgrading natural flake graphite concentrates from both Santa Cruz and BamaStar mines. South Star is executing on its plan to create a multi-asset, diversified battery-metals company with near-term operations in strategic jurisdictions. South Star trades on the TSX Venture Exchange under the symbol STS, and on the OTCQB under the symbol STSBF.

South Star is committed to a corporate culture, project execution plan and safe operations that embrace the highest standards of ESG principles, based on transparency, stakeholder engagement, ongoing education, and stewardship. To learn more, please visit the Company website at http://www.southstarbatterymetals.com

This news release has been reviewed and approved for South Star by Richard Pearce, P.E., a "Qualified Person" under National Instrument 43-101 and President and CEO of South Star Battery Metals Corp.

On behalf of the South Star Board of Directors,

MR. RICHARD L. PEARCE,

President & Chief Executive Officer

For additional information, please contact:

South Star Investor Relations

Email: [email protected]

Phone: +1 (604) 706-0212

Website: www.southstarbatterymetals.com

Twitter: https://twitter.com/southstarbm

Facebook: https://www.facebook.com/southstarbatterymetals

LinkedIn: https://www.linkedin.com/company/southstarbatterymetals/

YouTube: South Star Battery Metals - YouTube

CAUTIONARY STATEMENT

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Information

This press release contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements". Forward-looking statements in this press release include, but are not limited to statements regarding the Private Placement, including the closing date, the use of proceeds and potential acceleration of Warrants and Finder's Warrants, production at Santa Cruz, and scaling operations as well as advancing the Alabama project; and the Company's plans and expectations.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

SOURCE: South Star Battery Metals Corp.

F.Pedersen--AMWN